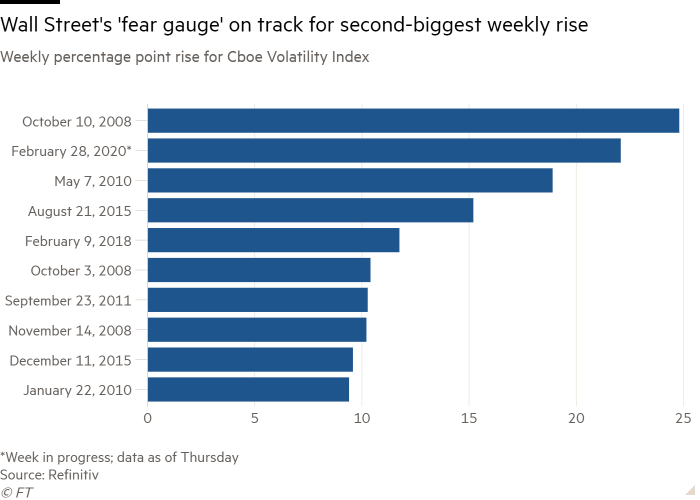

Volatility index hits highest level since 2015

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Cboe volatility index — known as Wall Street’s “fear gauge” — jumped to its highest level since August 2015, reflecting the heightened volatility in US stocks at a time of growing concerns over the coronavirus outbreak.

After a tumultuous run for the market, the Vix is staring down its second-biggest weekly rise on record, having gained 22.1 percentage points since Friday’s close. The biggest weekly rise was 24.8 percentage points for the week ended October 10, 2008, during the depths of the financial crisis.

The Vix hit 39.2 by the close on Thursday, up from 27.6 a day earlier.

Investor angst over the potential economic fallout has sent all three major US stock indices into correction territory, defined as a drop of more than 10 per cent from a recent high. In a tumultuous week for global markets, the S&P 500 has lost 10.8 per cent of its value, which would mark its worst week since October 2008.

*This post has been amended to say the Vix rose to its highest level since 2015, not 2011.

Comments