Tokyo’s bourse to reboot trading on Friday after worst outage since 1999

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Tokyo Stock Exchange has announced that trading will resume on Friday, after a hardware glitch caused equity trading to be suspended for a full day in the worst outage since the world’s third-biggest bourse shifted to a fully electronic system in 1999.

The TSE admitted that the decision to restart trading on the $6tn market would involve some risk. By Thursday evening, the operator had yet to establish what went wrong when the main system failed, before the switch to the back-up system also malfunctioned — raising concerns of a repeat.

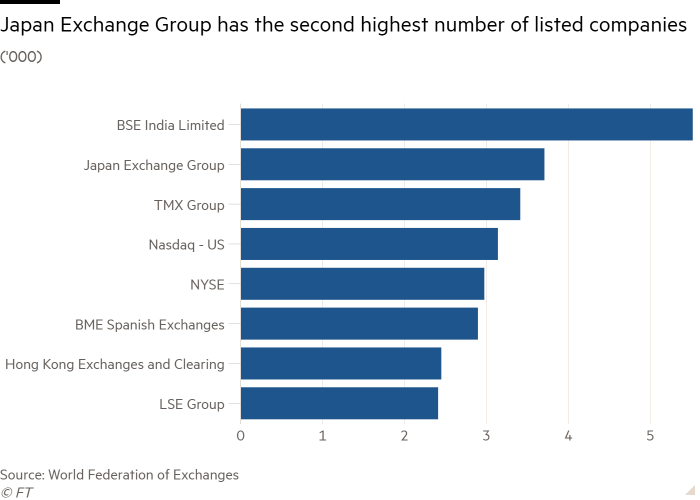

The shutdown, which fell on a critical day of economic data releases and portfolio rebalancing, affected more than 3,000 stocks listed on exchanges run by TSE’s parent, Japan Exchange Group. The group is Asia’s largest operator, by overall market capitalisation of listed companies, and foreign investors account for about two-thirds of its average daily trading volumes and value.

The exchange announced the halt shortly before the market was due to open at 9am. It later said the closure would last for the full day.

At a news conference, bourse officials said they discovered a fault with a piece of hardware just after 7am. When its system switched to back-up infrastructure, the process did not work and the exchange was unable to distribute market information as normal.

The TSE added that it was planning to replace the affected hardware and preparing to ensure normal trading from Friday onwards. The group ruled out hacking or a cyber attack as a cause for the system failure.

“We’ve always aimed to operate the market stably . . . with the system slogan of ‘Never Stop’,” Koichiro Miyahara, TSE’s chief executive, said at a news conference. “In that sense, we deeply regret causing trouble to so many people with today’s incident.”

The full-day closure is unprecedented for the bourse since it upgraded its systems and switched to fully electronic trading 21 years ago. The company said it chose to do so out of concerns of “confusion” among investors if it rebooted its systems midway through the day.

Oki Matsumoto, chief executive of Monex, one of Japan’s three largest online brokerages, said the TSE had probably made the right decision not to reboot trading on Thursday.

“It could have made the situation more complex,” said Mr Matsumoto, citing the difficulty of untangling orders made to brokers before the shutdown was announced.

Instead, TSE executives have decided that orders placed on Thursday would be invalidated, meaning that if trading resumes as planned on Friday it will do so based on Wednesday’s closing prices.

The outage — the first to affect all listed stocks on the TSE since one in 2005 that lasted part of the day — also hit exchanges in Nagoya, Fukuoka and Sapporo, which use the same underlying cash equity trading system built by technology group Fujitsu. When Fujitsu announced in 2015 its involvement in an important upgrade to the TSE’s “Arrowhead” trading system, it adopted the “Never Stop” slogan for the project.

Fujitsu apologised for the malfunction of its hardware, and said it would work closely with TSE to prevent it from happening again. Mr Miyahara said the bourse was not planning to seek damages from Fujitsu, saying the responsibility fell “entirely” on the TSE as the market’s operator.

Katsunobu Kato, Japan’s chief cabinet secretary, said the shutdown was “highly regrettable” because it curtailed investment opportunities.

Derivatives trading continued as normal on the Osaka Exchange, which is owned by JPX but relies on different systems.

Nomura, Japan’s largest brokerage, said it was taking customers’ orders but warning them that trades might not go through.

The TSE suffered a series of embarrassing glitches in the mid-2000s but had been relatively stable since 2010, when it introduced Arrowhead.

The outage comes on a day when equity volumes would traditionally be high, said brokers. October 1 is the first day of both the new financial quarter and the second half of Japan’s financial year. That makes it an active day for fund managers to adjust their portfolio weightings.

Comments