All hope for a Brexit deal is not lost, but for how long would it buoy Britain?

- While the prospect of Britain crashing out of the European Union without a deal looks likely, Brussels is famous for last-minute compromises

- Even if a deal materialises, UK financial markets are vulnerable without the country charting a credible strategy for long-term industrial revival

Emotions are running high and negotiators from both sides look so far apart that the prospect of Britain crashing out of Europe on bad terms looks very likely. But could the impossible still happen?

After all, Brussels is famous for pulling off last-minute compromises, so it may still be possible to snatch some sort of victory out of the jaws of defeat. It’s the outcome markets are least expecting which could catch investors off guard, sparking major risk reversals all round.

If Brexit tensions can be defused, the British pound, equities and debt markets would all enjoy major reversals of fortune.

There are already good reasons to think more positively about the future. Bargaining positions may seem entrenched, but there is growing awareness about the potential damage that a hard Brexit shock could inflict on growth prospects, job creation and financial stability on both sides.

At some point, there is bound to be a wake-up call for the European Union and the British government to soften their stance and thrash out some sort of compromise. Hope for a breakthrough is starting to be reflected in investor surveys, with a recent Reuters’ poll suggesting the pound could trade up to 4 per cent higher over the next 12 months if the EU and UK managed to reach agreement in time.

Even the traditionally cautious Bank of England seems to think the British economy is on track for a quick V-shaped recovery, probably envisaging a positive outcome for Brexit later this year.

Under the Organisation for Economic Co-operation and Development’s more pessimistic scenario for a double-hit global recession this year, Britain's economy could be particularly hard hit, possibly contracting by as much as 14 per cent in 2020.

05:55

What if Covid-19 is here to stay? Why we may need to prepare for the coronavirus becoming endemic

It’s not a risk Brussels can afford to treat lightly with Europe already reeling from the pandemic, recession and the threat of creeping deflation. A sinking UK economy could pull Europe into even deeper trouble.

Britain drops plans for full border checks on EU goods after Brexit

Reaching a free-trade agreement with Britain would be the much-preferred option, cheaper than having to pay out excessive amounts on economic stimulus to get Europe’s recovery back on track. Brussels is no stranger to deep political crises and renowned for pulling off last-minute deals to settle them.

Brussels knows full well it would shoot Europe’s economy in the foot if it pushes Britain too far, triggering a hard Brexit and the risk of a deeper, longer-lasting recession for both sides. It is not what Germany, France or Italy need at a time when their economies are feeling deep pandemic pain and desperately seeking better times.

As Europe reopens, minister says don’t treat Italy like a leper colony

If a workable EU-UK free trade deal can be agreed in time, the impact on British markets could be cathartic. Pessimism towards the pound would unravel quickly, ratcheting the currency back to pre-2016 Brexit referendum levels above 1.50 against the US dollar.

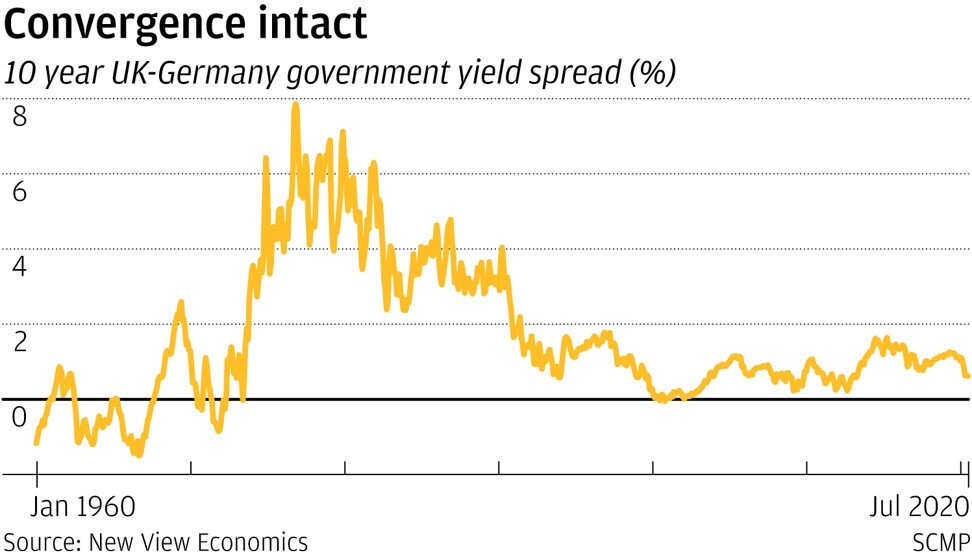

On a relief rally, the FTSE-100 share index could move sharply back towards its recent 52-week high of 7,727 and the benchmark 10-year UK government yield spread over Germany could converge back towards zero per cent from the current 0.62 per cent.

There would be a short-term sense of relief all round that UK markets were off the hook, but the key question would be for how long?

A compromise free-trade deal would still leave Britain marginalised outside Europe and in an uncertain relationship with the rest of the world. Without a credible strategy for long-term industrial revival, Britain’s economy and its financial markets would still be at risk.

David Brown is chief executive of New View Economics