The bottom window is the correlation between the VVIX and S&P 500 5 period. The market can be near a reversal when this correlation gets over .00 (currently .30). Next window up is the VVIX/VIX ratio with a 3 day average. This indicator helps to define the trend, and it has turned lower today.

The next window up is the rate of change (ROC) of the VVIX. When the ROC of the VVIX is near -10, the SPX can be near a short-term high (currently at +9.72). The market has least stalled in the rally phase. The bigger picture suggests the mid-June low could be the bottom for this year.

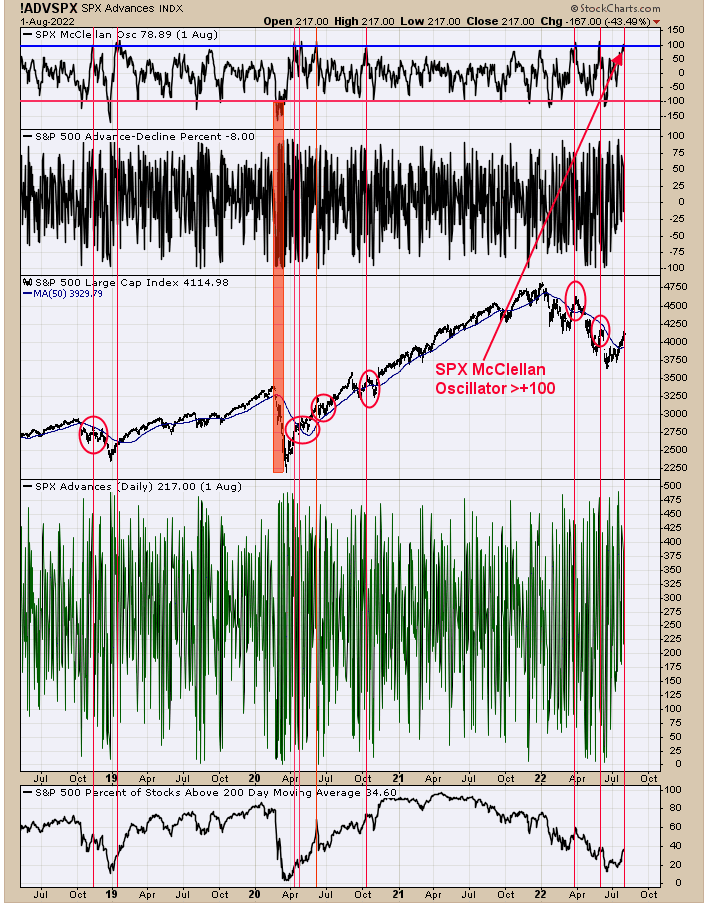

The top window is the SPX McClellan Oscillator. This chart goes back to mid-2018 and shows the times when the SPX McClellan Oscillator traded above +100, identified with red vertical lines. On July 29 of this year, the SPX McClellan Oscillator closed at +100.57. The SPX Oscillator hit +100 eight times (not counting this time) going back to mid-2018, and all but one had either a short-term pullback or at least traded sideways for at least a couple of weeks.

As mentioned before, the market has interred into the 3RD quarter, the weakest quarter of the year. The evidence suggests the market is entering into a trading range that may last most of the third quarter.

Above is one of the indicators that is giving an intermediate-term signal. The bottom window is the 50-day average for the Up down Volume percent, and the next window up is the 50-day average of the Advance/Decline percent.

Intermediate-term lows have formed when both indicators traded below -20 and turned up, which are noted with red vertical lines. The previous signals had led to a sideways or up and down pattern before the rally began, suggesting that may happen here.

Notice that when both indicators reached below -20 and turned up, they continued to advance even though VanEck Gold Miners ETF (NYSE:GDX) traded sideways. We contribute this to strengthening the gold miners bullish percent index where more stocks produce Point and Figure buy signals. The evidence point to a base building bottom that may take several weeks for the rally to get going.