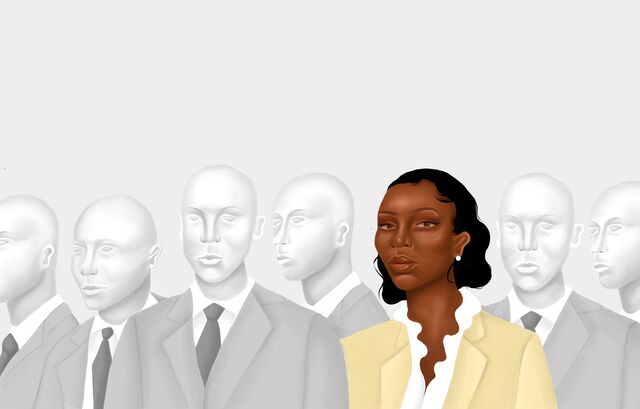

The Only One in the Room

On Wall Street, being Black often means being alone, held back, deprived of the best opportunities. Here, Black men and women tell their stories.

It might seem impossible to tell the history of Black people on Wall Street. That’s because the finance industry shut African Americans out of its executive suites and banking partnerships and off trading floors for decades. Even now, despite diversity programs and pledges to do better, Wall Street’s highest echelons lack Black faces, with rare exceptions.

Another challenge to telling the story of African Americans in finance is that the people who’ve lived it blazed wildly different paths. There is no one definitive experience.

But all their stories matter. What happens inside this industry ripples out into American wallets, homes, neighborhoods, corporations, and government. Outright racism and institutional failings on Wall Street have limited Black wealth and dreams. But African-American bankers have also sometimes helped pave the way for others to succeed.

This year’s corporate avowals, workplace statistics, and diversity benchmarks have risen in a cacophony that risks drowning out the very voices they’re meant to spotlight.

Some of those voices, edited for brevity and clarity, speak out on these pages. They reflect decades of a Black presence on Wall Street, from just a few years after Martin Luther King Jr.’s assassination to today, amid fury over George Floyd’s death at the knee of a Minneapolis police officer.

Some made it to the top, some left disenchanted. Some became rich, some were so marginalized they had to sue.

Some think Wall Street is hopeless, some are more optimistic than ever. —Kelsey Butler and Max Abelson

I. Getting There

Racquel Oden, 47, is northeast divisional director for the consumer bank and wealth management business at JPMorgan Chase & Co., overseeing 10,000 employees. She began her career in 1997 as an equity trader at Morgan Stanley and has also held roles at Merrill Lynch and UBS Group AG.

I didn’t have any family who ever worked on Wall Street, so it wasn’t anything I knew. I had an unusual career in that I graduated with my MBA from Hampton University, an HBCU [historically Black college or university], which is very different, and was recruited to Morgan Stanley and joined the equity division, which started my career on Wall Street.

Both my parents were immigrants to this country, and I was the first to attend college and experience life here in the United States. With that, I was definitely taught to have a strong work ethic: Focus on your education. Did I ever feel [I had] to be twice as good? A hundred percent. I was a Black woman on Wall Street, so I knew that was par for the course.

Tessie Petion was an intern at Citigroup Inc. before she took a job at Deutsche Bank AG following graduation. After heading environmental, social, and governance (ESG) research at HSBC Holdings Plc, she left in May to join Amazon.com Inc. as head of ESG engagement.

I was a junior in college [in the late 1990s]. I did an internship with Sponsors for Educational Opportunity [a nonprofit that offers educational and career support to young people from underserved communities]. I went down to New York for the interview. I had interviewed before but had never had a very corporate job before. I expressed a preference for consulting. SEO actually gave me an offer for investment banking. The great thing about SEO is that you had essentially 200 interns who were people of color—Asian, Black, Latino, East Asian, and South Asian, a bunch of kids who were from all over the place.

I never, ever thought that I would be in banking, never considered it. I had an information systems background. Banking seemed very much like, you know, the movie Wall Street. I didn’t see a lot of me in the movie Wall Street.

And so when I got the internship [at Citi] I was like, OK, well, let’s give this a shot. Definitely not a world I considered.

Jared Johnson, 30, is the co-founder of the apparel brand Season Three Inc. He became a JPMorgan Chase & Co. associate in 2015 but decided to leave in 2017. This year he graduated with master’s degrees from Harvard’s John F. Kennedy School of Government and MIT’s Sloan School of Management.

I’m originally from St. Louis. I went to college at Purdue. I was paying a ton of money to go there, and I was going to have a ton of debt. I took this accounting class that was notorious for being the weed-out class. I did incredibly well in it. And afterward, I felt, maybe this just comes naturally to me. I was hyperdetermined and hyperfocused in a way that I’d be shocked if I could ever get back there again in life. I made everything about landing that job. I read every book. I did everything. So when I finally was placed [through SEO] in JPMorgan, I was very excited. I was like, This is my opportunity.

I had a few suits at the time. I remember having this gray suit, a light gray suit, and then I probably had this black suit. And I remember showing up to JPMorgan, and everyone wears a dark blue suit. I didn’t know that was the Wall Street look. Dark blue suit, white shirt, black shoes.

I’m remembering a room, 10 to 12 people, all the Black interns. This one [older Black colleague] would invite everybody to this meeting. He basically would explain the fact that you were highly visible as a Black employee in the bank. And everything you did, good or bad, would be magnified: “So if you’re really good here, and you shine during the summer, a lot of people will notice it. And if you’re really bad, or you mess up here and there, a lot of people will take notice of that.”

One of the things he would say is that on the private-banking side “your career trajectory was limited as a Black person. And the reason why was at a certain point it becomes about who you know. It’s all personal relationships that matter. If you grew up in Greenwich, Conn., and you just happen to know a lot of people who have money, you could be successful, because you could call on your friends’ parents and hopefully get some of them to become clients.”

His argument was, you don’t have that. You don’t have that luxury. So you probably won’t be able to generate business. You basically have a ceiling on your career in the private bank [and should] find roles in investment management.

I get a phone call from someone in HR. If you were doing a movie, it was one of those highlights. You get the call, and you jump with joy. I made my entire college experience about getting this job. Now I had it.

I invested in a closet full of dark blue suits and white shirts.

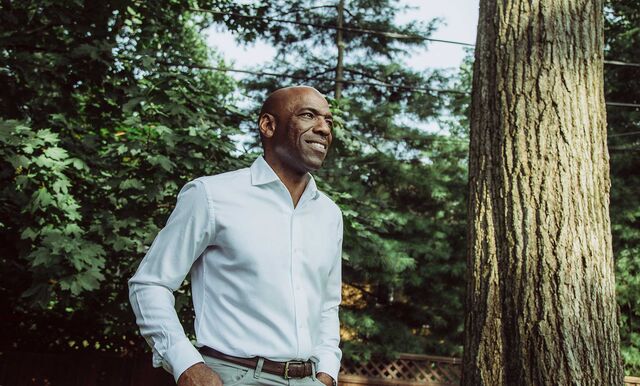

Anré Williams, 55, is group president of American Express Co.’s global merchant and network services unit, which handles relationships with banks and merchants that accept AmEx around the world. Williams joined AmEx’s marketing division full time in 1990 after interning at the company.

I was the first person in my family to go to college, so I kind of learned as I went. [At Stanford,] I majored in economics, and I decided when I was an undergrad I wanted to work in business in some capacity. I wasn’t sure what industry. I didn’t know if it would be in accounting or in finance or in marketing or in sales or manufacturing. I wasn’t sure, but I knew I wanted to work in business.

I knew that at some point I may have to get an MBA if I wanted to be able to be equipped to excel at the highest levels of business.

At the time, I would often look for information, for inspiration, or for role models or people who had charted a path. I would look for books, or biographies, or newspaper articles, or magazine articles. One magazine I used to read often—cover to cover—was Black Enterprise, because it highlighted African-American executives or entrepreneurs who were successful in business.

I read about Reginald Lewis, an entrepreneur who did one of the largest leveraged buyouts of the time. Or Barry Rand, who was an executive at Xerox in the late ’80s and ’90s. Or Ken Chenault, who was at American Express. Reading about people to inspire me, to see what their paths were. Where did they go to school? Where did they work before? What industries were they in? What did they major in? Those types of things. To get a sense of how they charted their path.

I ended up working for a couple of years after undergrad and went to business school at Wharton. I majored in marketing when I was there and [minored in] real estate finance. I wasn’t sure what company to join or what industry, but I knew [Wharton] would be great training. I wanted to work in product management and marketing for the summer, and American Express was one of the companies that offered me a summer internship. I joined for the summer and had a fantastic experience and ended up coming back to American Express full time, and I’ve been in the company ever since.

Chris White, 45, has worked for Salomon Smith Barney, MarketAxess, Barclays, and Goldman Sachs Group. He is the chief executive officer of advisory firm Viable Mkts LLC and BondCliQ, a centralized bond trading platform. (Bloomberg LP, the parent of Bloomberg News, competes with BondCliQ in providing bond-price information.)

I often say to people, “I’m the least-educated person in my family.” My parents both have master’s degrees. My father had an MBA from Columbia that he got in the early ’70s, and my mother has probably about four master’s degrees in childhood education and in special education. So really, really well-educated.

I went to [Phillips Academy] Andover for high school, and then I went to Brown University. I played basketball there. I didn’t pursue graduate school or anything like that. I found my way to Wall Street because, you know, there’s sort of a steady pipeline of Wall Street executives who played sports. I [took] the traditional Ivy League route: One of the basketball-playing alumni got me a job at Bear Stearns the summer after my freshman year. I was a horrible employee, because I’d never worked in an office before.

Then my junior year, I got a summer job at Smith Barney. And it was just a magical summer. I really enjoyed the work. I was working in mortgage-backed support. The head of fixed income at that time was a Brown alumnus who’d played basketball and actually remains one of my mentors.

One of the things at the time—it was a huge thing: There was a Black trader working on the trading desk, a guy named Mike Baker. And so to me, it was like, well, if he can become a mortgage trader, then I can. You have to imagine going into an industry where you are so often the only one. That already sends a signal as to what’s possible.

There’s not a person today on Wall Street that is successful because they just came in and rocked it. It’s not the way Wall Street works. You come into Wall Street, and then someone takes a vested interest in your success, and they help you.

II. At Work

Racquel Oden: Women don’t apply for jobs unless they feel like they have every qualification. Being a Black woman, I was committed to ensure there was no box I didn’t check. I could do asset management, I could do wealth management, I could do investment banking, I could do retail, I could lead large organizations, I could run strategy, I could handle a P&L [profit and loss statement], I could focus on product distribution. I was going to have all the licenses, I was going to have all the degrees. And I think that was important to me to feel like I could be successful on Wall Street.

I became chief of staff to the president of a pretty large organization at UBS. It happened based on me presenting at a meeting and someone seeing the work that I did and asking me if I would join their team.

It was just a normal executive update, and that day the president showed up—no one even knew he was going to be in the meeting. So it was never intentionally planned that way. But [I] was prepared for my topic, asked three or four very pointed questions, knew my numbers, knew how to respond, and he had heard about the reputation that I had and got to see it in action based on that meeting.

So does that happen often? No. But I think what’s critical and important was that you had a senior person—a White male—who saw something in some way that said, “I want that person on my team.”

You need to be prepared at all moments, because you never know when “that moment” is. I wouldn’t have known that that meeting was going to be “the moment.” I always bring 110%. I’m always overprepared, and I always want to make sure it’s that level of quality at all times.

[That job] gave me exposure at a very senior level to understanding large organizations and running them at the executive committee level. Today, leading an organization of 10,000 people, I obviously get to leverage [that].

Tessie Petion: At my internship at Citi, the MD [managing director] of the group was a woman, but six months into my career at Deutsche Bank, I moved to London where I worked on the trading floor, and quite consistently, I was the woman of color—rather, I should say, I was the Black woman. To everyone’s credit, no one was blatantly racist to me.

At one of the banks I worked at there was a forum on diversity, and there was a presentation. They pulled together all of the diverse members of the team. It was divisionwide. Literally, I’m not exaggerating when I say it was me made to look like a collage of pictures. You could spot me in the class, several times. There was me, [and] an East Asian woman—she’s actually Brazilian but of East Asian descent—and a South Asian man.

We played “spot each other” [on the] huge collage. I was on it at least three times, if not four. The East Asian woman was on it twice. The South Asian man was on it three times. And we said, “OK, if you’re thinking about putting together a diversity panel and you find yourself having to repeat the picture of someone, take a step back and think, OK, we might have a problem.”

It was like, this is a celebration of diversity? And I just remember thinking, Do you not see the irony here? No. OK, great. Awesome.

[SEO was] very good about putting us in front of senior people on Wall Street. There was a woman [Carla Harris], she works at Morgan Stanley. I think when I first met her, she was a director, and now she’s an MD, and she’s on the board of Walmart. They were very good about showing us that there are people who make it at senior levels. But at my firm, I didn’t see that. I saw that it existed. I didn’t see it every day.

Photographer: Schaun Champion for Bloomberg Markets

Franklin Raines: “Don’t Just Talk About It”

People assume a lot about me because I am Black. I have a friend who has worked on Wall Street for the last 17 years, does very well for himself. But people assume because he’s Black he has a disadvantaged background or he’s from some disadvantaged home in the area. None of that is true, but that’s the assumption that’s made. I think that people assume that they know everything there is to know about me because I’m a Black woman from Brooklyn, and I’m pleasantly surprised when that is not the case.

Part of the moral of the story is that I am very, very, very used to being the only Black woman in places. At my first grad school, I was the only Black woman in my year—actually in both grad schools, I was the only Black woman. That’s something that’s not uncommon for the folks that end up sticking around on Wall Street.

We have to be supercareful about everything, because if it goes badly with me, then maybe the next time they look at a person of color then they’re like, “Well, we tried that one, right?”

The thing that I say all the time to juniors [in the office] is it doesn’t mean that you can’t have a career, but you do have to know that [being supercareful] is the case all the time. I am being candid, but, I guess, to me, being Black on Wall Street is [being] someone who’s a resilient person, who knows that they might get left out of some conversations but will find a way to get in that conversation anyway, right?

Something that I actually thought was weird: You know, on all these [PowerPoint] decks, here’s my picture everywhere. But it probably helped in some ways socialize the idea that I’m the one coming in, that I’m the one that’s leading the meeting, that I’m the one that sets the pace. A big part of that was who I worked with. My bosses at the end at HSBC, if we had a meeting in the U.S., it was my meeting. If someone tried to talk to them because they were men or non-Black, they’d be like, “This is Tessie’s meeting.”

Jared Johnson: I had no connections to Wall Street. I didn’t know anyone who worked for a bank. Outside of TV shows, movies, it really was just a figment of my imagination. When I was in college, I was reading the Wall Street Journal, reading the Financial Times, trying to educate myself as much as I could.

I built this construct in my mind of what it was like to work on Wall Street. That construct really was that all of my colleagues, everybody I worked with, would be exceptionally smart, because the bar to get into the door was so high. I had a concept of all the forces that would work in the opposite direction of that: structural racism, unconscious bias, nepotism in some cases. I think I had a loose idea of how those things factor into a workplace like JPMorgan.

But I still expected a level of excellence and a level of intelligence. I would ask myself, Who interviewed this person? How did they get here? Because frankly they weren’t that bright. Some people wouldn’t even pass the test in my mind that they would be able to convince someone else of their brightness. And that flat-out surprised me.

[But] you can’t skate by at the same level of your White colleagues. You have to be excellent in order to succeed.

My expectation working there the whole time was if I’m going to walk into a room with 10 people, I’m probably going to be the only Black person there.

I moved to a role that was more of a sales support role. I worked mainly with this one guy. He dressed very well, I guess, in a cheesy Wall-Street-guy way. He had nice watches and drove a Porsche. Slicked-back hair. I never liked him. And the feedback he would always give me was to be more vocal or more emotional. I would never have raised my voice, or showed any emotion, or cried at the office. His remark was, “I can’t even tell if you are enjoying what you’re doing, or if you’re happy, or celebrating.”

“Fit” was this subjective idea about what JPMorgan’s culture is currently like. JPMorgan is very proud of the culture it has.

What they were doing was almost training you to learn the language, learn the customs. We were taught and groomed how to operate in a White corporate world. People are very resistant to give up any elements, traditions of the White corporate American culture to make room for something that looks different.

I landed on this team that called on independent investment advisers and ended up having a really great experience. My standing and stature grew, because I was in a position where I was highly valued. I felt I was in a space where I was given a lot of autonomy. I was respected and valued by the members on my team, and felt I was in this zone of growth.

By the time I left, I had a full beard, and my hair was much longer, and I was much more comfortable being closer to what I felt was myself at the office. I felt that was something I had to earn. I certainly felt I carved out more space to be myself and built a reputation with people that gave me more latitude to take risks and bring more of my full self to work. But I don’t think, even at the end, I would be able to tell you that I felt at home.

Anré Williams: Seeing people who you feel are like you or are similar to you—that you feel have done what you aspire to do—shows you that it can happen for you. It’s a physical demonstration that it can be done. And I always say that if you can see it and you believe it, then you can achieve it.

That’s, in a way, what Ken [Chenault, AmEx CEO from 2001 to 2018] was to me.

Just imagine being 19 or 20 years old and reading about people that I didn’t know that I thought did something amazing that I aspired to. Seeing Ken, among others, on the cover of Black Enterprise magazine at that age, it was really inspiring to me, because that told me that it was possible. It was hard. It would be difficult. But it was possible. And that’s what it was.

It just so happens that I was placed in the same business unit as a marketing summer intern where Ken was. And knowing that the senior leaders in our business unit reported up to him and that I was working on PowerPoint presentations that he would ultimately review and decide on with them was something that was inspiring to me.

I wanted to work in a company where I felt that I would get a fair shot. And some of the other companies I interviewed at—they were top-notch companies—but I wasn’t convinced that they had enough diversity within the executive and senior ranks to make me feel that if I was there I would get a fair chance. Having Ken and others like him at American Express made me feel more comfortable joining the firm.

Photographer: Lorenzo Pesce/contrasto/Redux

Dick Parsons: “A Part of Our Society”

Unfortunately, there have been injustices in the world and racial problems in America for hundreds of years. It’s not anything new. And as someone who’s African American and in the Black community, the way that my generation was taught was don’t let those things get in the way of you trying to produce and excel and succeed. You can’t let outside influences deter you, because it’s a burden to carry. It’s a lot to think about.

And that’s the part that’s difficult, because you’re taught to compartmentalize, to not let outside influences deter you from the path that you had inside of your corporate environment. And because of that, sometimes people don’t bring their whole self to work. Over the years, you might not want to talk about how you truly feel about things going on, because you don’t want to get into a divisive racial conversation with people in the workplace.

You just want to focus on the content—the content of whatever it is that you’re doing. And it’s difficult to do that. It’s who you are and how you were born, and you’re not able to ignore it, but then you’re told to try to minimize it in some ways to try to make sure that you make people feel comfortable, that you’re not consistent with whatever their stereotypes are. So you can try to focus on performance. And that’s really the thing.

So these things come up like, you know, the Rodney King beating [by Los Angeles police in 1991]. It’s not a topic that you look forward to discussing at work at all, because it gets you into a conversation with a lot of people who may not be well-informed, who may ask a lot of questions which are full of bias. It takes your energy away from the positivity you’re trying to keep to excel in your business career.

That sometimes is unavoidable, because you’re in a group discussion, and it comes up, and you have to deal with it. But it’s not something that anybody that I knew, back in the early ’90s, looked forward to discussing at work, because it was just a negative reminder about how unfair things are, and how they work, and unfortunately how they still are in America.

O.J. Simpson and the Bronco chase and his trial—that was another difficult time, when in America every poll said that there was a difference in the way that White Americans saw that whole episode and the way Black Americans saw it. You didn’t really want to talk about it at work in a group of people, unless you had to, because there were very different views about it.

Chris White: There’s a theme here to the problems with being Black on Wall Street. It’s a problem of perception. You’re perceived in ways that are unrecognizable from how you perceive yourself. That’s where the problem really starts.

That manifests itself in two very clear ways: It manifests itself in benefit of the doubt, and it manifests itself in terms of leadership opportunities. Two people could be saying the exact same thing. In one case, someone’s given the benefit of the doubt. They’re believed. They’re trusted. In another case, they’re doubted. They’re not listened to. They’re not heard. And it’s painfully obvious to you when you’re not.

[At Smith Barney] it was all great until there was a merger with Salomon Brothers, and everybody I knew from that mortgage desk got fired. And then they moved me. I wanted to stay in fixed income, so I ended up landing on the municipal side of the business.

By the way, a lot of Black people get put into munis.

It’s the sort of unwritten rule on Wall Street, because there are minority mandates around new deals for munis. That’s always been an area of the market where you have more Black representation.

So that’s where I really started to get my first taste of what it’s like to be Black on Wall Street. I was on the institutional sales desk, and I’m not blameless. I was a young kid. There’s also quite a bit of hazing sometimes, especially when I was coming up in the late ’90s. One day I responded back to someone hazing. I don’t know what I said. I probably snapped back and said something.

I got pulled into a room the next day by the head of the desk, [who] told me that the person I responded to felt physically threatened by me. I’ve never been in a fistfight in my life, so to hear that somebody felt physically threatened—this is what I mean by benefit of the doubt.

Physically threatened? I guess because it was coming from me, the head of the desk deemed it important to actually have a one-on-one conversation with me about it. And the messaging I got from that wasn’t, “Hey, you were physically threatening to someone.” The message I got was, “Watch the way you stand up for yourself.”

It was so shocking for me. It really soured me, too. I left soon after that, because I got a job to trade at a hedge fund. That was sort of short-lived, because the dot-com bubble burst, and Sept. 11 happened, and the market became something totally different.

Electronic trading and innovation in the bond market became something that I was obsessed with. I worked for a startup that then became public, and from there, I ended up moving over to the sell side, going back to traditional Wall Street. But I was going back not as a salesperson or trader. I was going back as someone who was supposed to be leading innovation.

Sometimes you’re in the room, and you might be invisible. One time, I was in the room, and we were talking about a vendor, and the head of sales didn’t like the CEO of this vendor, and he said, “I wouldn’t trust that brown fork-tongued devil farther than I could throw him.” Now, I’m there, so I can’t imagine what’s being said when I’m not in the room. And it just sends a message to you. There’s locker room talk, and we all get it. But it definitely, definitely sends a message.

I was lucky enough to eventually, through another major merger, work for a guy who was really well-respected on Wall Street. The business at the time had asked him to write a plan around modernization of the global credit desk. I ended up writing probably about 80% of that plan. He presented it. He ended up leaving, but before he left, he went to the business, and he said, “Listen, Chris White wrote that plan. I didn’t really write it.”

He did something very kind. He actually validated my contribution. See, that’s something that is very frustrating, that some people don’t recognize about the perception issue. I needed a White guy to validate me with other White guys, because there’s no way I could have been validated just on my contribution alone.

There comes a time in any job when you want to be valued as an employee. You’ve got to take your boss aside, and you’ve got to say, “This is what my expectation is. How do I get there?” So, I took my new boss aside: “This all has to do with perception of value. I wrote the plan. I’m implementing the plan.” My ask isn’t outrageous, and [yet] he’s telling me I should probably look for another job.

If I stay in a place where my boss says something like that to me, whose responsibility is it? Whose problem is it? That’s my fault.

I was incredibly optimistic about the next place I was going to, because here was a big quote-unquote important dealer. They’d hired me to do a job that was on the cutting edge. I was one of the few people in the world that could do it. And I’m sitting there, and I’m saying, This is going to be great. I’m going to have a fantastic career. I’m starting out as a VP, I’ll go to MD, and who knows what’s after that.

I remember saying to my wife, “This new place that I work at, I think they have more Black traders and Black salespeople than all of the other Tier 1 dealers combined.”

We’re not quota people on Wall Street, [but] we are consistently viewed that way.

Photographer: Joseph Ross Smith for Bloomberg Markets

Elaine McReynolds: “This Is Not Going to Stop Him”

One time, I had my boss speaking to me, and I just was drifting off because of the way he was speaking to me. I was thinking to myself, “You know what? If we matched résumés right now, in terms of just academic accomplishments and all of those things, I would trump yours. In fact, I bet you if we matched our parents’ résumés, my parents would trump your parents. And I bet you if we matched our grandparents’ résumés—because my grandfather was an appellate court judge—it would probably trump your grandparents. But you’re speaking to me as if somehow, I snuck my way in here.”

There is something really maddening where people seem to judge whether or not you’re worthy of being there without ever looking at you with objectivity. If you wanted to look at me objectively, I was just like all those guys are on the floor. I was a boarding school guy. I was an Ivy League guy. There’s only one thing different [about] me [and] anybody else.

I really hit my stride there. And I ended up building some really cool stuff. Not once was I ever considered for promotion or for leadership.

There was a seminal moment that made me realize that no matter what I did at this bank, I was never going to move forward. This is what happened. Because of what I have built in the bond market, I developed a bit of a name. One day my phone rings, and it’s someone representing the European Union, [from] a regulatory body out of Brussels. They say, “Hey, we’ve heard about you. We know that you are an expert in bond market liquidity. We would love for you to come to Brussels and give a talk on this to our group.”

Can you imagine how hard it is to become recognized to the point where you get a cold call from the head of a f---ing European regulatory body? You’ve got to really be doing some stuff.

Anyway, I bring it to whatever sort of organization internally [is required] to evaluate these things. They’re like, “This is awesome—we love doing favors for regulators, which is always good relationship building. Let’s have a meeting.” In the meeting, I’m explaining what the problem is. I’m leading the meeting. And then it seems that at the end of the meeting, the takeaway is: Chris White, can you please write up the talking points?

At that time, there’s nobody in the bank on this topic of bond market liquidity that would be more informed than me. I don’t care what their title was. I don’t care how long they have been there.

I write the talking points.

They sent someone else. If I can’t represent this bank on a topic that not only in this bank, but probably worldwide I’m a recognized expert in, then when can I represent the bank? But it’s really f---ing hard, man, to explain to me why I didn’t get the look to go.

Photographer: Elias Williams for Bloomberg Markets

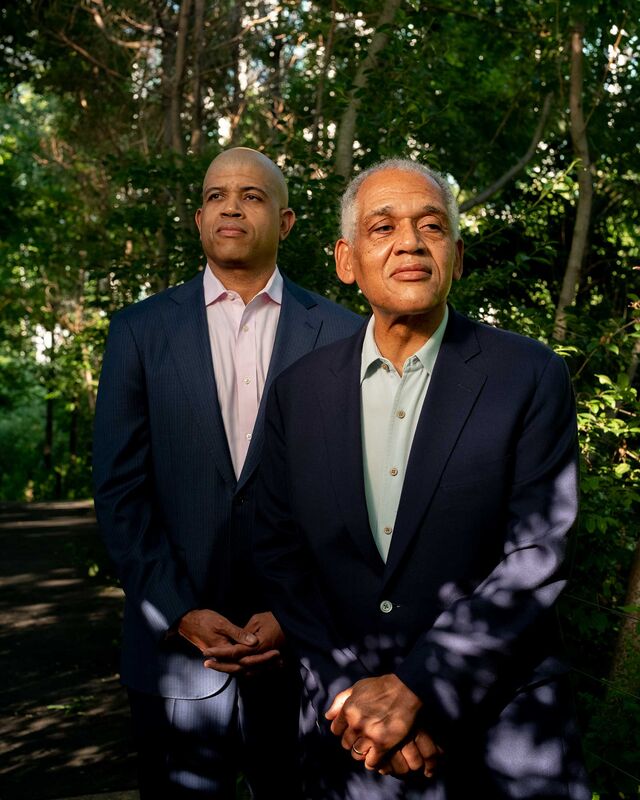

W. Don Cornwell: “My Son Is a Star Banker, But He’s Relatively Lonely”

Wall Street has a problem with Black excellence. And what I mean by Black excellence is most supersuccessful people in Wall Street or in industry are just really excellent at stuff. That’s how they got there, right? That’s how they did it. But when someone’s excellent as a Black person, as a trader, or as a salesperson, or in my role as a strategist, as an inventor, it’s not embraced.

I’m randomly walking on the floor about two weeks later, and one of the few Black partners pulls me aside. I don’t know this guy. I know him by name. But I don’t really know him. And he says, “Chris, your bosses wanted me to speak to you. I actually don’t understand what the problem is. I’ve observed you being a really capable guy. I thought that maybe you would lean on me for how to navigate here as a Black person. You never seem to need me. I’ve actually found that quite refreshing. And I saw that you knew your s---. And I was like, I thought that they would love you. For some reason, they don’t like you.”

Now, that said two things to me. One, it told me that my bosses perceived my issue as being a Black issue. Why? Because they sent a Black guy to randomly talk to me. Why didn’t they send one of the partners in the business that I worked in every day? They sent him. Imagine you were the only Jewish guy at a firm. Imagine you were the only gay person at a firm or the only woman at a firm. And the random person that comes to talk to you about what’s going on happens to be Jewish, or gay, or a woman.

The other thing that it told me—this was a very profound thing—they don’t like me. And what they don’t like about me is the way that I make them feel. The only thing I can imagine is what they did not like from me is the level of confidence I have around my content and my natural desire and leadership abilities. They didn’t like that. Now, what’s amazing about that is like other people, depending on what they look like, those are the intangibles that they make you a partner. And so, again, I’m responsible for my own career, so I know I got to go.

III. Looking Back

Racquel Oden: I call this moment hopeful. And I am superhopeful. I believe, truly believe, that this is a moment that feels so different this time, and that it can be different. I’m committed to making it real, personally. And I think that’s what we all have to say, right? We’ve got to hope and believe, and then we have to be committed to making it real.

I would probably push a little further on mentors and sponsors. A mentor is that person that you can bounce an idea [off of], get some advocacy from. But what’s really critical is sponsorship—that senior executive that’s going to be your advocate whether you are in the room or not and who is looking at you as the next talent.

If you can’t find yourself in your organization, that’s why outside networks are extremely important. Certainly [that’s the case] in my own personal cabinet of senior executives that look like me, other Black females and Black males. You’ve got to be able to speak to others who understand the things that you’re going through that are specific to what they’re experiencing as well. You can’t look in one place for it. I think you have to have that circle of trust.

If we think about where we were as Blacks on Wall Street, that number hasn’t improved. If you think about where we are as Black females on Wall Street, that number certainly hasn’t improved. So statistically it hasn’t changed.

Photographer: Jeffery Salter for Bloomberg Markets

Brigette Lumpkins: “I Was Perceived as a Diversity Hire”

But is the conversation different, and do we feel this could be a turning point where we can finally change the statistics? I think that’s what’s different. And I think that’s what’s going to be really critical as we think about this moment. How do we make this moment more than a moment, where we actually have what I call sustainable change and real impact, so we’re not repeating statistics again?

I would tell my younger self, “You’re going to find it harder, you’re going to work harder, you’re going to experience more obstacles, but your persistence and drive and faith are going to allow you to have a journey that will make it better for your daughter and girls that are coming behind you.” And I’d end it with, “I see you. I see you.” —Kelsey Butler

Tessie Petion: Wall Street is not doing a good enough job thinking about why people fall out. We expect juniors to fall out, but midcareer? That’s the vulnerability for many people. Why are people falling out midcareer? I think that 100% can be improved. If you’re midcareer, it either means you were a junior and kept at it, or it means you came in post-business school. But either way, that’s the point in your career where you’re likely to stay somewhere for maybe five, six years.

Post-financial crisis, if you are a junior and you have offers from an investment bank and a tech company, I think at this point you’re more likely to pick the tech company. Amazon is 26 years old, and nothing we do is “because we did this 20 years ago.”

The whole point of diversity—the proof case of diversity—is that you have people that come to the table with different experiences. I think about systemic inequality, because maybe it’s something I might have experienced. So I push you to think about it differently. It’s hard, though. I didn’t sense the pushback was because I was a Black woman. I think the pushback is because Wall Street doesn’t historically think deeply.

That’s what ESG tries to change. But 20 years ago, if I tried to have that [ESG] conversation at an investment bank, they would have laughed me out of the room. I don’t think it’s different because of who I am. I think it is because status quo works, right?

Obviously, I got hired at a very senior level at Amazon. Now I am [a mentor]. And to be fair, I was that person for several people at HSBC. I can say that I think that there were lots of juniors who saw me there and thought, OK, maybe I can do this, right? Yes. And so I did think about that a lot when I left. I’m the person, and I’m leaving. What does that mean? How did they interpret that?

The VP of customer fulfillment—obviously that’s a big deal for Amazon—is a Black woman. I looked at the person who does transportation, and that’s a Black man. Anyone who is a VP at Amazon is someone who could be a CEO of a smaller company. I looked and said, Can I see myself on that trajectory? I think I can. But I was really conscious of the fact that by leaving the bank, I was one less person that modeled, “This is how you can do Wall Street at HSBC.”

I was lucky to only sort of bookend my career [in finance]. I was a junior, and then I came back in supersenior. And so that’s really specific to my career. For sure there have been people that have been allies that have been really helpful.

At the bank, there have been people that have said, “I’m looking out for you and making sure that you have all of the [opportunities] possible.” One hundred percent that happened to me at HSBC. It’s what put me into the room. I guess my expertise did it. But also you had people that said, “Hey, I want to make sure you find this person.” You always need that first opportunity in order to get the rest of them. —Gillian Tan

Jared Johnson: The summer at the bank would look different than the winter at the bank, because there were a lot more young Black people [interning]. [But they] didn’t get offers.

I did internalize a lot of those messages to be a nonthreatening Black person to White people. As traditional as they come: That’s the idea. Wear a suit. Present yourself this way, so people don’t feel a sense that this is uncomfortable. You don’t want to look like you’re overindulging.

It was all of these rules. The way I would describe it is “respectability strategy.” It’s this idea of, if you can show up and show proof that you’re more professional, more buttoned-up, more polished, than your peers, then you’ll overcome whatever challenges are thrown your way. Because you don’t fit the stereotypes of what people think about Black people. —Max Abelson

Anré Williams: People still say in the workplace, “Don’t talk about race, don’t talk about religion, don’t talk about politics.” And people try to do that. But I think what’s happened now in [the aftermath of George Floyd’s death] is that we’ve gotten to a point where people know they can’t remain silent.

Remaining silent in a way is almost an implicit acknowledgment that you’re OK with the way things are and you’re just going to ignore it. And people aren’t comfortable ignoring it anymore or allowing it to be ignored. And that’s what’s different right now, I think.

You want people to feel comfortable being who they are at work and being comfortable doing that. I think as the years have gone by, more and more people are encouraged to do that. Whether it’s someone’s sexual preference or orientation, whether it’s gender, whether it’s religion—I mean, people are encouraged to be a little bit more open and forthright about who they are and what their needs or expectations are. And I think that’s a good thing, because that’s a big part of their life. It’s who they are, and that shouldn’t take away from the talent and what they can produce.

Carla Harris: “It Didn’t Intimidate Me”

Over the years, I was involved in campus recruiting and making sure that—if I wanted the company to have diversity—I should be one of the people to go on campus. With what happened [this year], it just struck a chord with me that things were really, really bad. And I just didn’t feel that I could remain silent. I wanted to be able to say something to all of our Black employees [1,400 or so] in our network in the United States. And I wanted them to hear from me directly.

A few people reached out to me and said they were going through a lot, and they thought it was really difficult. And so I just wanted them to hear from me. I want to share my feelings. I want them to know that I found the recent instance to be horrific, to be inexcusable, and to be maddening.

But I also wanted to share personally that at times I feel terrified about the things that could happen to me or to my friends or to my relatives or to my son in a world which sometimes is completely unpredictable. You just don’t know how things can go sideways sometimes when they shouldn’t. The point I was trying to make to all of them [in an internal video] is that everybody is going through a lot emotionally, but they need to remain positive.

The video ended up being shared internally by other leaders with their teams. I think people were surprised that it was personally coming from me and it was a personal perspective, because usually I stay focused on the business side and this was really how I feel about this personally.

It’s not like this has never happened before, as if there’s no one that’s ever lost their life as a result of law enforcement being too forceful. It happened with Eric Garner here in New York City. It happened with Philando Castile [in Falcon Heights, Minn.]. It’s happened before. But I think the difference this time is that you’re in the middle of a global health crisis, a global pandemic where everyone in most large cities around the world was required to shelter at home.

So, parents are having to be at home with their kids in the house, sheltering, not sure what’s next. In that environment, we have a lot of emotion, a lot of anxiety, a lot of stress, a lot of uncertainty. Everyone’s watching television, watching the news, on social media and online.

And then we see these incidents that are happening, and they just get people really upset. It just reminds you that there is racial inequality. That was where I think people finally said enough is enough. And the demonstrations and the protests didn’t just happen in Minneapolis where it started. They had gone global. And when you look at the images of the people who were demonstrating, they weren’t just Black Americans, right? That was the key to me.

The key was it wasn’t just Black Americans. It was all races, all ages. And it wasn’t just U.S. It was global. And to me, that’s so different than anything we’ve ever experienced before. This time just felt very, very different. —Jenny Surane

Chris White: It’s 2020, and you’re like, “Wait, how many Black MDs are there at this global investment bank?” And you’re shocked by the number. That’s because during ’08 or ’09—or any year you can pick that wasn’t such a good year—we definitely feel more susceptible to being let go.

I’ll tell you something I observed. One of the biggest accounts on Wall Street for fixed income as a salesperson is an annuity, because they’re just so big in the volume that they do that you always look like a big producer. Most of the people who are running sales desks or are MDs and things like that, they’re people who cover those accounts.

This young African-American guy wasn’t young—he was like 26, 27—he was the backup coverage on this account. The lead coverage got moved to a different desk. And so they hadn’t figured out who the new coverage was going to be. As the backup coverage, he’s doing all of the work.

And here’s the thing: This is what I mean about when the leadership opportunities come. Here, through natural circumstance, [is] a leadership opportunity where this 27-, 28-year-old kid could be covering this account. That would make him the biggest producer on the desk. Do they let him cover the account? No. They pulled [in] some partner, like out of semiretirement, and that partner covers the account with him remaining as the backup.

Anjelica Watson: “People Are More Vulnerable”

Here’s how the story would have been different: They let him cover the account. He knocks the cover off the ball. He then gets fast-tracked to MD. He then becomes the head of the desk at 33 or 34, because he looks like such a frickin’ superstar.

It’s a little butterfly effect, things like that. When people ask me, how come there’s so few desk heads or MDs in this space that are Black? It’s stuff like that.

Why everyone’s interested in this topic right now is George Floyd and police brutality. That’s a perception issue, too. That’s perceiving someone as a threat or being violent or as a criminal just on sight.

On Wall Street, it’s being perceived as not being competent or being too aggressive or not being worthy of leadership based on sight, not on any of the other evidence around you. As a Black professional on Wall Street, you have to figure out how to deal with that.

Here’s the last thing: So I’m very happy with my career. I’m not angry about any of this. Are there times where it makes me slightly frustrated hearing some of the bulls---? Yes, of course. But this is not isolated within Wall Street.

So now I’m a tech entrepreneur. Look at my résumé. I worked for one of the most successful fixed-income startups in the history of fixed-income startups. I worked at some of the most prestigious dealers. I have patents in my name for platforms that I’ve built as the lead inventor.

The problems with perception definitely impact my ability to raise money. No question about it. You have to ask yourself a question, and this is a real question: If Mark Zuckerberg was Jamal Zuckerberg, would Facebook exist?

It goes back to that benefit of the doubt. Is it possible that someone could have seen a Black kid who didn’t graduate from Harvard in a hoodie and sneakers and jeans and looked at him and said, “I believe that he’s really onto something here”? —Matthew Leising

Butler covers private credit in New York. Tan, Abelson, Surane, and Basak cover finance in New York. Leising covers market structure in Los Angeles.