From Nixon to Trump: Here's how stocks performed under each U.S. president

U.S. presidents, for better or worse, get too much credit for the economy and stock market performance. The Federal Reserve, in its quest for the elusive soft landing, exerts more direct control over the nation’s economic levers.

Nevertheless, it’s instructive to recall the touches — some light, some heavy — that presidents have had on the markets.

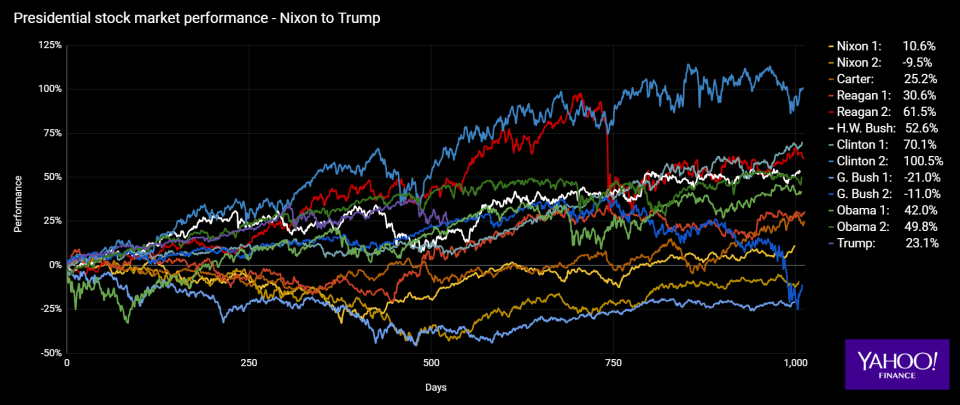

Elections are often referendums on the economy, and so it was with George H.W. Bush, sailing into office after the Reagan Revolution “delivered” returns of 30.6% and 61.5% in the S&P 500 over Reagan’s two terms. But despite a 52.6% return during Bush’s 1989 to 1993 term, the economy had fallen into mild recession.

Though skilled in international affairs, economics was not Bush’s strong suit. As Yahoo Finance editor-in-chief Andy Serwer writes, “[President] Clinton based his campaign [against Bush] on the catchphrase ‘It’s the economy stupid,’ which originally was an internal reminder for campaign workers created by Clinton strategist James Carville.”

Later, Bush would blame Federal Reserve Chairman Alan Greenspan for his loss to Clinton. “I reappointed him, and he disappointed me.”

Fighting the Fed

Prior to the Federal Reserve Reform Act of 1977, which was designed in part to establish Fed independence, other presidents took a more heavy handed approach toward consulting with their Fed counterparts. As President Lyndon Johnson waged twin wars in Vietnam and on poverty, deficits stacked up, and this concerned Fed Chairman William McChesney Martin. The two got together at Johnson’s ranch, and a confrontation ensued.

“Johnson got Martin alone and did not mince words. According to different accounts, the 6-foot-4 Johnson pushed the shorter Martin up against a wall,” writes the New York Times. “‘Martin, my boys are dying in Vietnam, and you won’t print the money I need,’ he said.”

The Fed eventually succumbed to “money printing” pressure (now called “accommodative monetary policy”), President Nixon closed the gold window, stagflation ruled, gas lines ensued. Thus, was the 1970’s. The most exceptional returns belonged to Jimmy Carter, but 25.2% wouldn’t overcome an Iranian revolution and economic malaise.

After Fed chairman Paul Volcker flexed his independent Fed muscle, ratcheting short-term rates to an eye-watering 19% in 1981, the reset button had effectively been hit, setting the stage for his successor, Alan Greenspan — a chairman who would earn the dubious nickname “Easy Al.”

Clinton: Greenspan’s big winner

President Bill Clinton was the biggest winner in the Greenspan era, racking up returns of 70.1% and 100.5% in his two terms. President George W. Bush inherited the dot com bubble bust, and racked up a loss of 21.0% in his first term. But a recovery was underway, quite literally built on housing. Most of us remember how that ended.

George W. Bush’s second term ended with stocks down only 11.0%, which disguises the 40.8% peak-to-valley loss from the market high in October 2007 until President Obama was elected.

Like his predecessor, Obama inherited a bubble economy recently busted, but one much worse than than before. But trillions of fiscal and monetary stimulus would eventually turn around a financial crisis into stock markets returns of 42.0% and 49.8% over Obama’s two terms. Unfortunately, economic growth didn’t rebound with stocks, leaving economists to wonder if we had entered a new, slower normal.

The Trump factor

Enter President Trump. By November 8, 2016, the Fed had begun to raise rates (once, the prior December), and it looked like the monetary spigots couldn’t be counted on. But stocks were emerging from an earnings recession, and Q3 GDP wasn’t terrible at 1.9%.

After a stomach-churning drop in stock futures on Trump’s election night, the following day would close in the green, and it was off to the races for U.S. stocks. The promise of pro-business policies, deregulation, tax cuts, infrastructure and other fiscal stimulus helped stocks climb 37.5% by January 2018.

But volatility, which had become a distant memory, reared its ugly head again. And a hawkish Fed, burgeoning trade war and non-U.S. global slowdown have weighed on risk markets since.

As of Friday, December 7, Trump’s return stands at 23.1%, 523 trading days from his election. It’s anyone’s guess where stocks will stand on November 3, 2020.