Mainland Chinese banks, banned from crypto assets at home, weigh services in Hong Kong after policy change

- Some mainland banks and family offices are considering starting or reactivating virtual asset projects in Hong Kong, Deloitte China’s digital asset leader said

- Hong Kong’s new digital asset rules have generated buzz, but some investors say they want to see more detailed plans

Some mainland Chinese banks, family offices and other financial service providers are considering kicking off or reactivating virtual asset projects in Hong Kong, including offering cryptocurrency services to their clients in the city, Robert Lui, Hong Kong Digital Asset Leader at Deloitte China, told the South China Morning Post on Tuesday at Hong Kong’s FinTech Week.

“I received calls from some of our friends in the mainland yesterday, and they were talking about ‘one country, two systems’ and whether their virtual asset businesses can come to Hong Kong,” Lui said.

Hong Kong unveils policies to take on Singapore as virtual-assets hub

With the latest regulatory change, businesses are getting a clear signal that more virtual asset-related investment products, including security token offerings, are encouraged to come to Hong Kong, he added.

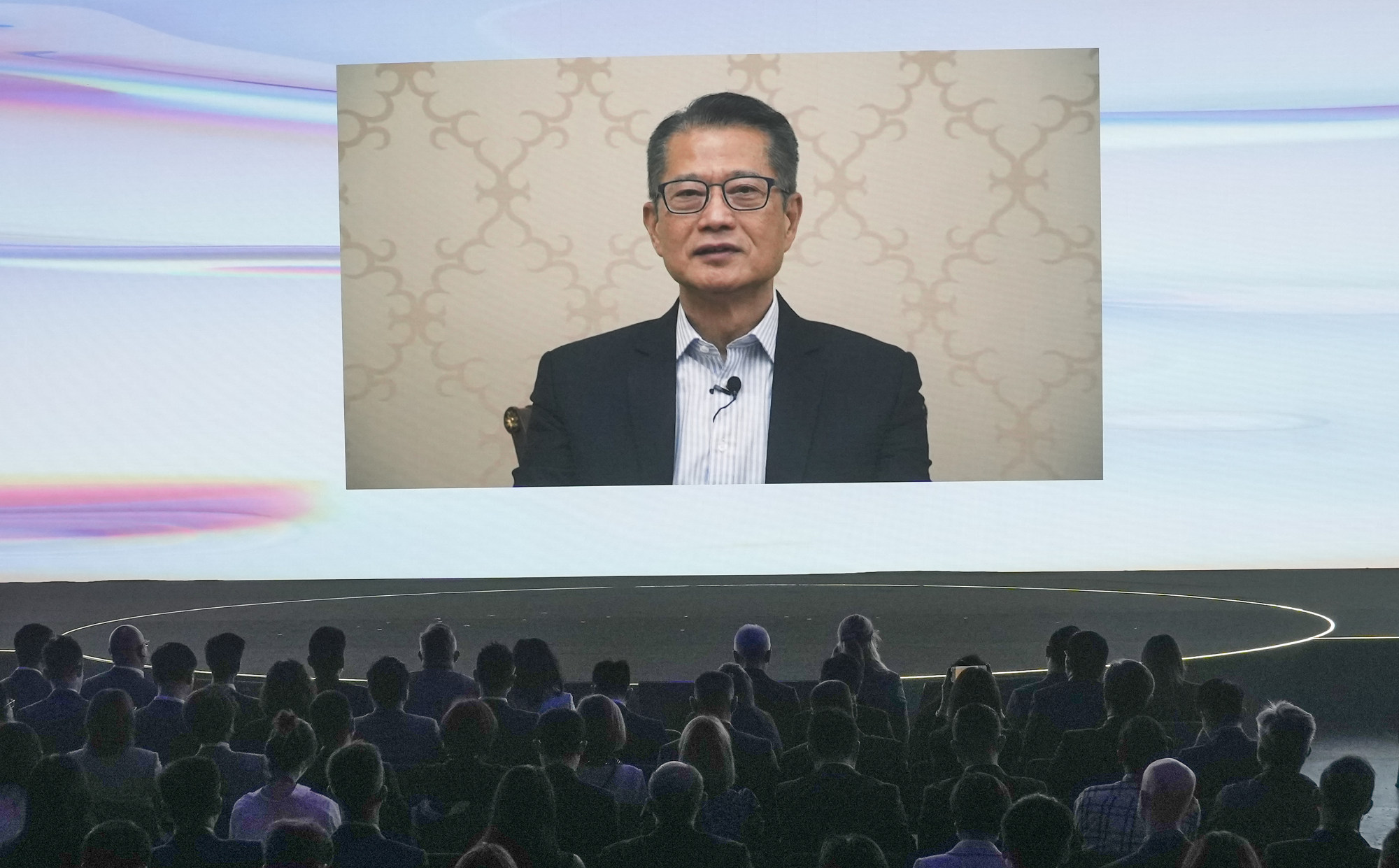

The Hong Kong government recognises “the potential of DLT [distributed ledger technology] and Web 3.0 to become the future of finance and commerce” and “is prepared to embrace this future”, Secretary for Financial Services and the Treasury Christopher Hui said on Monday.

King Leung, head of fintech at the government agency InvestHK, also told the Post in an interview at FinTech Week that he foresees gaming as a space where mainland entrepreneurs could come to Hong Kong to experiment with virtual assets.

“In China, there’s so many talents and so much money in the Web2 gaming space, and Web3 gaming in Hong Kong has, from organic growth, [developed] an amazing ecosystem,” Leung said. “So if you were the founders of Web2 gaming, where do you go? You would naturally come to Hong Kong.”

Some cryptocurrency enthusiasts in mainland China, whose crypto-related business activities are subject to constant scrutiny and crackdowns from Beijing, have also expressed excitement about Hong Kong’s change in direction, saying the city could now be a good place to move their endeavours.

Singapore stresses ‘responsible’ fintech as stance diverges from Hong Kong

Still, many investors and observers remain cautious as they await more detailed measures.

“You can see the [Hong Kong government’s] sincerity from the documents, but in the long term, how it’s executed and whether there could be sustainable development, those need the test of time,” Jun Yu, founding partner of venture capital firm A&T Capital, wrote on Twitter.

While Hong Kong’s convenience and connectivity with mainland China makes it the best choice as a springboard, moving directly to Singapore or Western countries would still be more helpful for Chinese Web3 entrepreneurs, he wrote.