Table of Contents

FX futures make up a tiny part of the global foreign exchange market today, but given recent changes, they and similar instruments have the potential to grow fast enough that FX may eventually follow in the footsteps of U.S. Treasuries—a market that was mostly OTC and in which futures now top cash trades in terms of average daily volume (ADV).

The chart below tracks the growth of Treasury futures over the past 15 years. Does this trajectory represent the future of FX?

The Growing Role of FX Futures

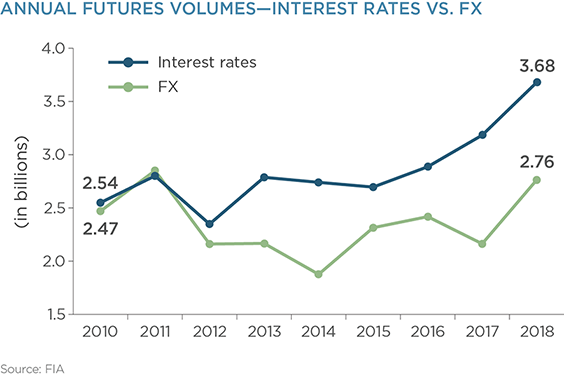

FX futures have an ADV of approximately $100 billion, making up about 2.5% of the $4 trillion that is traded in FX each day. According to FIA, annual volumes have not increased significantly since 2010 and grew less than interest-rate futures.

However, trading volumes in cleared non-deliverable forwards (NDFs) have grown substantially since the introduction of Uncleared Margin Rules (UMR) and are now estimated to account for close to 20% of global NDF volume, according to industry sources. Although these sources indicate that the growth in cleared NDFs has hit a ceiling, there are several trends now playing out in the market, which suggest that exchanged-traded and cleared FX products will become a bigger and more important part of the trading activity in FX:

- Regulatory Changes: The biggest global FX dealers are already subject to new margin rules under UMR. The list of covered market participants will grow over time. Any institutions with an exposure of over $50 billion in notional uncleared derivatives will need to adhere to UMR regulations as of September 2020, which is expected to bring the number of affected users to 200, according to triOptima. Another estimated 900 parties will be affected a year later when the threshold is lowered to $8 billion.

These rules are designed specifically to increase the costs of uncleared trades in order to prompt market participants to shift to cleared transactions. According to the 2016 BIS triannual survey, roughly 40% of FX volume is traded between dealers that have been most affected by UMR to date. If one were to assume that non-dealers (including customer banks and institutional investors) shift their trading to a similar degree from bilateral to cleared NDFs, the share of cleared NDFs could grow to as much as 50%. - Consolidation: The acquisition of large FX platforms by exchanges like the CBOE’s purchase of HotSpot and the LSE’s acquisition of Refinitiv, with its Reuters and 360T platforms, represents an obvious attempt by the exchanges to grab a bigger piece of the FX market by capitalizing on the regulatory push toward cleared trades. This is not unlike what market observers believe the CME’s objective was in acquiring NEX/BrokerTec, the leading platform for cash Treasuries.

However, the growth potential for FX futures moving forward is significantly larger, given that Treasury futures already trump cash trading. By owning OTC and exchange-traded liquidity pools, exchanges can provide FX users with a unified view of both markets. This would open up FX futures to a much wider audience and is likely to fuel the growth of FX futures trading. - Product Innovation: Exchanges are creating products that blur the line between OTC and exchange-based trades. OTC-like innovations include cash-settled forwards and FX Link on CME, which is described as “creating a seamless connection between the FX futures contract and the OTC FX marketplace as a CME Globex-traded basis spread” which “results in a simultaneous execution of FX futures cleared by CME and OTC spot FX…”

How Will Futurization Affect the FX Landscape?

There are still many questions to be answered before it’s possible to predict precisely how far this shift will go and how large a part of the global foreign exchange market futures and like instruments will become.

Market participants that have not been subject to UMR will soon find out how much more expensive it will be to trade uncleared NDFs. Before this happens, we simply don’t know how much of their trading will go cleared. UMR does not impact spot trading, deliverable forwards and swaps, which make up a large part of the FX market. Any shift from OTC trading in these instruments will depend on how successful the exchanges are in linking the OTC and exchange-traded/cleared markets across a large number of currency pairs.

But if FX futures continue to grow in volume, and if foreign exchange markets ultimately follow U.S. Treasuries by becoming more “futurized,” we can expect continued restructuring and innovation, as executing futures brokers and clearing brokers look to maximize market shares in a growing business. And FX dealers will look to compete and stem losses, in part by attempting to transition trading volume internally from traditional OTC market-making business to their own futures commission merchant (FCM) franchises. And who will be the biggest winners? FX customers, who will be able to reap the benefits of the investments in new product innovation by exchanges, brokers and FCMs alike.