“We need to continue to be rational. Irrationality doesn’t help. We need to deal with the facts.”

Dr. Tedros Adhanom Ghebreyesus, World Health Organization Director General

In January when we first began getting information about the outbreak of the coronavirus (now named COVID-19) I made an effort to communicate through LinkedIn and Twitter my concerns and worries about the virus. I was worried about the nature of the disease and the critical differences between COVID-19 and SARS. I thought that in comparison, COVID-19 would be more infectious and dangerous over the course of a larger outbreak, for two main reasons. First, the infected people did not show immediate high temperatures like those infected with SARS (alerting others to the disease), and the incubation period of COVID-19 is 14 days, during which individuals can be infectious without showing any symptoms. In other words, COVID-19 wouldn’t be detected as easily as SARS, and nor could you contain it via taking travelers’ temperatures as they landed in airports. Yet, the markets initially continued to rally in the United States into mid-February.

This equity market confidence didn’t last: two weeks ago, the markets began to drop. We now have a full-blown panic in the financial markets over the spread of COVID-19. The virus is the top news story across all media, and many people are growing nervous over the prospect of this creating a global recession.

COVID-19 is present in the US as well, with the first death in the state of Washington announced over the weekend. San Francisco and the state of Washington have both declared states of emergency over the potential outbreak. Throughout the United States, contingency plans are being drawn up and put into place in the event of a large outbreak.

In my book “World Event Trading” I dedicated 5 chapters to infectious diseases, and the reaction to COVID-19 is well within the normal course of how people react to the news of a disease. There is tremendous uncertainty and fear, which is then reflected in the market response. The normal reaction is to be cautious, attempt to get away from the disease and reduce risk until more knowledge is gained. This is exactly what is happening now, and this has contributed to the spread of the disease.

How is COVID-19 worse than the seasonal flu?

At this point, one of the biggest drivers of COVID-19 fear is the lack of knowledge about its infection and mortality rates. In the US, the seasonal flu infects about 8% of the population (about 27 million) each year. It has a mortality rate of somewhere between 0.03%-0.05% according to CDC data. In the current 2019-2020 flu season, there have been 14,000 deaths so far. In 2018, it was a bad year and over 65,000 died. Seasonal flu is very infectious, but the mortality rate is relatively low (unlike SARS at +10%) and it peaks in January and February.

For COVID-19, the symptoms are similar to the seasonal flu with fever, cough, sore throat, runny nose, etc. However, doctors are still trying to understand the disease and the full extent of its symptoms.

In the largest study on the disease to date, the Chinese Center for Disease Control and Protection analyzed 44,672 confirmed cases in China between Dec. 31, 2019 and Feb. 11, 2020. Of those cases, 80.9% (or 36,160 cases) were considered mild, 13.8% (6,168 cases) severe and 4.7% (2,087) critical. Unlike the flu, the death rate from COVID-19 appears to be around 2.3% in mainland China with the Hubei province at 2.9% and other provinces at only 0.4%.

According to WHO, individuals at the highest risk for severe disease and death include people aged over 60 years and those with underlying conditions such as hypertension, diabetes, cardiovascular disease, chronic respiratory disease and cancer. They note that “disease in children appears to be relatively rare and mild with approximately 2.4% of the total reported cases reported amongst individuals aged under 19 years. A very small proportion of those aged under 19 years have developed severe (2.5%) or critical disease (0.2%).”

If we do a simple equation, we get the potential for COVID-19 deaths in the United States at a low end of 104,000 and a high end of 598,000. The low end is a more likely outcome, due to the US response and good-quality healthcare system. Therefore, it would appear that COVID-19 represents a doubling of a very bad flu season.

How long will this go on and what will be the peak?

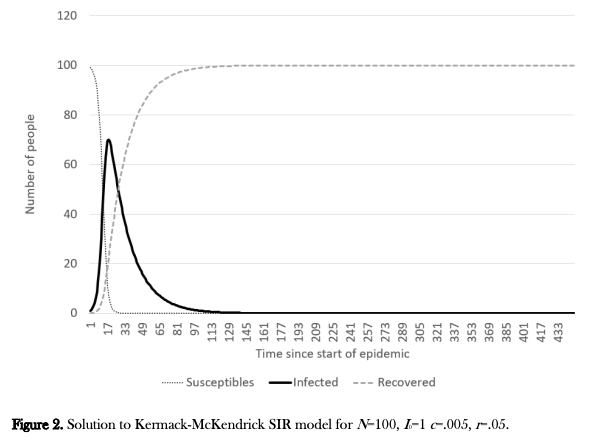

In most infectious disease outbreaks, we can chart their progress using the Kermack-McKendrick SIR model. A graph is below:

Nobel Prize winner, Dr. Robert Shiller explains the model:

“The Kermack-McKendrick (1927) mathematical theory of disease epidemics marked a revolution in medical thinking because it gave a realistic framework for understanding the all-important dynamics of infectious diseases. Their simplest model divided the population into three compartments: susceptibles, infectives, and recovereds, hence it is called an SIR Model or compartmental model. S is the number of susceptibles, people who have not had the disease and are vulnerable. I is the number of infectives, people who have the disease and are actively spreading it. R is the number of recovereds, who have had the disease 13 and gotten over it and are no longer capable of catching the disease again or spreading it. The total population N=S+I+R is assumed constant.

The key idea of the Kermack-McKendrick mathematical theory of disease epidemics was that in a thoroughly mixing population the rate of increase of infectives in a disease epidemic is equal to a constant contagion rate c>0 times the product of the number of susceptibles S and the number of infectives I minus a constant recovery rate r>0 times the number of infectives. Each time a susceptible meets an infective there is a chance of infection. The number of such meetings per unit of time depends on the number of susceptible-infective pairs in the population. The recovery from the disease is assumed for simplicity to occur in an exponential decay fashion, instead of the more usual notion of a relatively fixed timetable for the course of the disease.”

In layman’s terms, what we’re looking for is the point at which the number of recovered cases begin to exceed the number of infected cases. This indicates that the peak of the infection has occurred, and the peak of the virus spread in the community has occurred.

Has this happened?

In China, this has already happened: in February, Chinese agencies reported that the number of infections had fallen below the number of recovered cases. This is a likely reason behind why the Chinese government has felt confident in attempting to get their factories back in action. And yes, this could be premature. There have been confirmed cases of some patients who have appeared to recover from the virus and tested negative, later testing positive for the virus again. So much is unknown at this time, but experts believe this late positive result is due to the patients not fully recovering before being released. An alternative theory is that the initial negative test was incorrect, or that the virus is still being carried in the person’s body, but that they are no longer ill or contagious. Yet, it’s unmistakable that the number of recoveries in China is larger than the number of infections. This is a critical step.

Clearly, this is has not happened in the rest of the world. Iran, Thailand, Australia are all examples of where the number of infections remains higher than the number of people who have recovered. However, it is still early days in these outbreaks. The countries with better healthcare systems and those that are acting quickly to address the outbreaks will do much better than countries with less-efficient healthcare systems, including China (who was also faced with the “surprise” of COVID-19’s beginning). This includes the United States, which has an established healthcare system and a response already in place.

To be clear, this remains a fluid situation and there are many factors influencing the outbreak.

Panic

The past week was extraordinary as the financial markets began to radically reassess the risk of the outbreak and the impact on profits for US companies. The price movements have been extreme (both up and down) during the day. It is astonishing what can happen when those in leadership fail to grasp the severity of the disease and the mood of the public. The approach from the Chinese authorities is a paradigm for what can happen as they moved quickly from denial to serious actions to combat the disease.

In the United States, we’ve had something similar happen. Initially, HHS and CDC provided clear and rapid information about the outbreak and the concerns over COVID-19 spreading to the United States. However, President Trump did not originally see this as a major issue for the country. He said in January at the World Economic Forum that the US “have it totally under control” and downplayed it at a business roundtable during his trip to India in February.

At the same time, officials from the Centers for Disease Control (CDC) and National Center for Immunization and Respiratory Diseases were telling a very different story. Vanity Fair published this quote on Tuesday 25 February:

“It’s not so much of a question of if this will happen in this country anymore but a question of when this will happen,” said Dr. Nancy Messonnier, director of the National Center for Immunization and Respiratory Diseases. “We are asking the American public to prepare for the expectation that this might be bad,” she added ominously.”

On Wednesday during a CDC telebriefing, Dr. Nancy Messonnier then stated this:

“I understand this whole situation may seem overwhelming and that disruption to everyday life may be severe. But these are things that people need to start thinking about now. I had a conversation with my family over breakfast this morning and I told my children that while I didn’t think that they were at risk right now, we as a family need to be preparing for significant disruption of our lives. You should ask your children’s school about their plans for school dismissals or school closures.”

Trust

For any public official, there is a balance that needs to be struck between providing important medical information and strategies to protecting the population, and unintentionally creating a panic. While Dr. Messonnier did provide accurate and important medical and practical advice, panic also flowed soon after her comments that provided, perhaps, a bit too much information. The global financial markets reacted strongly to these kinds of statements from official organizations, along with the news of a “community” outbreak in the United States. Full-blown investor panic ensued.

On Thursday, the Trump administration held a press briefing and named Vice President Mike Pence to lead the efforts on the corona virus in the United States. This has signaled a significant reassessment of the risks. President Trump originally put forward a request for around $2 billion in funding for COVID-19 prevention and handling efforts, with Congress at work to provide an amount closer to $10 billion.

The Trump administration is now being questioned over the response and the placing of VP Pence in charge. The problem is that there is a lack of trust in the Trump administration’s response to the disease and an underestimation of the incredible, negative impact COVID-19 has had and will continue to have on the markets, the economy and the population. In the politically split US, each side wants to blame the other for whatever may be happening. To some extent, this response can be understood, and why each side feels justified in their accusations; panic and a desire to “blame” someone out of fear also plays a role. Yet, the risk of creating alarm through blame in the middle of the crisis is to yell fire in a crowded theatre and unnecessarily create additional panic that ultimately harms the entire public.

Reality

Circling back to the top of this article, I’ve quoted the World Health Organization Director General Dr. Tedros Adhanom Ghebreyesus and his appeal to be rational and focus on the facts. With disease outbreak, it’s important to remember that it’s never the disease that does the most harm from an economic perspective. Yes, the deaths and sickness are the immediate concern. But, it’s the public’s reaction to the disease that worsens the outbreak and harms the economy the most with jobs and lives at stake. As equity markets have lost $7 trillion globally and businesses are shutting down travel and conferences, Dr. Ghebreyesus’ words are appropriate to ponder.

Is this the height of the panic?

To answer this question, we have to understand why the panic started and what drove it. I would state unequivocally that there will still be some errors in how the response to COVID-19 is handled by the US and the rest of the world. But I am just as certain that it is unlikely that we will go through another cycle of not taking the disease seriously, having HHS/CDC officials issue dire warnings during a financial market meltdown and having an overreaction by the public and businesses.

Instead, we should do our best to focus on the facts, take appropriate steps and have realistic expectations of what this disease can do. Perspective is lacking and needed.

Really like the stats approach here!

Thanks Kevin, this is an extremely uncertain period of time that is generating massive amounts of uncertainty. We’re probably a month away from the peak infection period and 2 months away from when the general public begins to calm down.

Excellent commentary and analysis. Let’s hope the conservative estimate of 104,000 deaths is high. I think the interruption of supply chains, business and life in general is what is spoking the markets and will be fascinating to watch.

Thanks Guy! Yes, this week will be most difficult with the oil price war and a significant increase in US coronavirus infections due to better testing. However, we’ll also have a much better understanding of the mortality rate. If it’s 3.4%, then we’ll continue to see fear for the next month. If it’s 0.5-1.0%, then coronavirus is more like the seasonal flu and markets/public should calm down. Right now, it’s pure panic. If you are a long term investor, interesting time to be buying. If you are the “grab-your-beef-jerky-and-shotguns-and-head-to-the-hills person, then you’d be selling aggressively. Both may be right, but it depends on your time frame.

Great article. I have been discussing it during meetings and while talking to clients. Is it still playing out the way you envisioned? How much toilet paper have you bought?

Jamie, not as much as everyone else in the country! I guess everyone thinks they are going to get quarantined. People need to take this seriously, but be smarter about it.

Friday was a big day and US finally getting it headed in right direction. I’ll post more on this in just a sec.