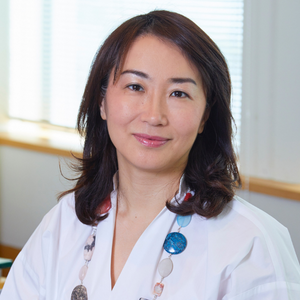

Jessica Titlebaum Darmoni: Senior Manager, Head of Marketing, ErisX

“You should always ask for more when you’re talking about salary,” advises Jessica Titlebaum Darmoni. “You want to demonstrate that you are willing to negotiate for the best rate, for yourself and for them.”

“You should always ask for more when you’re talking about salary,” advises Jessica Titlebaum Darmoni. “You want to demonstrate that you are willing to negotiate for the best rate, for yourself and for them.”

Darmoni speaks to self-educating herself on derivatives, the value of finding your culture match and why asking for more is an astute move.

From Creative Writing to Listed Derivatives to Crypto

Darmoni is a true self-taught financial professional.

After graduating from the University of Maryland with an English-Creative Writing degree, and a backpacking tour of Southeast Asia, she entered into the niche market of listed derivatives. Her CV was picked up online for a marketing role at a technology consulting company. Without knowing much about derivatives or having any industry connections, Darmoni found herself inside an exclusive corner of finance.

At that time, she began reading an industry newsletter published by a journalist/broker John Lothian to learn more about the listed derivatives space. After asking for an internship and working part time for John Lothian News, she went on to become the Head of Sales. Concurrently, thanks to a lot of networking for her role, she was also writing and interviewing for theglasshammer.com from near its inception and for over a decade. She credits a lot of what she has learned to John Lothian as well as The Glass Hammer founder Nicki Gilmour.

She continued to read the Financial Times, thanks to a three year gifted subscription, and has now read the analog paper for sixteen years on a daily basis. She also went back to school for a Masters in Journalism and grew her network in the derivatives space. One of her mentors Karen Wuertz gave her a career-changing piece of advice: get involved with an industry activity.

In 2009, along with her co-founder Leslie Sutphen, Darmoni created the non-for-profit networking organization Women In Listed Derivatives (WILD). At over 1200 women strong, the organization promotes networking and relationship-building among women in derivatives through social, educational and mentoring events.

Reframing the Salary Negotiation

“One of the things WILD taught me was that you should always ask for more in salary negotiations,” recommends Darmoni, who never used to realize how important it was to do so. “In fact, companies could almost expect it, because if you’re on the other side and working for the company, they want you to get them the best deal and ask for the best price. So you want to show that you are willing to negotiate, for yourself and for them.”

She credits a WILD mentor Pat Lunkes for teaching her that when you reframe the salary discussion as part of the interview, it’s not a risk to ask for more but rather a risk not to. Braving the conversation provides another opportunity to qualify yourself and set a tone around your value.

Hearing The Feedback That is Hard To Hear

Darmoni has come to value receiving the feedback that can be hard to hear. She finds even soliciting feedback by asking “why the no” can be very constructive and valuable.

“I used to hate feedback, but I think feedback and constructive criticism is so important. You may have really good intentions and just not know you’re doing something that isn’t working for you,” she says. “The feedback may be really hard to hear and digest, but sometimes it comes from a great place. Even if you may not agree, it’s good to hear it.”

Darmoni provides the personal example of being highly responsive to communication as a matter of practice. It would have been her habit to reply to a message as soon as possible, acknowledge receiving it and promise to come back with a response if she didn’t yet have one, to feel she had closed the loop. Her direct boss challenged her to break this habit and give pause before responding at all.

Now, rather than respond immediately, she steps back and responds only when she has reflected and is ready. Not only does this give her spaciousness for more thought, it shifts her value equation to her insight and expertise, rather than her availability, and helps her clarify her thinking because she’s not focused on just being responsive.

Finding Your Own Cultural Fit

Looking back on her career path, Darmoni stayed in one position for only eight months, when the cultural mismatch was both clear and painful. She emphasizes not to see a poor fit as a missed mark in your journey, but as guidance along the way.

“One of my career goals is to be a Commissioner at the Commodity Futures Trading Commission and I was working for a related regulatory agency. At the time, it felt like such a failure, and I was really disappointed that it didn’t work out,” she recalls. “Now I’m actually very proud of my time there. I think everybody has something on their resume that just didn’t work out the way they thought it would. I went on to find the cultures that I did fit in with.”

While it took getting past the feelings of wanting it to work, Darmoni is glad for the contrast of experiencing a culture she did not thrive in: “I know the dynamic of a team and how important that is, and I’m so grateful for where I am now.”

Shaping a New Asset Class

Darmoni currently works at ErisX, a U.S. based exchange and clearinghouse for crypto spot and derivatives markets. With her current focus on crypto, Darmoni enjoys helping to build a new asset class from the ground up: “Things are still shaking out. The leaders and players are still being developed, and we don’t yet know for certain what the major plays will be.”

As a way to explain Bitcoin, she cites the comparison between gold and Bitcoin as digital gold. Both involve mining, both are fixed in quantity and both have costs associated with mining and storing, so require hedging of risk.

With her passion for regulation, Darmoni would personally imagine there is valuable friction to come from the meeting of the established financial markets and the emerging world of unregulated crypto, though both may have to adjust how they approach the other.

She has a personal hunch that the crypto disruptors might even offer unexpected help: “My personal opinion is that decentralized initiatives may have thought-provoking solutions for problems that the established financial markets have and are working to solve.”

Darmoni admits that her 16-year self-driven love affair with finance, and especially derivatives, comes down to fascination with how much reach the market has in setting the prices of our daily lives and yet how little people know about the market itself, which makes it a powerful industry to be a part of.

The Value of Being Personally Motivated

During a Peloton ride with Robin Arzón that focused on finding your motivation within, Darmoni realized how much she resonated with being internally driven.

“I did not have a financial background so I learned mine through reading, asking questions and establishing relationships. I didn’t know a single person in finance or derivatives, whereas everybody knows everybody in my industry,” she says. “Aim to build relationships with mentors and sponsors. I’ve been lucky to have maintained great relationships with people that have helped me.”

While she used to find FT Weekend’s How To Spend It too frivolous, she admits she treated herself to a wellness retreat she found amidst its page for her 40th birthday.

This woman is even finding her vacations through her passion.

By Aimee Hansen