Why London became a centre of finance, but Shanghai won't

Here is a lesson for those who think that China's big business capital will become a major centre servicing massive outward investments…

When the British want to explain why the City of London is the world's leading international financial centre, they usually attribute its position to a couple of key elements.

Those on the political right who rather like the financial services industry, typically credit London's success to superior enterprise, together with a certain swashbuckling culture.

Their rivals on the left who tend to disapprove of financiers put London's rise down to a lax regulatory regime combined with a culture of naked greed.

A more balanced observer, however, would probably ascribe the City's success to other factors.

(The City of London, incidentally, refers to the area within the old Roman walls. By tradition this square mile is the home of commerce, in contrast to the neighbouring City of Westminster, which for the last 1,000 or so years has been the seat of government.

Today "the City" is used as shorthand for London's financial sector - much as "Wall Street" denotes New York's - even though many big banks have now moved east to London's docklands, while much of the fund management business has migrated west.)

For a start, there is London's convenient time zone, which handily straddles both Asian and North American business hours. Plus most of the inhabitants speak English, which makes it much easier for monoglot Americans to do business there. And then there is London's success in capturing the nascent market in offshore US dollar bond issuance in the 1960s.

No doubt all of these played a role. But there was another element behind London's development as an international financial centre which seldom gets mentioned, although it was vitally important: the decades-long decline in value of the British currency, the pound.

That might sound counter-intuitive, but it was key.

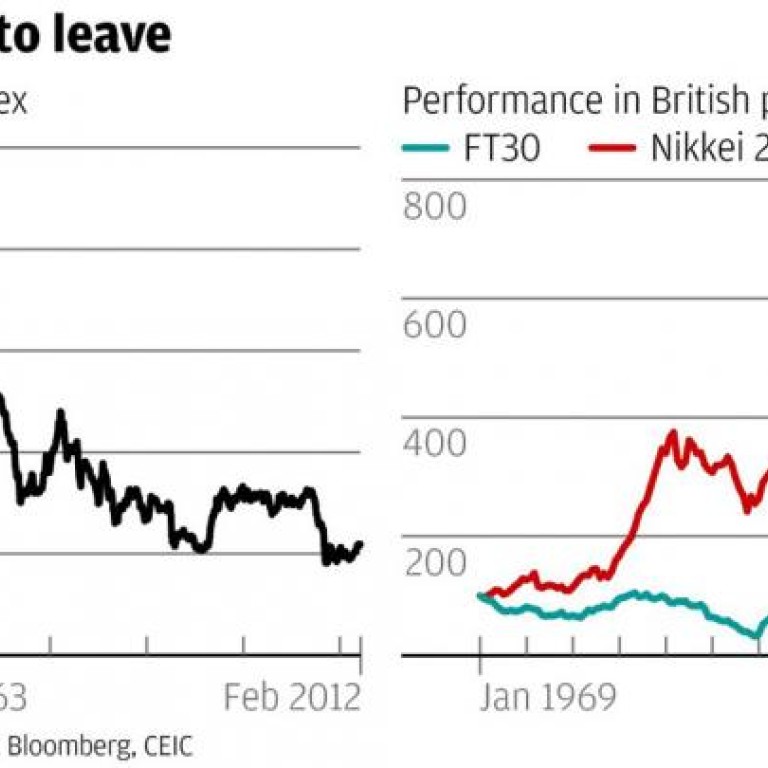

As the first chart shows, between 1967 and 1996, the pound lost 60 per cent of its value against a trade-weighted basket of currencies.

As a result, while it was often extremely hard for British asset managers to generate decent returns for their clients by investing at home, making money abroad was as easy as falling off a log.

For example, as the second chart illustrates, between January 1969 and January 1979 the FT30 index of leading British stocks declined by 7 per cent. Over the same 10-year period, thanks largely to the fall in the British currency, Japan's Nikkei 225 index returned 630 per cent in pound terms.

That added up to a powerful incentive for the British to invest abroad. As a result London developed an investment management industry, and supporting brokerage and securities services sectors, that habitually looked outward to international markets to make their living.

So it was largely British institutions and financiers that pioneered the opening of Asia's emerging markets in the 1970s and 1980s.

The Japanese, meanwhile, learned to stay at home. It wasn't xenophobia that kept them there, but the strength of their currency. With the yen appreciating at annual rates as high as 20 per cent during the 1980s, Japanese investors found that making a positive return from foreign markets was next to impossible.

That's one reason why London became a global financial centre while Tokyo never did.

There's a lesson here for those who believe that over the next few years Shanghai will establish itself as a major international financial centre servicing massive outward investments from China.

If your currency is locked into a long term strengthening trend - as most observers believe the yuan will be - then it is difficult to persuade domestic investors to venture abroad.

If you want, like the City of London, to grow as a world financial centre, it can help to have a currency in decline.