HSBC has finally done something for Britain rather than China

The chaos of this Government is such that sadly all too often it is easy to despair at our political leaders.

The drama that engulfed Westminster and led to the resignation of the chancellor and prime minister within just a few days last autumn was a new low for a Conservative Party severely tainted by Partygate.

But occasionally the system works precisely as it should and you have to take your hat off to those involved.

The bailout of the UK arm of stricken West Coast lender Silicon Valley Bank is one such instance – a sale of the business to HSBC assembled with lightning speed by Rishi Sunak, the Treasury, the Bank of England and the bank’s senior bosses.

Deposits are protected; the technology sector and the tens of thousands that it employs avoids disaster; it restores some – if not all – confidence in the banking system; and as Jeremy Hunt was quick to point out, not a single penny of taxpayer money was spent.

To pull off something that complex in the space of a weekend is hugely impressive and a reminder that Britain’s most important national institutions still possess the proficiency to rise to the occasion when needed most.

Yet questions remain. One of those that is in danger of being lost amid the frenetic pace of events is why HSBC stepped in to save the day.

Boss Noel Quinn went some way to answering that question with a short statement about how the deal beefs up its commercial banking operations particularly among “innovative and fast-growing firms” in the technology and life-science industries.

There’s no arguing with that logic.

With 3,300 UK clients, including start-ups, venture-backed companies and funds, you can understand why HSBC pounced.

It allows the bank to instantly tap into a formidable roster of blue-chip clients but also the vast network – or “ecosystem” to borrow an awful phrase – underpinning a highly lucrative entrepreneurial corner of the economy.

Indeed, if just a handful of these fledgling start-ups prove to be among the next crop of big British businesses then it could turn out to be the takeover of a lifetime given that the token sum of just £1 changed hands.

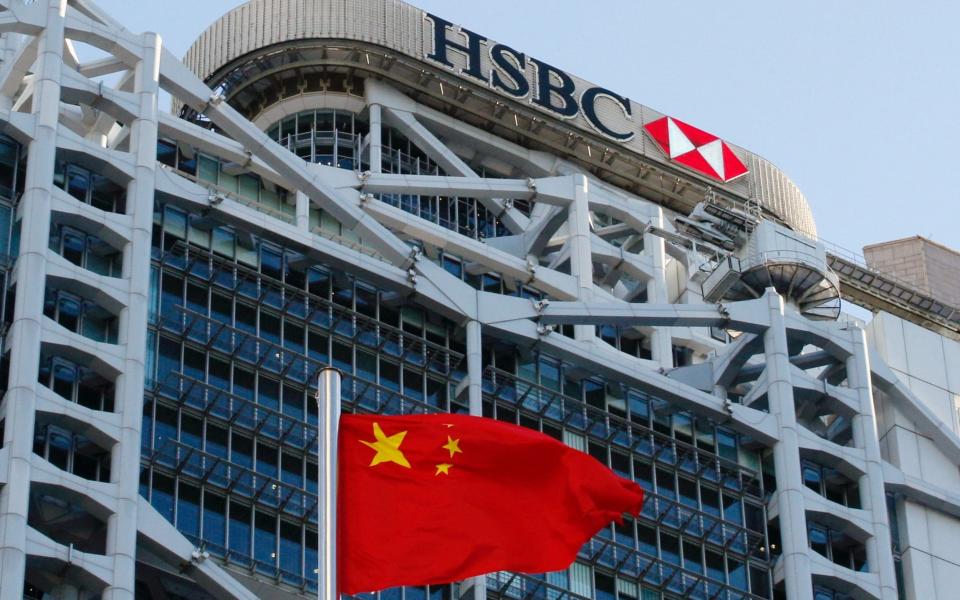

But a cynic might ask whether that is the whole story. As ever these days, it is impossible not to spot the shadow of China looming over Britain’s largest bank when it comes to matters of strategic importance such is the extent to which HSBC has doubled-down on the region in recent years.

It is possible of course that ministers were nervous about reports of Middle Eastern buyers circling SVB’s British unit, and HSBC was strong-armed into providing a more reliable homegrown solution.

There is obviously a reason why it was chosen from a process described as highly competitive.

It may be that it was the only big UK bank willing to step in, or perhaps it is the only one able to these days, such is the industry's retrenchment in the wake of the financial crash.

But equally it is not a stretch to think that HSBC spotted an opportunity to repair some of the huge damage that has been done to its reputation by cosying up to Beijing at the worst possible time.

The bank’s unabashed big “pivot to Asia”, as it innocuously describes it, has come just as the Chinese Communist Party turns increasingly hostile towards the West.

And what better way to suck up to the UK Government than spearheading a rescue deal that means the state doesn’t have to intervene to protect thousands of depositors in an industry that it is desperate to court.

It was only very recently that ministers unveiled a 10-point plan to boost growth by turning this country into a science and technology superpower.

The timing of SVB’s troubles was particularly delicate – with the budget just days away, an under-fire Treasury could ill afford such a PR disaster on its hands as Hunt looks to calm some of the concern over his planned tax raids.

So the goodwill is undeniable and having done ministers a huge favour by riding to the rescue it is not impossible to imagine that HSBC could seek to use that as leverage in the future if the situation in China becomes even more difficult.

The logic would go something like this: in return for providing stability to the banking system and propping up scores of fast-growing start-ups, HSBC is entitled to expect, if not request explicitly, more tolerance from the Cabinet over its predicament in China.

At the very least, the bank would probably be within its rights to ask that the Treasury doesn’t go out of its way to criticise HSBC publicly, or put additional barriers in the way of doing business, if and when a new Cold War between East and West ratchets up.

Quinn may also have an eye on an increasingly bitter row with its largest shareholder, the Chinese insurance giant Ping An, which has launched a campaign for HSBC to be broken up.

Though it has so far resisted the calls, it may be something that the board has to continually look at and by bulking up the UK arm, it makes it easier for HSBC to pull the trigger if the bank changes its mind.

HSBC may have finally done something for Britain rather than China but it is naive to think the bank won’t expect something in return.