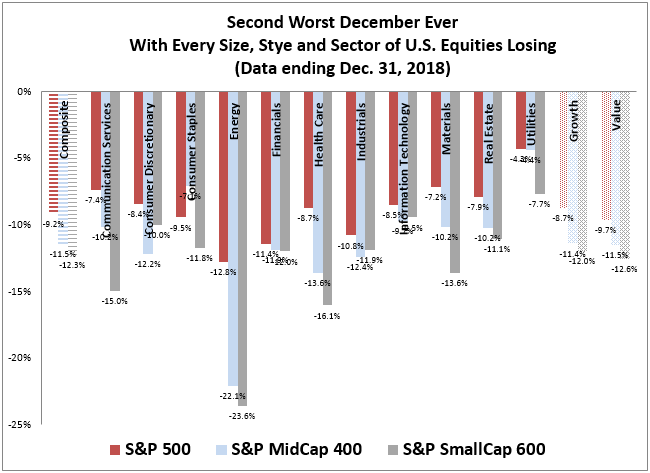

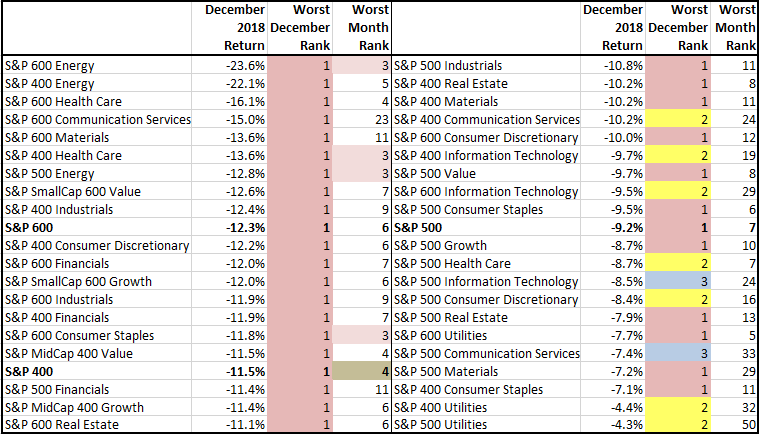

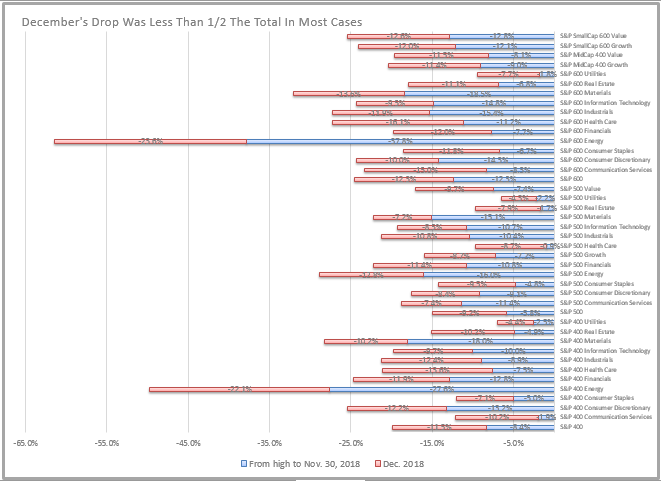

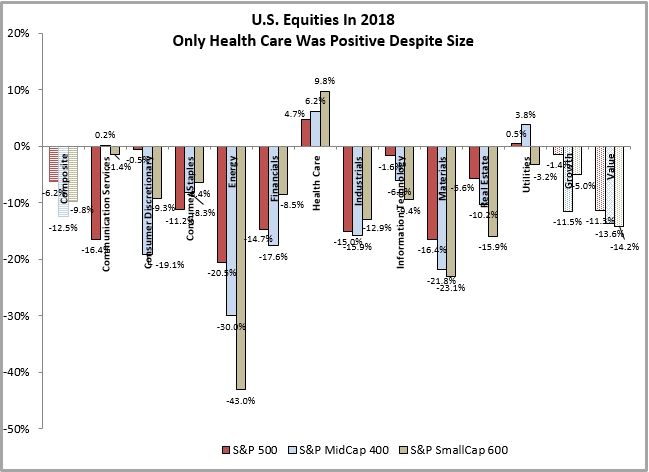

As the ball dropped this New Year’s Eve, most investors were more than happy to bid adieu to what proved to be a volatile end to 2018. The fourth quarter began with the October sell-off, which was just the start of a highly volatile quarter. The S&P 500® fell almost 7% in October alone, with losses accelerating into the end of the year during what is likely to be one of the worst Decembers on record.

Large equity market drawdowns such as these remind us of the importance of portfolio diversification. Traditionally, this has been achieved by building multi-asset portfolios that combine complementary asset classes such as stocks and bonds.

First generation multi-asset strategies, exemplified by a 60/40 allocation, seek to create balanced portfolios by diversifying across asset classes in fixed proportions. However, this technique does not maximize diversification benefits because it ignores the risk contribution of each asset class.

The recognition of these shortcomings led to the development of a class of investment strategies called risk parity, which seeks to equalize the risk contribution of each asset class. The primary goals of risk parity are to provide a smoother return profile and minimize losses from equity market drawdowns like we saw in the fourth quarter of 2018—so let’s examine how they performed.

While each of these portfolios also posted negative returns, the losses seen in the 60/40 portfolio and the S&P Risk Parity Indices were modest compared with the large drawdowns witnessed in equity markets (see Exhibits 1 and 2). As one might expect, the “risk-balanced” S&P Risk Parity Indices outperformed the global 60/40 portfolio across each volatility target.

Now let’s take this analysis to the next level and examine the asset class performance attribution within these indices (using excess returns). The S&P Risk Parity Indices comprise three asset class sub-components: equities (broad indices across the U.S., Europe, and Asia), fixed income (sovereign bonds across the U.S., Europe, and Asia), and commodities (energy, softs and livestock, grains, and metal sub-sectors).

The equity component drove the bulk of the negative performance, contributing a loss of 4.72%. The fixed income component offset some of the negative equity performance, contributing a gain of 2.79%, with the majority of the positive performance coming in December. The commodities component did not fare as well, contributing a loss of 2.97%, which in essence canceled out the diversification benefit provided by fixed income.

Q4 2018 may not be a stellar example of the power of diversification, but it underlines the need to maximize the so-called “only free lunch in finance.” When equities are given an outsized risk allocation, equity market losses like those seen in Q4 2018 will dominate portfolio performance. However, when each asset class is given equal footing, the diversification benefits have a better chance of shining through. Given the opportunity, investment strategies such as the S&P Risk Parity Indices have the potential to help smooth out drawdowns and improve risk-adjusted returns.

The posts on this blog are opinions, not advice. Please read our Disclaimers.