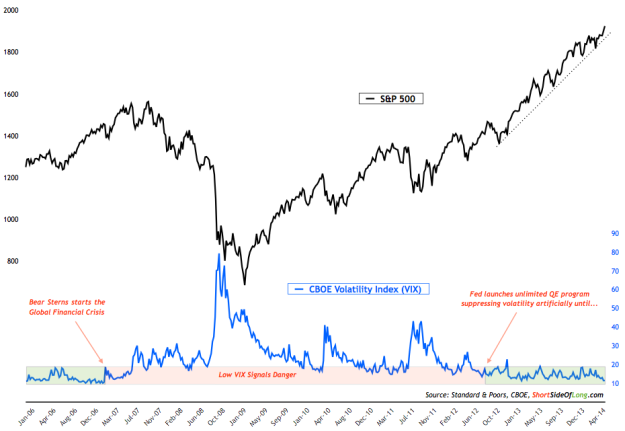

Chart 1: Volatility Index is hitting rock bottom complacency levels…

Source: Short Side of Long

I will be updating sentiment conditions properly and in-depth, as I usually do during the first weekend of every month. However, I thought it was prudent to open up a discussion as early as today on a phenomenon the majority of you readers have most likely already noticed. Let's call this condition a lethal and dangerous cocktail mix of rock bottom complacent volatility, extremely low volume readings and the lack (or even better—non-existence) of bearish investors. While you glance over Charts 1 to 3, I will quickly cover these three cocktail ingredients.

First, historically speaking, extremely high volatility into a major sell-off has almost always been a great buy signal if one exercises patience and some kind of timing skills. On the other hand, while low volatility isn’t necessarily a sell signal, the rock bottom complacency seen today resembles conditions just prior to the Global Financial Crisis of 2007/09. Low volatility is dangerous for many reasons, including the fact that traders take on more and more leverage to turn minuscule market moves into decent returns. It is true that for now volatility could stay artificially low, as long as central banks continue with their super-easy monetary programs.

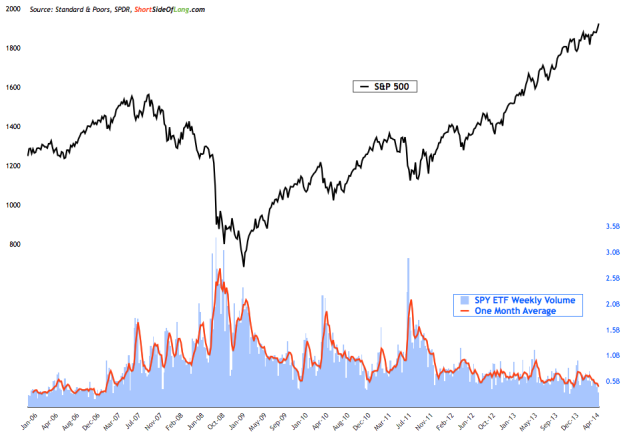

Chart 2: …while US stock market volume is currently at six year lows!

Source: Short Side of Long

Second, the majority of the time, extremely high volume into a major sell-off has been a great buy signal if one exercises patience and some kind of timing skills. During true buying opportunities (market bottoms) we know retail investors (dumb money) are dumping shares because of high volume spikes, known as panic selling. And in similar fashion to volatility, low volume isn’t necessarily a sell signal, but it does portray lack of commitment on the behalf of market participants. Chart 2 clearly shows that market peaks occur during low volume and recent readings are at six year lows!

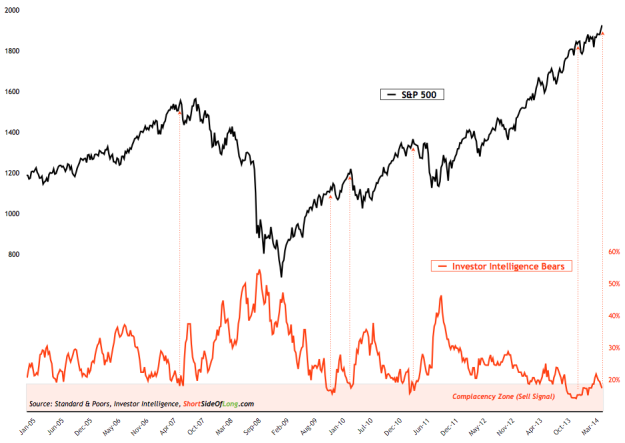

Finally, for the stock market to keep climbing, there needs to be a wall of worry in place. Various financial commentary will describe this condition in many different ways, using many different indicators. Personally, I like to use Investor Intelligence Bearish readings, seen in Chart 3. The more bears we have declaring negative views on asset prices, the more fuel we have to climb higher as prices bottom. As these investors realize they have been wrong and start putting their cash to work, one by one they're seen buying at higher and higher prices. However, once we run out of bears, we also run out of fuel and the wall of worry disappears.

Chart 3: Where are the bears? Previous low readings have led to peaks!

Source: Short Side of Long

The caveat here, relative to the 2007 peak, is that fundamentals are much worse with demographics deteriorating, interest rates are at or near record lows, global debt levels surpass 2007 highs by over 30%, central bank balance sheets are now loaded with absolute garbage, and economic recovery is the worst since World War 2 (despite multi-trillions in stimulus). Finally, employment conditions have no improved at all for over five years now, despite the rubbish commentary in the media.