Over the last five months, PC Jeweller has been caught in a spiral that has wiped off billions in investor wealth. To be precise, since Jan 19, 2018, the jewellery chain from New Delhi has lost over 75% of its market value, worth $2.8 billion up until last week, on the BSE.

Now, the company—with over 90 outlets across 70 Indian cities—is looking to staunch the bleeding by planning to buy back some of its own shares. The ploy seems to be working as its stock surged nearly 32% in early hours of trading on May 07. But behind this stock market see-saw is a curious backstory.

It all started in January this year when Mumbai-based financial and technology company Vakrangee bought shares in PC Jeweller. However, none of the exchange filings showed who the shares were bought from.

Then, in April, the company disclosed in a filing to the stock exchange that one of its promoters, Padam Chand Gupta, had gifted some of his shares to his family members through off-market transactions. This triggered concerns over transparency and the quality of disclosures by PC Jeweller.

Vakrangee has been under the Securities and Exchange Board of India’s (SEBI) scanner since February over its corporate governance practices and alleged market manipulation. The market regulator’s probe into Vakrangee is still ongoing, while PC Jeweller denied any association with the Mumbai-based IT firm.

Fears escalated again last week after reports of the arrest of PC Jeweller’s managing director, Balram Garg. The company has, however, so far denied all allegations.

“I would just like to say that don’t go by the rumours and have faith in us as you always had it,” Garg said in an interview with Zee News. On Friday, May 04, the shares of the company jumped 44% after Garg’s clarification.

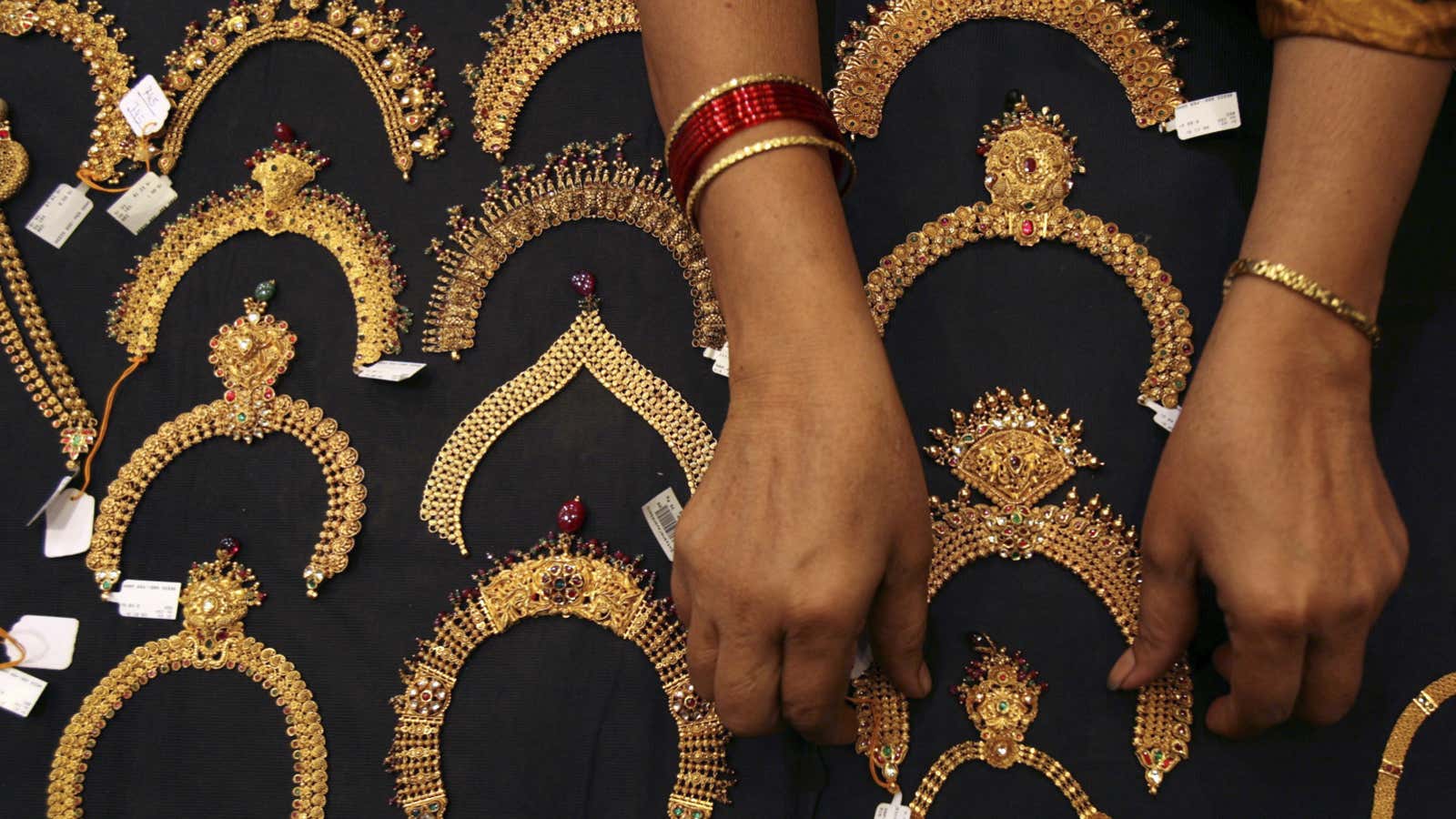

PC Jeweller’s travails come as India’s gems and jewellery sector, one of the country’s largest exporters, has been battered after a banking fraud involving the country’s top jewellers, Nirav Modi and Mehul Choksi, surfaced earlier this year. And these latest events at PC Jeweller will do no favours to the sector’s confidence.

Small beginnings

PC Jeweller started as a stand-alone jewellery shop in Delhi’s busy Karol Bagh market in 2005, led by brothers Pramod Chand Gupta and Balram Garg. It eventually added more stores and set up manufacturing facilities for exports, wholesale, and retail purposes. Prior to setting up PC Jeweller, the Gupta brothers were engaged in the family business of selling jewellery.

PC Jeweller rode the wave in the last decade as more Indian shoppers turned to the organised jewellery market, leading to the rise of national chains such as Tanishq, Kalyan Jewellers, and Malabar Gold and Diamonds. These brands offered more designs, advertised heavily, and established a large network across the country.

India is one of the largest consumers of gold jewellery in the world. Weddings alone account for 40% of all gold sales, followed by the harvest season and festivals.

Buoyed by the rising demand in India’s organised gems and jewellery market, currently estimated at Rs1.7 lakh crore, PC Jeweller initiated a share sale, raising Rs600 crore from the initial public offering (IPO) in 2012. The company then had a turnover of Rs3,042 crore from its 20 stores.

Since then, the chain has added 70 more stores in over 70 cities, entering even small markets such as Alwar, Ajmer, and Hapur in the last few years. The company has opted for a franchise route to help it support this rapid expansion. It has also launched online sales through its own website, apart from selling its designs on Amazon and Flipkart.

For the financial year ending March 2017, the company posted a 21.6% growth, clocking a turnover of Rs 8,099 crore ($1.2 billion).

The stock of PC Jeweller has been a big wealth creator for investors; it more than doubled in 2017. However, all of those gains have been erased in the crises of last few months.

The company’s market value now stands below its projected sales of Rs10,000 crore for the financial year 2018, underlining the level of investors’ concern.

The proposed buyback may help improve matters temporarily, but the shine won’t return to PC Jeweller unless the management is able to move quickly and decisively, and assuage concerns about the lack of transparency for both the investors and regulators.