U.S Government Sanctions Russian Crypto Miners after IMF Report

Key Insights:

On Wednesday, the U.S. government announced sanctions on crypto mining firms for the first time.

The latest sanctions come following the IMF highlighting the possible evasion of sanctions through crypto mining.

Bitcoin (BTC) showed little reaction despite the increased level of scrutiny.

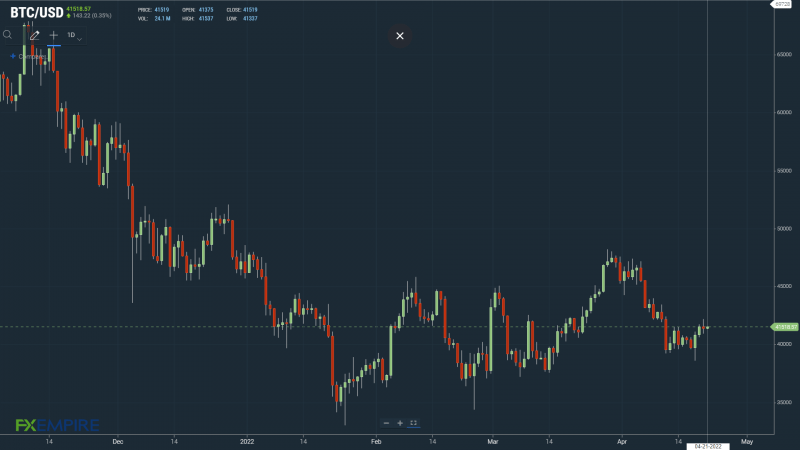

Government and regulatory scrutiny over cryptos have plagued the crypto markets since December.

The war in Ukraine and punitive sanctions on Russia have intensified the level of scrutiny. Governments are monitoring crypto movements and investigating any suspicious activity.

This week, there has been plenty of chatter on cyberattacks, with both Russia and North Korea center stage.

On Tuesday, the IMF also raised its concerns over cryptos and sanction evasion in the IMF Global Financial Stability Report.

U.S. Treasury Sanctions Crypto Miners Evading Sanctions on Russia

On Wednesday, the U.S. Treasury issued a statement on fresh sanctions targeting entities facilitating Russia to evade sanctions.

Titled ‘U.S. Treasury Designates Facilitators of Russian Sanctions Evasion,’ the Treasury stated,

“This is the first time the Treasury has designated a virtual currency mining company.”

The Under Secretary for Terrorism and Financial Intelligence, Brian E. Nelson, said,

“Treasury can and will target those who evade, attempt to evade, or aid the evasion of U.S. sanctions against Russia, as they are helping Putin’s brutal war of choice.”

Nelson went on to say,

“The United States will work to ensure that the sanctions we have imposed, in close coordination with our international partners, degrade the Kremlin’s ability to project power and fund its invasion.”

The Treasury stated that

“By operating vast server farms that sell virtual mining capacity internationally, these companies help monetize its natural resources. Russia has a comparative advantage in crypto mining due to energy resources and a cold climate. However, mining companies rely on imported computer equipment and fiat payments, which makes them vulnerable to sanctions.”

As a result of the focus on virtual currency mining companies,

“OFAC designated this holding company, Bitriver AG, pursuant to E.O. 14024 for operating or having operated in the technology sector of the Russian Federation economy.”

Additionally, OFAC designated Russia-based subsidiaries of Bitriver AG.

The U.S. government’s targeting of virtual currency mining companies coincided with the IMF Financial Stability Report.

IMF Highlights Risk of Cryptoization and Sanction Evasion

On Tuesday, FX Empire reported on the IMF’s focus on cryptos in its quarter Global Financial Stability Report.

The IMF discussed the risks of cryptoization and sanction evasion through the crypto ecosystem by way of,

(1) the use of exchanges and other crypto asset providers that are non-compliant with sanctions or capital flow management measures or both;

(2) poor implementation of adequate due diligence procedures by crypto asset providers; and

(3) the use of technologies and platforms that increase the anonymity of transactions.

The IMF then turned to crypto mining, stating,

“Mining for energy-intensive blockchains like Bitcoin (BTC) can allow countries to monetize energy resources, some of which cannot be exported due to sanctions.”

Despite the increased level of scrutiny and the timing of the Treasury’s targeting of crypto mining shops, Bitcoin has held relatively steady.

Bitcoin (BTC) Price Action

At the time of writing, BTC was up 0.35% to $41,519. The early upside reversed a 0.31% loss from Wednesday.

Technical Indicators

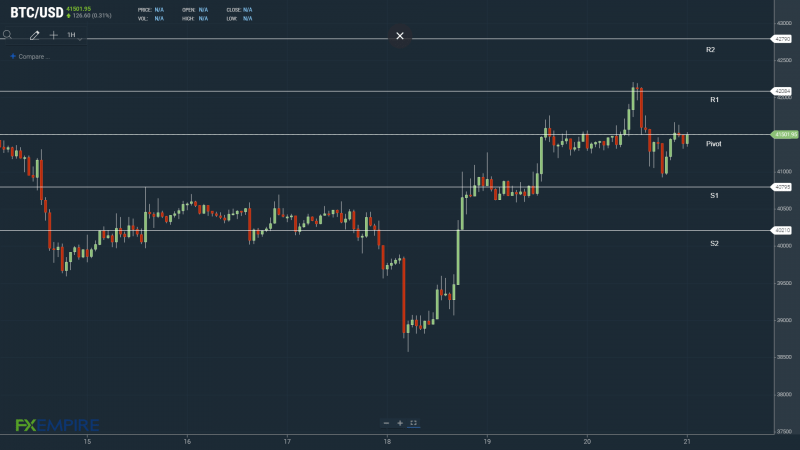

Bitcoin will need to avoid the $41,501 pivot to make a run on the First Major Resistance Level at $42,084. Bitcoin would need broader market support to return to $42,000 levels.

In the event of another extended rally, Bitcoin could test the Second Major Resistance Level at $42,790 and resistance at $43,500. The Third Major Resistance Level sits at $44,079.

A fall through the pivot would bring the First Major Support Level at $40,795 into play.

Barring an extended sell-off, Bitcoin should avoid sub-$40,000. The Second Major Support Level at $40,210 should limit the downside.

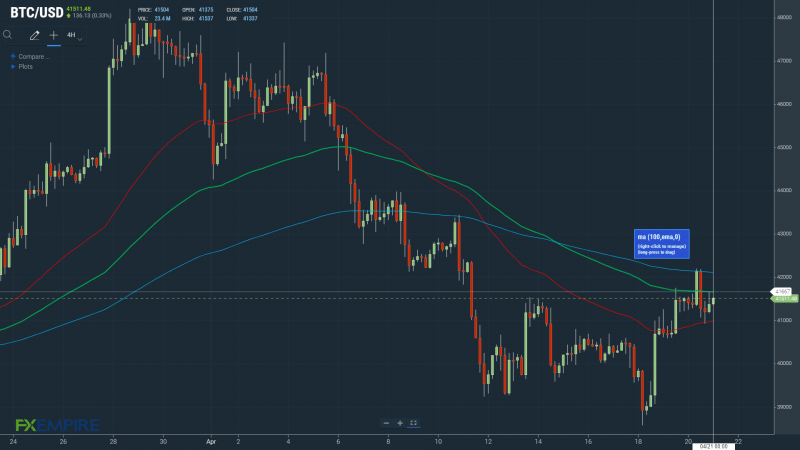

Looking at the EMAs and the 4-hourly candlestick chart (below), it is a bullish signal. Bitcoin continues to sit above the 50-day EMA, currently at $41,060.

This morning, the 50-day EMA narrowed to the 100-day EMA, providing support. The 100-day EMA held steady against the 100-day EMA.

A move through the 100-day EMA, currently at $41,667, would support a return to $43,000 levels.

This article was originally posted on FX Empire