Investors pour money into emerging markets at near-record rate

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

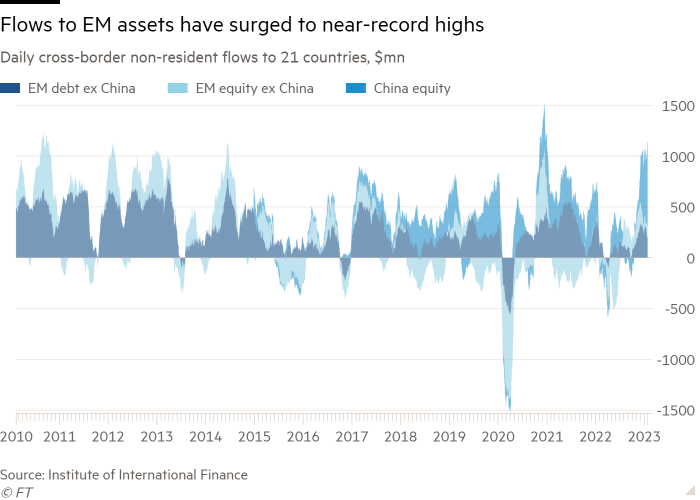

Investors are piling into emerging market stocks and bonds at a near-record rate, as falling inflation and the reopening of China’s sprawling economy help reverse last year’s slide.

Emerging equity and debt markets have attracted $1.1bn a day in net new money this week, according to high-frequency data tracking 21 countries from the Institute of International Finance. The speed of cross-border flows is now second only to the surge that followed the lifting of coronavirus lockdowns in late 2020 and early 2021, surpassing previous peaks over the past two decades.

The strong inflows underscore a big shift in sentiment this year after a grim performance for developing markets for much of 2022. Falling global inflation has led many market participants to bet that major developed market central banks, including the US Federal Reserve, will soon stop increasing interest rates — relieving a major source of pain for emerging markets.

Jahangir Aziz, an analyst at JPMorgan, said there was “a lot of gas in the tank” for a further rebound in inflows now that key economic uncertainties that weighed down emerging markets “are lifting”.

The threat of recession has receded. Data released on Thursday showed that the US economy grew more than expectations in the last quarter of 2022, expanding at an annualised rate of 2.9 per cent, while unemployment claims remained low.

China’s decision to scrap its zero-Covid policy has also had a big impact. The country’s inflows account for $800mn of the $1.1bn daily flows for all emerging markets, IIF data show, while other developing countries are benefiting from the knock-on effect of Beijing’s move.

Emerging market assets have been further helped by investors’ expectations that developing countries will outgrow advanced economies this year. JPMorgan expects gross domestic product in emerging markets to grow by 1.4 percentage points more than the rate in advanced economies in 2023, up from zero in the second half of 2022.

Stocks in the benchmark MSCI Emerging Markets index have risen by nearly 25 per cent since their low in late October. A rise of more than 20 per cent from a recent low is deemed a bull market.

Despite the strong start to 2023, some investors and analysts warned that the rate of inflows was unlikely to be sustained.

Paul Greer, portfolio manager for EM debt at Fidelity International, said much of the rally in EM assets may be behind us.

“The first and second quarters [of 2023] will see an uplift in China, there’s no doubt about that,” he said. “But much of that is now priced in by markets . . . We may have seen the lion’s share of the rally in this cycle.”

Greer said the rally was partly explained by investors returning to EM assets after cutting their exposure drastically over much of the past decade, and especially during the first three-quarters of last year.

Many developing economies previously struggled to deliver fast rates of growth in the wake of the financial crisis of 2008-09, and were hit especially hard by the surge in global inflation and in the US dollar during much of 2022.

Greer added that despite the recent rebound, investors were unlikely to be optimistic about growth in emerging markets in the future. Rising levels of debt, greater fiscal strains across much of the developing world and the increasingly negative impact of demographics would reduce potential growth, he said.

“It is hard to be as rosy about emerging markets as it was before Covid,” he said.

Comments