SEC commissioner's report reveals a 'very troubling' pattern in stock buybacks and insider selling

Corporate executives cash out of their own stock more after their firms announce stock buybacks than on a typical day. And in the long run, the share prices of those companies underperform. This is according to a letter written by SEC Commissioner Robert Jackson.

The letter addressed to Senator Chris Van Hollen (D-MD) comes after the senator questioned SEC Chairman Jay Clayton last year around the pattern of executives selling shares after announcing stock buybacks.

During a call with reporters, Van Hollen characterized Commissioner Jackson's findings as "very significant and very troubling."

Jackson was scheduled to review his research on a conference call with reporters. However, according to Van Hollen, Jackson was advised by the SEC's general counsel that participating on the call might create issues concerning possible future SEC actions.

Jackson's research concluded that many corporate executives sell significant amounts of their stock immediately following the announcement of stock buybacks.

“If executives believe a buyback is the right thing to do, they should hold their stock over the long term. Instead, we found that many executives use buybacks to cash out. That creates the risk that insiders' own interests — rather than the long-term needs of investors, employees, and communities—are driving buybacks," Jackson wrote.

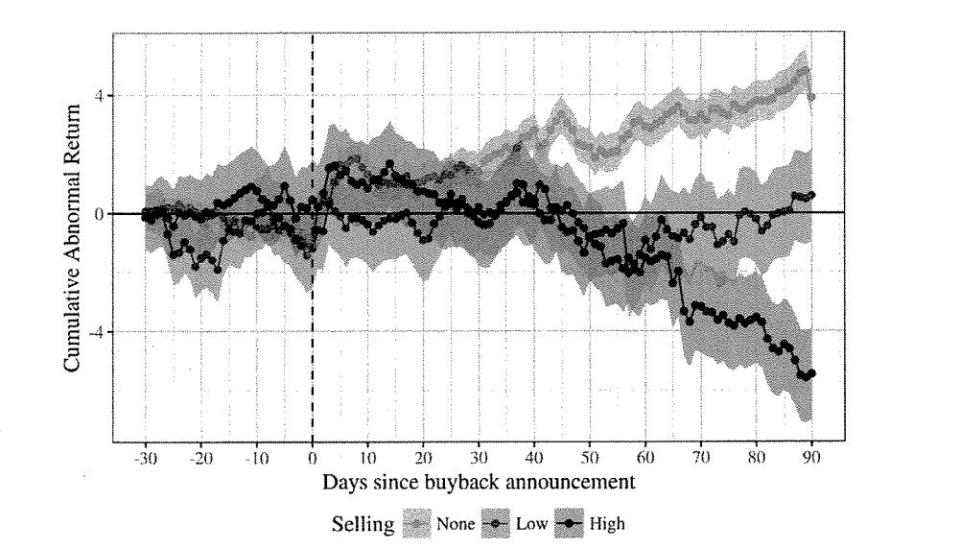

What's more, Jackson found that the stock price of those companies underperformed in the long run. Specifically, companies with insider sellers underperform other companies by more than 8 percentage points, Jackson’s research found.

"[Insider] selling on buybacks is associated with worse long-term performance," Jackson wrote. "It's well known that some buybacks produce long-term stock-price increases while others lead only to a short-term price pop. We show that, when executives unload significant amounts of stock upon announcing a buyback, they often benefit from short-term price pops at the expense of long-term investors.”

In the letter, Jackson noted that current SEC rules "do not address insiders' incentives to pursue buybacks at the expense of buy-and-hold American investors."

Van Hollen called the conduct of executives profiting at the expense of shareholders "clearly wrong."

"One straightforward remedy would be to prohibit these corporate executives from selling their stocks in a specific period of time around a stock buyback," Van Hollen said.

It's unclear how long that timeframe could be, but he floated the possibility of a couple of years.

Van Hollen said a review of the SEC rule is "way overdue" and it's time to re-open it and seek public comment.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.