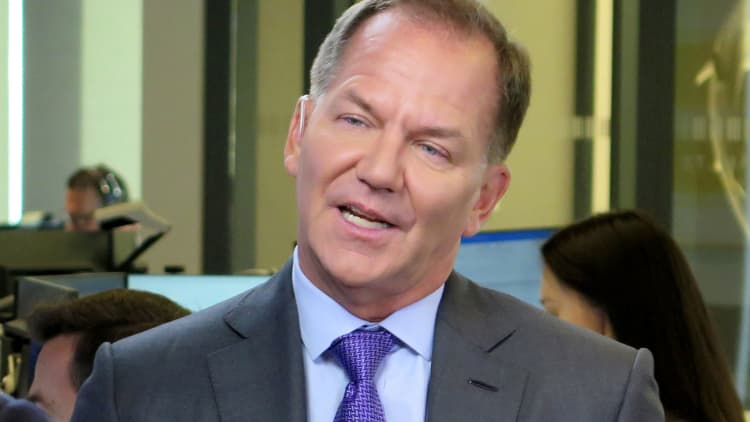

Paul Tudor Jones, the legendary hedge fund manager who called the October 1987 crash, believes the stock market will rally near the end of this year.

"I think we'll see rates move significantly higher beginning some time late third quarter, early fourth quarter," Jones said Tuesday in a CNBC "Squawk Box" interview with Andrew Ross Sorkin. "And I think the stock market also has the ability to go a lot higher at the end of the year. ... I can see things getting crazy particularly at year-end after the midterm elections ... to the upside."

But he said the move higher will not be sustainable and higher interest rates will lead to an eventual recession. Jones compared the current period to 1987 in the U.S., 1999 in the U.S. and 1989 in Japan. Though he noted he doesn't believe there's a market crash coming like in 1987.

"I think this is going to end with a lot higher prices and forcing the Fed to shut it off," he said. "When you look at the stock market relative to GDP, we're at levels that historically in some other countries led to a blow-off [rally] and then some type of economic contraction. ... It's an old story, we'll probably play it again."

Jones said he does not have significant exposure to the financial markets due to the timing of his predictions.

"I have a feeling we're getting ready to go into a summer lull. ... I can't remember how many years it's been since I've been this light in my positions," he said. "I like to have significant leveraged positions when I think there is an imminent price move directly ahead."

Earlier this year in an interview with Goldman Sachs, the hedge fund manager also predicted a rise in inflation and a surge in the U.S. 10-year Treasury yield. He recommended investors stay in cash or buy commodities and "hard assets" at the time.

Jones rarely talks to the press. He has a net worth of $4.5 billion, according to Forbes.