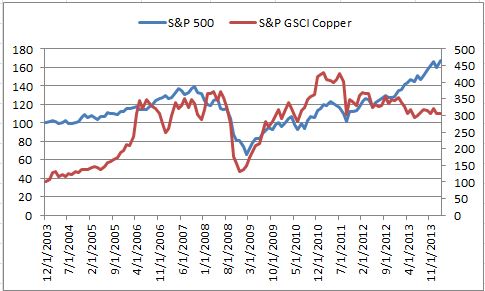

Thus far on the blog, we have written a few pieces about busts in the stock market. David Blitzer wrote, “Whenever this bull market ends, it is likely to be with a bang, not a whimper.” He also wrote about Deflation, Debt and Disaster where he pointed out we may be on the edge of deflation, which leads to stagnant economies and depression. I also pointed out the cycle of stock-to-commodity outperformance may be switching back in favor of commodities.

With the possibility of doom and gloom over the stock market, a natural question may be where to turn to protect your assets. Many consider gold a safe-haven, but is it really? My colleague, Reid Steadman, wrote about VIX – The Enforcer, where in a hockey analogy he pointed out that when other markets fail, VIX may be the last line of defense. It is a decent argument that VIX may act as a strong safe-haven.

However, many might be hesitant to believe that VIX, a reflection of volatility, is a safe-haven since it’s not tangible. Despite the fact that not even the luckiest person can catch the leprechaun with the pot of gold at the end of the rainbow, at least everyone can dream that picture. But what does a pot of VIX look like? Besides charts in a pot?

Although Reid does a good job of explaining what is VIX, as humans we possess irrational behaviors (besides believing we can catch a leprechaun with a pot of gold). One of our behaviors is biased expectations or overconfidence that leads to misapprehensions about oneself and to the illusion of control.

In a published card game example, investors are more confident in the value of the cards they TOUCHED. The example is as follows:

- A game is played with two decks of cards, red and blue. Players pay $1 and receive one card from one of the decks. The card is then returned to the deck, the dealer shuffles and draws one card. If the player’s card is drawn, the player wins $100.

- When the game is played with the blue deck, the dealer only shows the card to the player.

- When the game is played with the red deck, the player gets to touch the card and return it to the dealer.

- Players were asked to sell their cards prior to revealing the card chosen by the dealer.

The results show players valued the cards they touched more than they valued the cards they did not touch:

- Blue deck (no touching of cards): 19% were unwilling to sell their cards. Average asking price was $2

- Red deck (players were able to touch cards): 37% were unwilling to sell their cards. Average asking price was $9

Why does this matter? It is since investors may value the tangible property of gold as a store of value, or currency, that it has been considered a safe-haven asset as throughout history. But the question is at what price? Is gold as a safe-haven really more valuable than VIX at protecting your portfolio in hard stock market times?

That all depends on how we measure time frames and what we consider protection, but from the look of it, we put much too high of a value on the tangibility of gold.

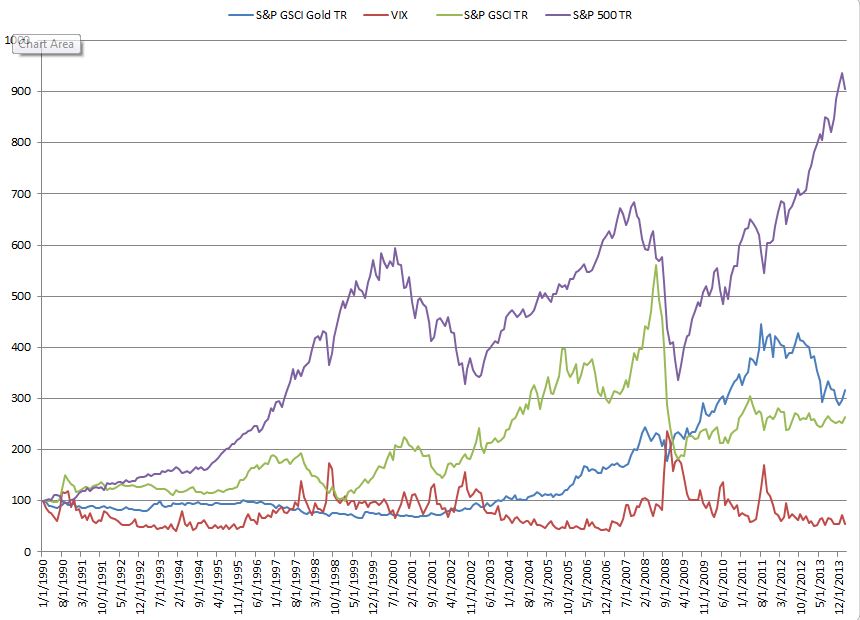

Let’s take a look at the overall cumulative return chart of S&P GSCI Gold, VIX, S&P GSCI and S&P 500. Gold looks pretty attractive relative to VIX but we need to dig deeper to see which does a better job as a safe-haven.

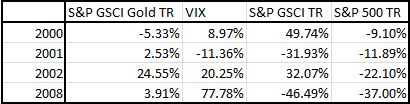

Using monthly data in the time period from Jan 1990, the only negative years for the S&P 500 were 2000, 2001, 2002 and 2008. The results of protection are mixed. In 2000 and 2008, VIX returned higher than the S&P GSCI Gold, but the opposite was true in 2001 and 2002.

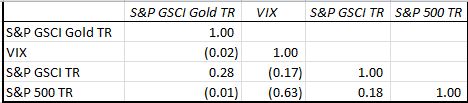

However, the results become more clear when evaluating other metrics. VIX has the lowest correlation to the S&P 500 of -0.63, compared to -0.01 of S&P GSCI Gold with the S&P 500 and 0.18 of the S&P GSCI with the S&P 500. This implies VIX has stronger diversification properties that could potentially lead to greater capital preservation when mixed with stocks.

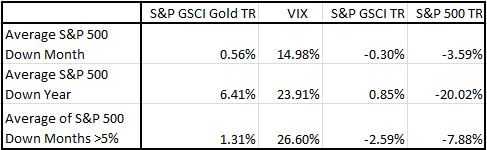

Further, on average of 287 months measured, 103 months were negative for the S&P 500 and 27 of those lost more than 5% in the month. While gold protected, VIX seems to have done a better job. An average monthly loss for the S&P 500 was 3.6% with a 15% gain from VIX and only 56 basis points from gold.

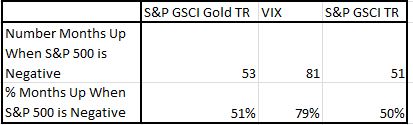

VIX also has the best record of positive months when the S&P 500 lost. In 79% of down months for the S&P 500, VIX was positive. The S&P GSCI Gold and S&P GSCI didn’t do a bad job but came up short again versus VIX.

Finally, maybe when it counts most, we measure two crisis periods during this time: the tech bubble burst and the global financial crisis. Once again both gold and VIX protect but VIX wins.

As investors, and humans, we really might price the value of the golden touch too highly.

The posts on this blog are opinions, not advice. Please read our Disclaimers.