How to reform today’s rigged capitalism

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

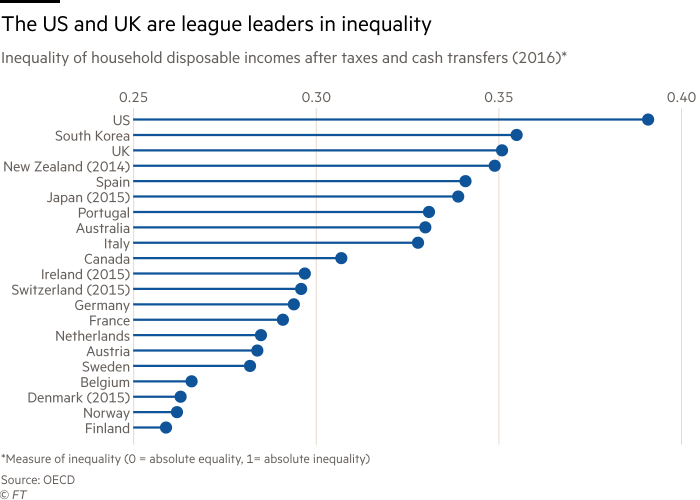

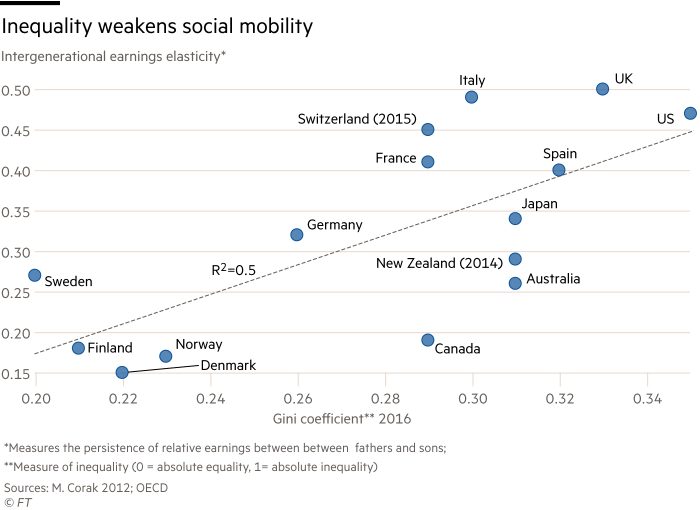

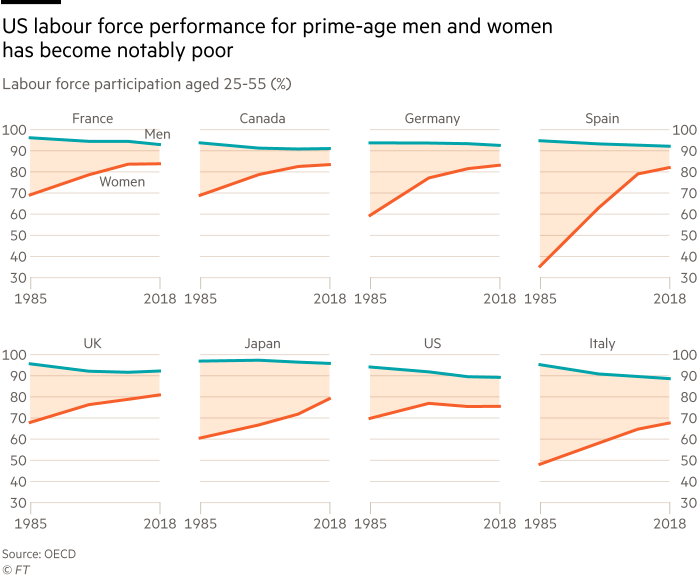

“It is clear then that . . . those states in which the middle element is large, and stronger if possible than the other two [wealthy and poor] together, or at any rate stronger than either of them alone, have every chance of having a well-run constitution.” Thus did Aristotle summarise his analysis of the Greek city states. The stability of what we would now call “constitutional democracy” depended on the size of its middle class. It is no accident that the US and UK, long-stable democracies today succumbing to demagogy, are the most unequal of the western high-income countries. Aristotle, we are learning, was right. (See charts.)

My September analysis of “rigged capitalism” concluded that “we need a dynamic capitalist economy that gives everybody a justified belief that they can share in the benefits. What we increasingly seem to have instead is an unstable rentier capitalism, weakened competition, feeble productivity growth, high inequality and, not coincidentally, an increasingly degraded democracy.” So what is to be done?

The answer is not to overthrow the market economy, undo globalisation or halt technological change. It is to do what has been done many times in the past: reform capitalism. That is the argument I made in a recent debate with former Greek finance minister Yanis Varoufakis on whether liberal capitalism should be saved. I argued, in effect, that “if we want everything to stay the same, everything must change”, as the Italian author Giuseppe Tomasi di Lampedusa wrote. If we want to preserve our freedom and democracy we need to embrace change. Here are five policy areas that need to be addressed.

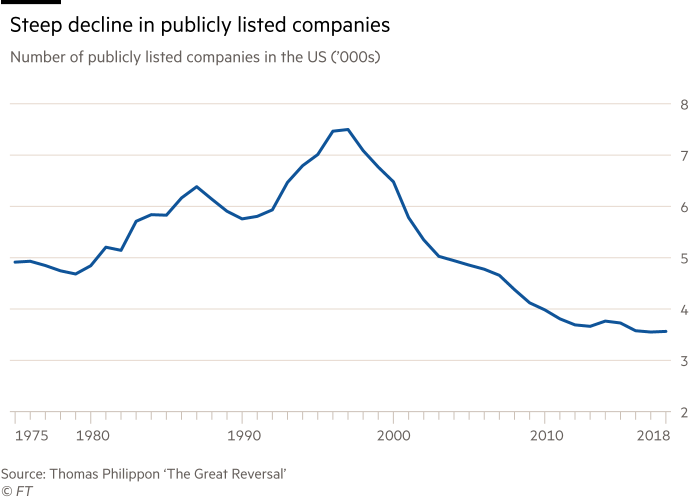

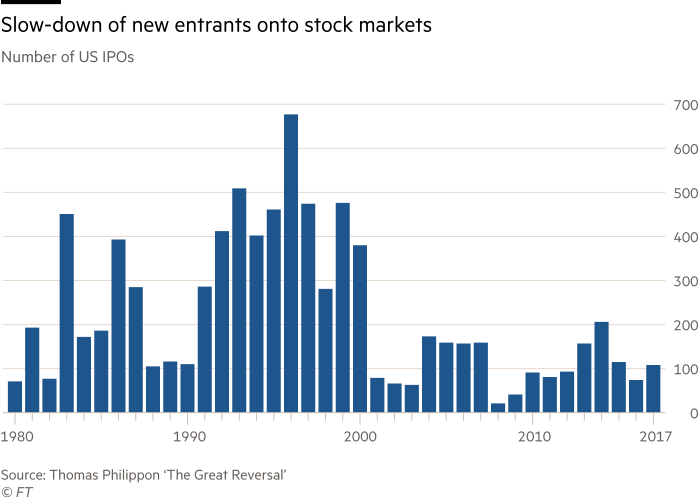

First, competition. Thomas Philippon’s wonderful book, The Great Reversal, demonstrates how far competition has weakened in the US. This is not the result of inevitable forces, but of policy choices, especially abandonment of an active competition policy. US markets have become less competitive: concentration is high, leaders are entrenched and profit rates are excessive. Moreover, this lack of competition has hurt US consumers and workers: it has led to higher prices, lower investment and lower productivity growth. In a paper on reducing inequalities, in an invaluable collection on “Beyond Brexit: A Programme for UK Economic Reform”, Russell Jones and John Llewellyn argue that concentration and mark-ups have also risen in the UK.

In the past decade, Amazon, Apple, Facebook, Google, and Microsoft combined have made over 400 acquisitions globally. Dominant companies should not be given a free hand to buy potential rivals. Such market and political power is unacceptable. A refurbishment of competition policy should start from the assumption that mergers and acquisitions need to be properly justified.

Second, finance. One of Prof Philippon’s most striking conclusions is that the unit cost of financial intermediation has not fallen in the US over 140 years, despite technological advances. This stagnation in costs has, alas, not meant financial stability. There is also evidence that there is now simply too much credit and debt. Radical solutions exist here, too: raise the capital requirements of banking intermediaries substantially, while reducing prescriptive interventions; and, crucially, eliminate the tax-deductibility of interest, so putting debt finance on a par with equity.

Third, the corporation. The limited liability joint stock corporation was a great invention, but it is also a highly privileged entity. The narrow focus on maximising shareholder value has exacerbated the bad side-effects. As the British Academy’s “Principles for Purposeful Business” report argues, “the purpose of business is to solve the problems of people and planet profitably, and not profit from causing problems”. That is self-evident. It is also hopeless to rely on regulation alone to save us from the consequences of myopic business behaviour, particularly when business uses its vast resources to lobby on the other side. The US Business Roundtable has recognised this. We need new laws, to effect required changes.

Fourth, inequality. As Aristotle warned, beyond a certain point, inequality is corrosive. It makes politics far more fractious, undermines social mobility; weakens aggregate demand and slows economic growth. Heather Boushey’s Unbound spells all this out in convincing detail. To tackle it will require a combination of policies: proactive competition policy; attacks on tax avoidance and evasion; a fairer sharing of the tax burden than in many democracies today; more spending on education, especially for the very young; and active labour market policies, combined with decent minimum wages and tax credits. The US has poor labour force participation of prime-aged adults, despite unregulated labour markets and a minimal welfare state. It is possible to have far better outcomes.

Finally, our democracies need refurbishing. Probably, the most important concerns are over the role of money in politics and the way the media works. Money buys politicians. This is plutocracy, not democracy. The malign impact of fake news (which is the opposite of what the US president means by the term) is also clear. We need public funding of parties, complete transparency of private funding and also far greater use of consultative forums.

Without political reform, little of what we need elsewhere will happen. If things then stay as they are, economic and political performance is likely to get worse, until our system of democratic capitalism collapses, in whole or in part. The cause then is great. So is the urgency. We must not accept the status quo. It does not work and has to change.

Follow Martin Wolf with myFT and on Twitter

Letters in response to this column:

Bank shareholders get a poor deal — it’s no wonder they are fed up / From Prof Eric De Keuleneer, Université Libre de Bruxelles, Belgium

Superstar companies are giving consumers more choice, not less /From Ryan Bourne and Diego Zuluaga

Force investment out of unsustainable practices / From Prof Michael Jacobs, Professorial Fellow, Sheffield Political Economy Research, Institute (SPERI), University of Sheffield, UK

Comments