By Marshall Auerback, a portfolio strategist and hedge fund manager. Cross posted from New Economic Perspectives

Another day andthe markets remain fixated on whether Greece comes to a “voluntary” arrangement with its creditors. The key word is“voluntary” because the myth of “voluntary compliance has to be sustained so that those deadly credit default swaps avoid being triggered.

But let’s face it: Greece is a pimple. If the rest of the euro zone could cut itlose with a minimum of systemic risk, Athens would have long gone the way of Troy. The real issue is whether the credit default swaps trigger such a huge mess with the counterparties that it creates renewed systemic stress which more than offsets the benefits to the holders of the CDSs.

The more interesting question is: suppose Greece finally does get a deal? I realize everybody says it is a “one-off”, but do you really think the Irish, Portuguese, or even the Spanish and Italians will go along with that, particularly if (as is likely) they continue to experience double digit unemployment and minimal growth?

Now you could argue that Portugal and Ireland, like Greece, are but small components of the European Union and could well be covered in one form or another via the existing backstops established over the last several months, notably the European Financial Stability Fund (EFSF) and the European Stability Mechanism(ESM).

But you can’t say this about Spain, which remains the real elephant in the room – not Italy – even though Spain’s borrowing costs remain lower than Italy’s. This is perverse.

Though Italy has a high sovereign debt, it has a low private debt (the product of years of high budget deficits, but that’s the story for another blog). Italy has a fiscal deficit that is low relative to most economies today. It already has a primary surplus.The greater than expected past expansion of the ESCB and the current ongoing LTROs are likely to absorb panic and forced selling of Italian debt. The Italian 10-year yield could fall back below 5% (having already fallen from the 7% plus levels, pertaining a mere 6 weeks ago).

In theory, this rally in bond yields should lead to a reassessment of the gravity of the Italian problem and therefore the European sovereign debt and banking problem. That could be positive for equity markets and, indeed, has been so since the start of the year.

But does Spain truly deserve the borrowing advantage it now has in relation to Italy? Its 10-year bonds are yielding some 60 basis points lower. True, its sovereign debt to GDP ratio is low at about 75%, but partof its enormous private debt will almost certainly have to be “socialized.” Moreover, Spain has virtually the highest non-financial private debt-to-GDP ratio of all the major economies. Its ratio is almost twice that of Italy’s. Its fiscal deficit last year was probably higher than the official estimates, close to 9% of GDP (the previous Socialist government routinely lied about its figures – in fact, no country, not even the US, has lied more extensively about the condition of its banks. Spain, relative to GDP, has the largest shadow real estate inventory in the world, with the possible exception of China, which probably doesn’t even have a reliable second or third set of books).

Let’s be clear about one thing: this is not a tale of Mediterranean “profligacy”, as least as far as public spending was concerned. Anybody looking at Spain through a sensible financial balances framework in the mid-2000s would have observed that the private sector was being squeezed badly by the fiscal drag. The external position was in deficit (current account) which means the public and external balances were draining growth from the economy. Yet it still boomed up into the onset of the crisis. How did that happen?

The profligates were all in the private sector, although you could readily argue that the government’s “responsible” fiscal policy created the conditions for a private sector debt binge. Prior to 2008, the Spanish economy was held out as the darling of Europe however the reality was quite different. The country was running budget surpluses by 2005 and foreign investment was booming. Most of this investment went into construction which was stimulated by a massive real estate boom.

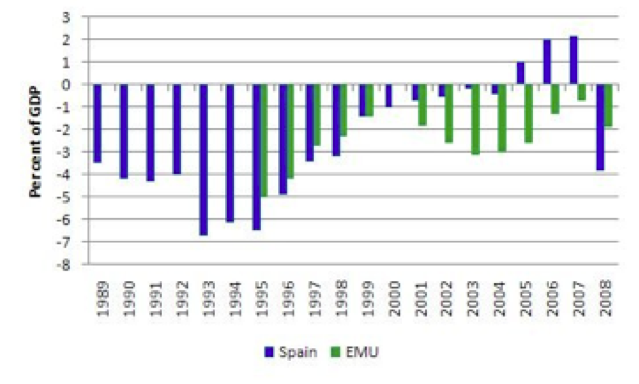

A few years ago, using data from the Banco de España (central bank) Bill Mitchell graphed the national budget deficit as a percentage of GDP for Spain and the EMU overall from 1989to 2008 (data for the EMU clearly didn’t start until 1995). As Mitchell notes, one can observe the tightening of fiscal positions as the Growth and Stability Pact provisions were forced on the EMU nations:

EMU and Spain: Budget deficit % of GDP,1989 to 2008

Consistent with a tightening fiscal position leading to surpluses in 2005, the only way that this boom could continue was for the private sector to go increasingly into debt.That is exactly what happened and because the property boom was so large the debt levels were also very high – average household debt tripled. And that, in contrast to Italy, is the core problem with which Spain is dealing today to a substantially greater degree than Italy. So it’s wrong to lump the two together interchangeably as the markets have been doing. Paella and pasta don’tmix well together.

Okay, but that was the previous Zapatero Administration. Now we supposedly have a new “responsible” conservative government that promises to carry out the same policies even more resolutely. And look how successful they’ve been: Spain’s joblessclaims shot up a further 4% in January from December to 4.59 million, a sign that the euro zone’s fourth-largest economy is still shedding jobs at a record rate. All sectors posted more claims but the rise was sharpest for services at5.1%. In construction, weighed down by a four-year property slump, the number of residents registered as job seekers rose 2.1%. Compared with the same perioda year ago, overall claims rose 8%. GDP contracted 0.3%.

Okay, “give them time”, argue the defenders of the new government. And, if the Rajoy Administration was truly embarking on a new policy course, that would be a fair comment. Unfortunately, this government has signed onto even tighter fiscal policy rules. Somehow they are expected to suck demand out of their economies through tax increases and spending cuts, but when the slower growth that results in means the target for deficit reduction is not met, the Spanish, like their Greek, Irish, Portuguese and Italian counterparts, will be punished for it.

Eventhe Rajoy Administration implicitly appears to recognize this danger, as it is already moving the goalposts in regard to its spending cuts targets as a percentage of GDP. Unfortunately, they blame this on external circumstances beyond their control. To the extent that they agree to submit themselves to rules which were routinely disobeyed by the Germans and French during the EMU’s inception, that is true, although theSpanish government refuses to acknowledge that their resolute tightening fiscal policy ex ante might well have something to do with the fact that Spain’s economy continues to deflate into the ground ex post. Remember, the history of the Stability and Growth Pact has long demonstrated that these nonsensical rules are already impossible to keep within during a significant downturn. And now the new Spanish government wants to tighten them even further and invoke pro-cyclical fiscal reactions earlier.

This, at a time when the national unemployment rate is approaching 23%, and the youth unemployment rate (25 yearsor younger) is at 49%, according to the latest Eurostat data.

Sonearly 50 per cent of willing workers under the age of 25 in Spain are without work and will remain like that for years to come. That will damage productivity growth for the next decade or more. It is an indication that the monetary system has failed and attempting to reinforce those failures with more austerity will only make matters worse. The new government’s proposed fiscal policy “reforms” are particularly toxic policy mixture for Spain.

Of course, the ongoing threat of a disorderly default in Greece also remains a potentially dangerous area if it is not contained by the ECB’s actions. But it’s more interesting to see what happens as the magnitude of Spain’s problems become more apparent. Will the troika tell Spain that a Greek style 70% haircut is not in the cards? Will they try to suggest that the government is rife with corruption, that the country is chock-a-block full of scoff-laws and tax evaders, and that the efficient Germans would do a much better job of collecting taxes?

Spain is still a relatively young democracy. The transition began a mere 37 years ago when Francisco Franco died in 1975, but there was an attemptedcoup by Antonio Tejero as recently as 1981. This is worth pondering whilst observing the implosion of Spain’seconomy. The decision for Europe’s bosses is this: they must ultimately confront the consequences of their policy choices. They can destroy the eurozone by continuing with the same failed mix of policies or by salvaging it by adding what has been missing from the outset: a mechanism for shifting surpluses to the deficit regions in the form of productive investments (as opposed to handouts or loans). Turning states like Spain into sundrenched economic wastelands within the eurozone, andforcing the rest of the currency area into a debt-deflationary spiral, is a most efficient way of blowing up the whole system and possibly threatening the very existence of Spanish liberal democracy itself.

It seems to me that if CDS was genuine insurance, it would only pay out once.

The problem with CDS is not inherent to CDS, which are, has has been noted, essentially a form of insurance. It is that the firms that sell them do not have to disclose the contingent liability/notional amounts, so one cannot assess the likelihood that the firm from which one is buying CDS protection is going to blow up if/when the default is triggered.

If there was any integrity to our financial accounting/disclosure regime, the contingent liabilities would be disclosed and capable of being priced in.

In any event, under Dodd Frank, most CDS are about to be subject to mandatory central clearing and collateralization which will centralize (but not eliminate) counterparty risk. Satyajit Das wrote a series of pieces about the risks involved with central clearing on this site a couple of months ago.

Dunno if links work but here goes:

http://www.nakedcapitalism.com/2011/10/satyajit-das-will-a-central-counter-party-tame-derivatives-market-risks.html

Buyers and sellers of credit default swaps have long argued CDS are executory contracts, not insurance policies. For accounting purposes, for tax purposes, for not-holding-capital-against-their-position purposes, they want it to be treated like a contract. But this is problematic when the sellers of CDS — the Ambacs/MBIAs/other monolines — run into trouble and face bankruptcy.

Skippy… so beard, you wish to further this practice with printing?

The monolines are mostly out of business; there is just one left (out of 9 or so, depending on how you count) that is actively doing new business. I don’t see how the bankrupting of the monolines has mattered terribly much, except to employees and shareholders of monolines, and there is still a mountain of CDS issued by banks and dealers out there. Monolines certainly have very little to do with European sovereign debt CDS or CDS on banks themselves. Most of monolines’ exposure to housing bonds is through “traditional” financial guaranty insurance and direct investment in the bonds.

Thanks Cole but, that was just for beard to give him some scope.

Skippy… from housing CDS exposure to sovereign CDS. How is it, that a nation can be usurped by a mathematically false equation, swapped globally via doggy contracts?

PS. I’m reminded of a little game played at the end of 3rd phase ranger school. The mini SEAR school at the end. A circle of naked men at night, facing inwards, with one naked man in the middle, in a state of induced mental and physical exhaustion. Object: the man in the middle must brake out of circle and the naked men forming the circle must stop the man from doing it… all with their eyes closed. Failure of any component of this game is met with punishment, more than not… for all. Calvin ball is for wussies. Snicker…

CDS is not like insurance. If it were insurance, a protection buyer would need an insurable interest. If insurance were like CDS you could buy a policy on your neighbor’s house, burn it down and collect.

International legislative action that immediately declares all Credit Default Swaps null and void.

Let’s start to finish with the farce:

At the bottom of the inverted financial pyramid are overvalued land, wood structures, dry walls and granite countertops – i.e. cheaply over-build houses.

These were sold to people who could only afford them with mortgages that had unrealistic starting conditions and on the premise that housing prices would continue to rise forever.

These mortgages were bundled, sliced and diced into Mortgage Backed Securities and sold to investors. Home equity loans, car-loans and credit card debt were converted to Asset Backed Securities and sold off.

On top of these MBS/ABS papers some geniuses constructed an additional financial layer.

These were insurance contracts that covered against the default of ABS, MBS and various types of bonds. These insurance contracts, Credit Default Swaps, are totally unregulated private agreements. They were widely created and dealt with when the risk of default of the underlying papers was assumed to be low.

Some of the insurers who issued these CDS never had the capital to back all the policies they wrote. In a competitive environment they offered too low premiums to insure against default risks.

Some insurers partly insured themselves via reinsurance. When they sold a CDS on a bond issue of some $10 million they went to other insurers and bought themselves CDS, let’s say $5 million or perhaps even for $20 million. The re-insurers partly re-insured themselves again by buying CDS elsewhere.

Some people simply betted on a change in the default risk of some bonds. They did not even own the MBS or bond in question, but bought or sold insurance against the default of a specific MBS or bond anyway. Some may have bought total insurance from different insurers in a way that a default of the MBS would pay them ten times the nominal value of said MBS.

Imagine you could have ten fire insurances on your home that would each pay out the full value of your house if it burns down. That would probably give you some very hot ideas.

That is exactly the reason why fire insurance regulation prevents such a case. But CDS are unregulated, their originators are unregulated and there is no settlement mechanism for them other than the private contracts between the parties.

The original size of the mortgages going into default are probably $300-500 billion. The total mortgage origination in the last years were a few trillion dollars. These and additionally credit card loans and auto loans that were converted to Asset Backed Securities in a volume of about $6 trillion.

But on top of these $6 trillion of MBS/ABS and bonds insurances, re-insurances and re-re-insurances were written with an estimated total nominal value of some $65+ trillion. The real number is unknown, but it is bigger than the whole worlds yearly GDP.

Now the housing bubble busted. There was simply too much supply created to sustain ever rising prices. Without rising house prices a lot of homeowners had to default on their mortgages.

With the mortgages going into foreclosure, the MBS and other asset backed papers where suddenly less worth than expected. This triggered credit insurance events. People who had bought the Credit Default Swaps suddenly demanded money from their insurers.

It turns out that these insurers, or their re-insurers, or whoever meanwhile carries the now negative side of the CDS in question are out of money and the insurance agreements are worthless. The worlds biggest insurer, AIG, was nationalized because it had written too much credit insurance for too low prices.

The big danger now are not defaulting homeowners. The big danger are not Asset Backed Securities that might lose some value.

The big danger is the pyramid of credit insurances that is certain to come down and that will take with it at least half of the existing finance infrastructure.

Banks, hedge funds, pension funds, municipals and others who bought insurance will find that it is worthless. Banks, hedge funds an others who sold insurances will find that they will have to pay out more than their total capital.

We currently see a credit-freeze because nobody wants to lend to anybody as it is impossible to know how much credit insurance the other party has written or how much it depends on their validity. You do not lend to anyone who might already be bust.

That is the situation we are in and it shows why the Paulson plan is utter crap and nothing but a huge robbery.

The Paulson plan would not help at the bottom of the inverted pyramid, the housing market, and not at the top, in the CDS market.

Paulson knows that the crash of the CDS market is inevitable. His plan is an attempt to let the taxpayer pay for the stabilization of the middle of the pyramid in the hope that the big crash will come only after the election (and in the hope that the loot might help Paulson’s beloved Goldman Sachs to survive.)

There is only way to avert the crash.

Declare all CDS contracts, worldwide, as null and void. There is precedence for this:

During the Great Depression, many debt contracts were indexed to gold. So when the dollar convertibility into gold was suspended, the value of that debt soared, threatening the survival of many institutions. The Roosevelt Administration declared the clause invalid, de facto forcing debt forgiveness. Furthermore, the Supreme Court maintained this decision.

The maze of the value and ownership of $65+ trillion of financial credit insurance contracts has frozen the credit markets. Nobody is lending to anybody else because the value of the counterparty is in doubt.

Those $65 trillion reasons for the credit market freeze will never go away without a huge crash that then will have worth consequences than the 1929 stock market crash. The only way to eliminate these reasons is internationally concerted action to declare the legal obligations of all CDS’ null and void.

At the same time:

all financial exchanges and markets of the world close for a week

CDS are declared null and void and new CDS creation is forbidden until new regulation is in place

the publicly dealt financial entities have seven days to figure out and publicly restate the value of their liabilities and assets excluding all CDS

a onetime windfall tax will be created that socializes overt advantages some entities will have from this

the proceed of that tax shall be used to prop up the capital of the big losers in a program comparable to the Reconstruction Finance Corporation of 1932.

To spend taxpayer money to buy up some MBS that lost value will do little to avert the coming CDS crash.

A $700 billion bailout can not save a unregulated $70 trillion CDS market that is under severe stress.

There is precedence that decisive legislative action can solve this really big problem. Unless this is done, all money to prop up the markets by whatever means is simply wasted and will make no difference in the final outcome of the crisis.

After CDS’ are gone, Congress should set up a new Home Owners’ Loan Corporation to solve the foreclosure problem and stabilize housing prices. This will then stabilize the MBS/ABS markets. Losses will have to be taken, but the catastrophe would be avoided.

If you are a U.S. citizen you may want to call your Congressmen and Senator on this issue. Monday morning might be a good time to do that.

There is only way to avert the crash. auskalo

Disagree. So-called “credit creation” is the root problem so let’s abolish any further. That would create a huge deflationary hole in the money supply as existing credit was paid off with no new credit to replace it. Fill that deflationary hole in the money supply with new fiat handed out equally to the entire population including non-debtors and metered to keep the total money supply (reserves + credit) constant. Continue till all credit debt is paid off. Or if an additional increase in the money supply is desired then hand out money at a rate greater than the payoff of existing credit debt.

The above should keep the CDS from being triggered and greatly dampen further boom-bust cycles.

Our entire money system needs a re-think – hopefully along ethical lines.

auskalo’s comment was thoughtful and made much more sense than yours. Seems to me the world would be financially more stable by eliminating unregulated CDS contracts.

Next time I’d suggest you invest more than fifteen seconds of thought before dismissing someone else’s point of view, especially after they had put such effort into the way it was presented.

Seems to me the world would be financially more stable by eliminating unregulated CDS contracts. anon48

And I have the odd notion that an ethical money system would be as stable as possible.

Next time I’d suggest you invest more than fifteen seconds of thought before dismissing someone else’s point of view, especially after they had put such effort into the way it was presented. anon48

I did not dismiss it; I just disagree that it is “the only way to avert the crash”. And yes, it was well presented. I apologize for not acknowledging that.

However, you folks should wonder about a money system that needs so much jiggering and contract nullifying. The human race is losing patience with the present system. We’ll be fortunate if we don’t end up with something much worse – such as a gold standard.

Thank you auskalo!

CDS – is – the unexploded bomb sitting in the commons living room. Well I guess when you try to insure the universe, you’ll get your comeuppance. First as Tragedy, Then as Farce.

I believe that monolines use a technical trick to be able to write insurance – Among other things, they need their counterparty to have an insurable claim; with CDS you dont know if your counterparty would lose money if the company defaulted.

To get around this problem, they set up “transformers” – companies which are set up solely to write CDS. They then insure the debt of the transformers (which they own).

Transformers were the coup that allowed monolines to write CDS in the first place; I think it was a questionable decision by regulators (and one they likely regret). Note to self – another case where regulators did a bad job and more regulation probably won’t help.

I think you could make a “piercing the corporate veil” argument – that the transformer is a sham corporation and the two companies should be treated as one – in a legal case where they tried to claim they are an insurer not a writer of CDS (or vice versa). But I’m not sure. I suppose you’d have to get into the details of the transformers – who owned the equity, etc…. Posted by dblob

Via. http://blogs.reuters.com/rolfe-winkler/2010/03/31/gaming-cds-non-regulation/#comments

For you beard.

http://www.economicpopulist.org/content/credit-default-swaps-cds-explained

Skippy… if you love the 15th century so much… go back.

PS. sovereign CDS hahahahahaha!

if you love the 15th century so much… go back. Skippy

Not early enough. Double entry bookkeeping was invented in the 13th century, I seem to recall, by an Italian.

But no, I reckon I’ll stay here and see if the human race can at least learn to do money ethically.

What a twisted mess we make

when we dare to fractionate.

“Thou shall not steal”,

a simple rule,

but much too simple

for complex fools?

Yet you suggest issuing monies in order to facilitate the furthering of it all, under the guise of democratic issuing, ethic and morals rational. Seemingly you only have one agenda private issuance and will make up anything to advance it.

Skippy… do you have even the slightest knowledge about CDO’s and CDS? The contractual language used between monoline insurance and CDS ?

Seemingly you only have one agenda private issuance and will make up anything to advance it. Skippy

Why do you (and the gold bugs) insist on a single government enforced monopoly money supply for ALL debts instead of just government debts? Are you against abolishing the “stealth inflation tax”? Why? Is stealing from the poor your cup of tea?

And why do you oppose a JUST universal bailout?

As for CDS and CDOs of course I know what they are in general but no I don’t have a detailed knowledge. Why the heck should I? Your whole rotten system is in crisis. Why should I poke through a rotting corpse when it is obvious it stinks?

There is a time “for wiping the dust off one’s feet.” If you prefer that this Depression continue then the consequences are on your head, not mine. And if you don’t want ethical money creation then you want unethical money creation instead. That makes you a thief and worse, an oppressor of the poor.

If you don’t want ethical money creation then press ahead. The farce is entertaining in a sad

“And why do you oppose a JUST universal bailout?”… beard.

What… a bail of out fraud? Your so called JUST* solution would accomplish that, with, an accompanying avalanche of other dire consequences ie. excessive consumption, energy “”, further degradation of our living space, more pollution, more, more, more.

*just, ethical, moral, democratic, etc. Your definitions, biblical ones to boot as found here. http://mises.org/daily/1854

I did a quick Google and unfortunately most of the hits were for PM based currencies. But here’s F. A. Hayek’s idea of private fiat… beard.

mansoor h. khan says:

December 16, 2011 at 2:27 pm

F. Beard,

“Mansoor H. Khan or EconCXX may have other suggestions.”

My knowledge of competing currencies is from mises.org and F. Beard’s comments on NC.

I also frequent http://www.housepricecrash.co.uk/forum/ and find very high quality forum discussions on the monetary system.

Also, in my experience mainstream economics discussion web sites are useless. I always come away with the notion that:

“if these guys ever had to get a real job they would starve”

http://www.nakedcapitalism.com/2011/12/bill-black-dante%e2%80%99s-divine-comedy-%e2%80%93-banksters-edition.html#comment-571179

“insist on a single government enforced monopoly money supply for ALL debts instead of just government debts”… beard.

Because history tells me how bad the private sector has – does a job of it. Take the government back in the name of the people, make banks utility’s, sod off the greedy corporations et al that brought us to this point in time. PIMCO bucks? Goldman sachs? dollars, BP moola? WF/BOA smackaroos?

You have to be kidding right?

There is a time “for wiping the dust off one’s feet.” If you prefer that this Depression continue then the consequences are on your head, not mine… beard.

Take your meds, get your head off the crack in the ground, Mises quasi religious vapors and think beyond simple couching of complex situations.

Skippy… Make the banks work for the people cough citizens, roll back Citizens United (FTW how they co-opt language like that) should be Slaves Threatened – Coerced – Amalgamated with one authoritarian mouth piece per identity. But more than all make the government work for the betterment of all its citizens, sustainably.

Nicely summarized and stated.

I agree 100000%

When are folks going to jail for this gun-to-the-head BS? Gambling that effects social stability needs to be prosecuted as such.

I agree completely with you auskalo. The CDSs should be abolished. They serve no social purpose. Here we have a classic case of the tail wagging the dog. I’ve said this before, but CDSs are to hedging credit risk what nuclear weapons are to “hedging” defence requirements. Great in theory, but use them and everything blows up.

I do not see Spain going to the right, far from it.

The youth are the ones who’ve been filling up town and city squares all over Spain, with the M-15 protest in Puerta del Sol the precursor of OWS itself. Their futures are at stake, and they are taking this personally. They want something very different to what the elites propose as the solution to this mess. And a 50-60% cohort unemployed in any age group has a lot of time to think, and organize skilfully on the basis of that. Time and energy are on their side, too.

The old structures are wilting – the church does not have the power it once had (as in Eire, somewhat a result of the failure to deal in any way adequately with sexual abuse scandals), and Fraga is finally dead.

Q: What have the youth got to lose by going for it?

A: Absolutely nothing.

You don’t know the half of it. It’s not about the debt levels, the sector balances, the ratios. It’s about the flows. Italy has a much more diverse economy. Spain has been overwhelmingly reliant on construction since – its already 37 years? It seemed a necessary investment. Construction was required to accommodate that rapidly urbanizing population (Spain has always had high unemployment. Those were people _looking_ for jobs). It was a dream.

That’s over. You and I will not live to see it again and there in nothing waiting in the wings to take its place. What makes it better? Agriculture is _capital_ intensive today and low, low margin, (except for the equipment manufacturers in Germany). The only rational thing to do with the debt overhang is to walk away Icelandic. That isn’t likely. My assumption is the same as yours. Spain will try to finance those unproductive assets until she can’t.

Remember when the euro was the next reserve currency?

The elephant in the room is Germany and their MEFO Coved Bonds…. why can’t anyone see that? Speaking of elephants, the other large illusion in the room is Canada and their relationship with China and American lobby groups. I was reading last night about the pipeline using pipes from India … so, great illusions everywhere and very little truth!

Rep. Mike Doyle: ‘I Don’t Believe There’s A Lick Of US Or Canada Steel’ In Keystone XL Pipeline

http://thinkprogress.org/green/2012/02/07/420802/rep-mike-doyle-i-dont-believe-theres-a-lick-of-us-or-canada-steel-in-keystone-xl-pipeline/?mobile=nc

I’m asking for a bit of truth in advertising here. It’s been my frustration throughout this debate. We hear a lot of claims about the pipeline and I just want to be honest with the American people. My amendment just says this: TransCanada has told us they have made every effort to source as much steel through North American mills as they can. I’m simply asking them to certify that claim. Through my little amateur investigation, I don’t believe there’s a lick of US or Canada steel in this pipeline.

ContagionEx

Just because its your fault, doesn’t mean others can’t suffer for you!

http://www.youtube.com/watch?v=WA7rGotO-oI

Skippy… Have a nice day… eh.

Jeezum.

Where ya been , Doc.

Two years ago, I weirdly predicted that the banks would destroy Spain because they were the world leaders, on a per capita basis, in solar power and wind power generation.

(Also, again on a per capita basis, their high speed rail network is largest on the planet, by far –HSR China Inc. will surpass them some day, but probably not in this decade).

But this is absurd, right? Banks would certainly target a nation for economic death because there was a profit in it, but they would NEVER target a nation for economic death simply because, on certain days, that nation was able to derive 50% of its electricity needs, just from wind power alone (and thereby show the entire privatized world the true potential of government planned renewable power generation).

Or would they?

Note: Wind is free, after all, and banks hate free –unless it is that free/ZIRP gambling money that the Fed hands out.

Max, I’m afraid you are very wrong. Spain has one of the most expensive electricity bills in Europe because of heavy subsidies to inefficient renewables. 50% generated by wind??? More like 70% of the energy annually is imported (from places like nuclear France).

Also, the high speed rail network is been a huge political mess and most regions don’t have yet have access. It’s much better in most other countries I’ve been. In Spain *everyone* needs to own a car, same as USA.

No, not “very wrong,” in fact I’m not wrong at all. On at least three days in the year 2009, wind power met 50% of Spain’s electrical energy needs.

If on most days, Spain has to rely on France for a majority of its incredibly expensive electricity, wouldn’t it make sense to try something else, perhaps something a little closer to home?

Energy security, and all that?

btw: Spain has the largest per capita high speed train network in the world. Period. If you don’t like it, fine, take a plane instead … while you still can.

Lies (or in nicer words pro-nuclear propaganda that I use to see frequently in spanish forums). On global numbers Spain exports a bit of electricity (France, Portugal, Morroc) and just takes a minimum amount of electricity from France nuclears when balancing the network load which a normal thing on interconnected networks.

The wind generation averages something like 20% of the electrical output.

“The balance of international exchanges was as an exporter, with 6,105 GWh, 27 % less than

in 2010. This decrease is due to increased imports through the interconnection with France that,

after being classed as an exporter for the first time in 2010, have led the net exchange balance

for this interconnection to return to that of an importer with a value of 1,189 GWh in 2011.”

http://www.ree.es/ingles/sistema_electrico/pdf/infosis/Avance_REE_2011_ingles.pdf

Banks would certainly target a nation for economic death because there was a profit in it, but they would NEVER target a nation for economic death simply because, on certain days, that nation was able to derive 50% of its electricity needs, just from wind power alone Max424

Hah! Wind power is just the bogus, government subsidized boondoggle that banks would be interested in since the returns are most likely guaranteed.

The gold bugs have their conspiracy theories too.

I have hope for solar though since Nature exploits it well.

If a government was operating a power generation source, like say, a wind farm, banks would not involved.

So why would banks interested? That’s right; they would be very interested because that son-of-a-bitch government was operating independently; essentially eliminating an avenue for banks favorite activity; rapacious, private rent seeking in conjunction with generous government assistance and subsidies.

re: gold buggery

Indeed, gold bugs have some crazy conspiracy theories. Who gives a shit?

I have a conspiracy theory, one that I believe is backed up by overwhelming, factual evidence. I believe that Big Oil, Big Coal, Big Nuke, Too Big To Fail International Banks, and other forces of global neo-liberalism, will stop at nothing to prevent sovereign nations from pursuing renewable energy.

The oil, nuke and coal companies hate renewables for obvious reasons; and the banks and the neo-liberals hate nation-states that attempt to act with a sovereign purpose; again, for OBVIOUS reasons.

Spain does not produce more solar energy than Germany, even if the climate is more favorable. Don’t kid yourself.

Spain does has a lot of windpower (even if not as much as Germany) but that is mostly because it’s very generously subsidized by EU.

I doubt it is any reason anyhow.

Gambling in the stock market is outlawed after the 1907 financial panic. Bucket shops (e.g., where betting ten-to-one or $1 trillion dollars on an underlying $100 billion dollars in securities) are declared illegal.

The Commodity Futures Modernization Act of 2000—championed by Robert Rubin, Larry Summers, Alan Greenspan, Arthur Levitt and signed into law by President Clinton—deregulates the over the counter (OTC) derivatives market, despite the objection of CFTC Chair Brooksley Born. Bucket shops, more sophisticated than before but bucket shops nonetheless, are now back in operation.

The Gramm-Leach-Bliley Financial Services Modernization Act (1999) repeals the Glass–Steagall Act (used to separate investment banks, commercial banks and insurance companies), creating our now systemically fragile financial system. Banks use depositors’ money to gamble with, keeping all the profits and expecting the taxpayers to bail them out when their bets go bad or banksters threaten to bring down the financial system. This bankster extortion is uncivilized.

President Obama has added about +$5 trillion dollars to the national debt in the past three years trying to cover up the credit crisis caused by the financial elite. Obama’s inaction is sure to bring on a double catastrophe of a combined 1907 and 1929 economic debacle. America needs the government to start unwinding the +$707 trillion dollar OTC derivatives market and reinstate the Glass–Steagall Act, NOW!

Spanish mortgage laws, unique in their kind as far as I know, effectively implement debt slavery for life if (as it happens) the effective value of real state falls and the mortgage goes into default. Banks buy the mortgage for half the price and are still owed huge amounts.

That way the debt never decreases but grows forever… or at least for the foreseable future. That way Banco Santander and other Spanish bankster mafias under a corporate pretext can give dividends that would be the envy of Maddoff.

But of course this system is deeply rotten. It has been that way since the 90s boom of real state, greatly inflated well into the 2000s. A home that was worth €15,000 in 1982 had become “worth” €300,000 in the early 2000s. There was little justification for all this bubble, which mirrored in an exaggerated manner the housing bubbles of the USA, Britain and other countries (only Germany did not have a housing bubble of some sort thanks to state intervention against it).

But it is a private problem, and it does not need to be “socialized”. The assumption that Spain will bail out its toxic banks is not necessarily true (Ireland did, Iceland did not – there is an option).

But I really hope Spain collapses because it is a pain in the ass and I say so with compulsory fascist Spanish ID card. If Spain collapses maybe we Basques can break free. That would be nice.

“International legislative action that immediately declares all Credit Default Swaps null and void.”

Amen. Casinos and loan sharks.

When the SYSTEM is corrupt to the core, expecting solution to come from within is far from reality.

Massive crash will descend once all the effects of charade becomes inoperative, down the road.

Till then complain and rant!

International legislative action that immediately declares all Credit Default Swaps null and void.

Suppose it wasn’t INTERNATIONAL action that declared CDSs null and void but just Ruritania – a smallish financial centre – one accounting for, say, just 5% or so of the global total which is to say perhaps $35 trillion of a little over half the world economy. What would happen next?

Surely the proof of Buffet’s view that they are financial WMD. Unknown numbers of banks that complacently believe that they have a net zero position would suddenly find that they were net long or short by a few billion (or tens of billions). And if they weren’t then some of their counterparties would surely be. And who who sell new protection to plug the holes in such a panic? Surely no-one. So, like a nuclear firecracker, the detonations would follow in quick succession levelling th proud towers of finance – and the rest of us.

Or am I wrong? Please say I am.

In the meantime, the assembled Men of Means, desirous yet of realizing their phantom gains hard won through Good Time’s trials, must needs squeeze the re-pledged blood from somewhere….

Gentlemen, I give you…Spain !!!

The “elephants in the Room”, of course, are the EU and its political instrument of consolidating power, the Euro.

Also, it is ludicrous to think it is a matter of Spain vs Itally. It is a matter of all of the PIIGS and France too.

The whole EU?EC has been living on borrowed tie for decades, time paid for by the productive economics of the North. The Eurocrats will bleed Germany and the UK dry. What then?

Chuck the EU and the European Superstate, go back to a simple common market, and uphold national sovereignty.

Force the Euocrats to earn and honest living.

It is the only reasonable and decent way out of it.

The elephant in the room is the sheer ignorance of the writer of the article about Spain, its economy and the similarities/differences with the other countries named.