Last week the CBOE’s VIX futures set some new volume records. While volume is interesting, I think the real story is the open interest of VIX futures contracts. Is the volume just churn, or are VIX futures contracts being created or eliminated? Since raw volatility is tough to buy, VIX futures market makers must buy other things, like SPX options to hedge the VIX contracts they create—so there is the potential to influence other markets.

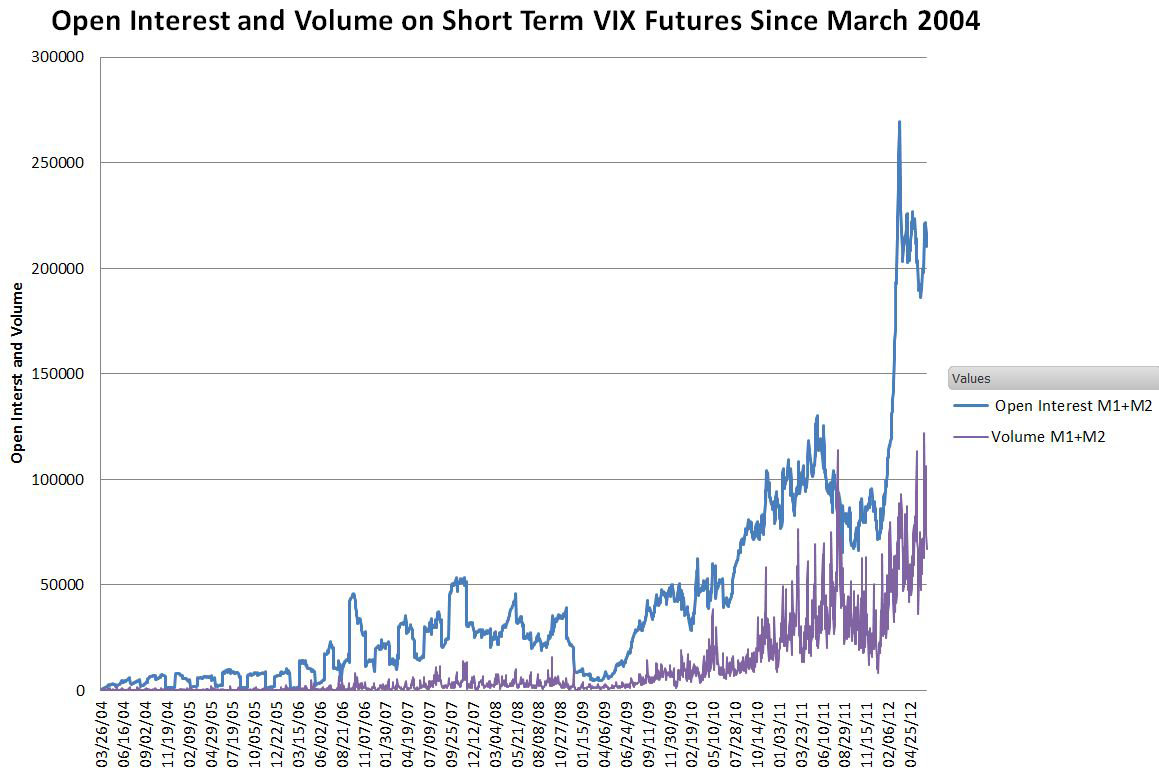

The chart below shows the open interest and volume of the combined first and second month short term VIX futures from their beginnings in 2004.

Open interest has dropped a bit from the record levels in the spring, but it’s still running about double the 2011 levels.

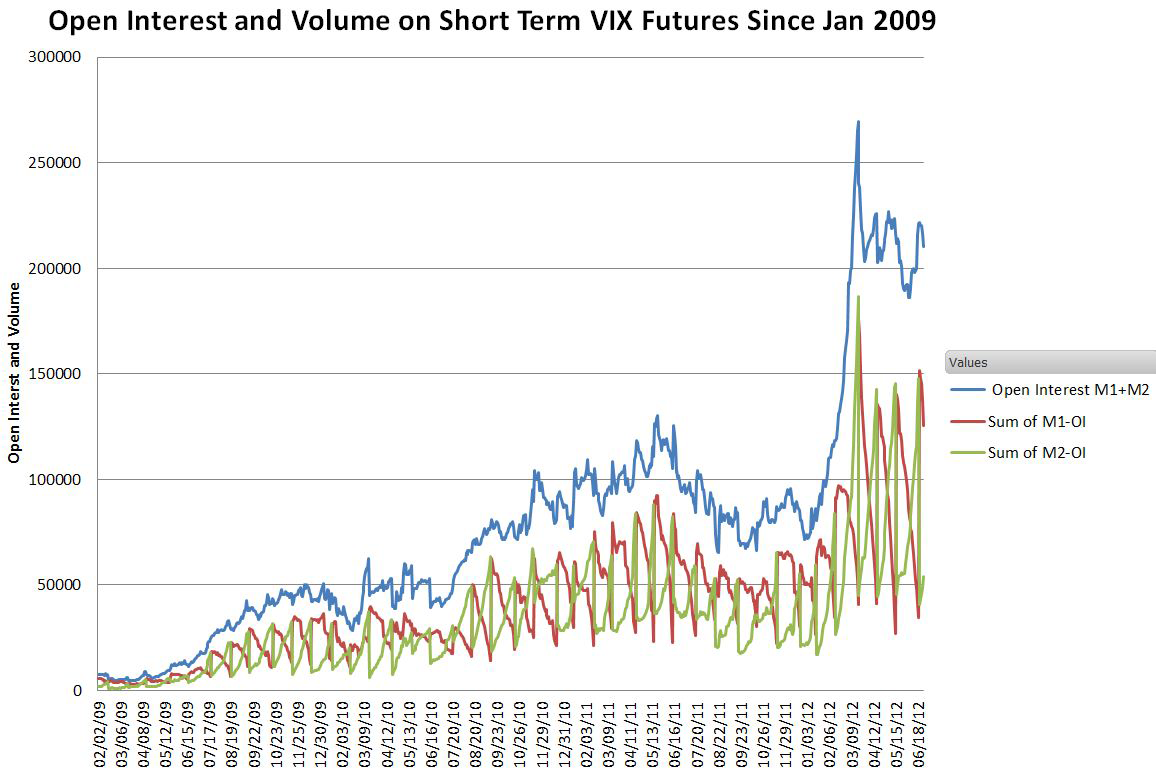

The next chart shows the individual open interest in the first and second month contracts compared to the sum of the two.

The intertwined saw tooth shapes of the two individual months are the footprints of volatility ETPs like VXX, TVIX, and UVXY that must roll around 5% of their portfolios ($125 million currently) from first month contracts to second month contracts at the end of every day to maintain a constant time horizon on volatility.

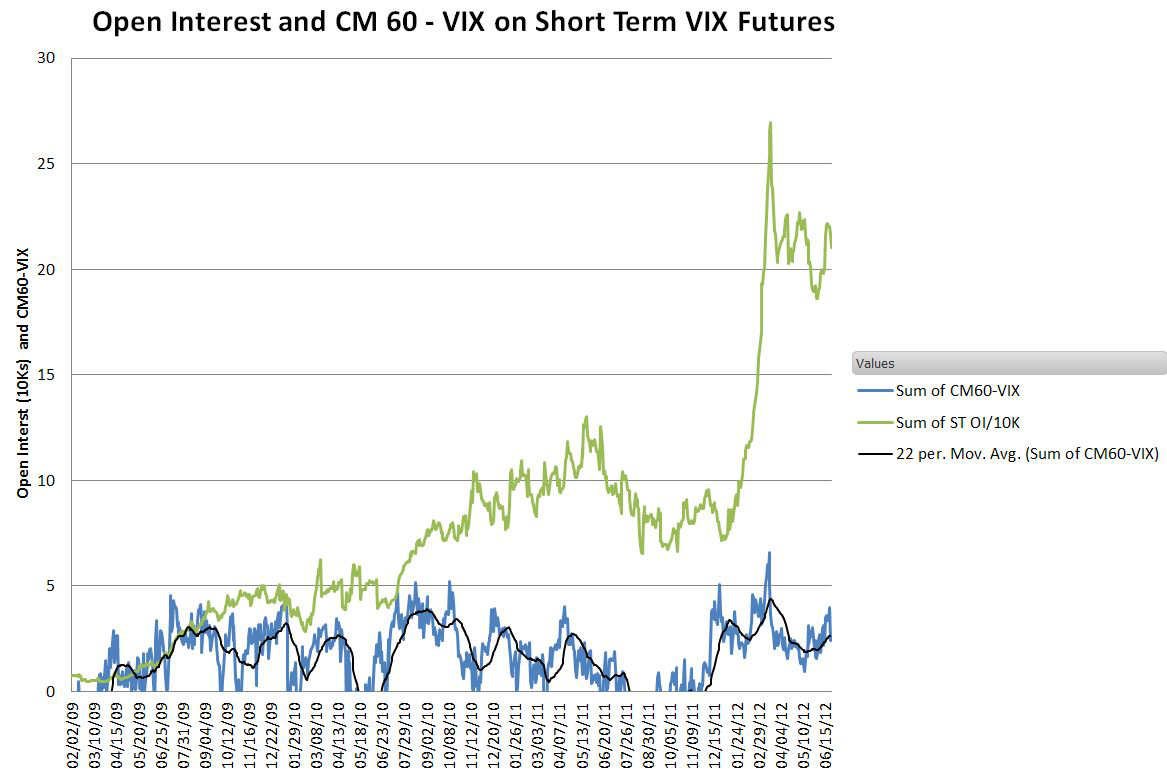

With nearest month VIX futures running around $20K approximately 6,000 first month VIX futures need to be sold by the ETP vendors, 15% of the daily volume of around 40,000. The chart below shows the open interest and the difference between the VIX index and a short term constant maturityVIX futures metric that doesn’t have roll costs.

While hitting an all-time highs when the open interest peaked in March 2012, the gap between the VIX and the VIX futures has been in the normal historical ranges after that—the market doesn’t look unduly stressed by the current open interest/volume level.

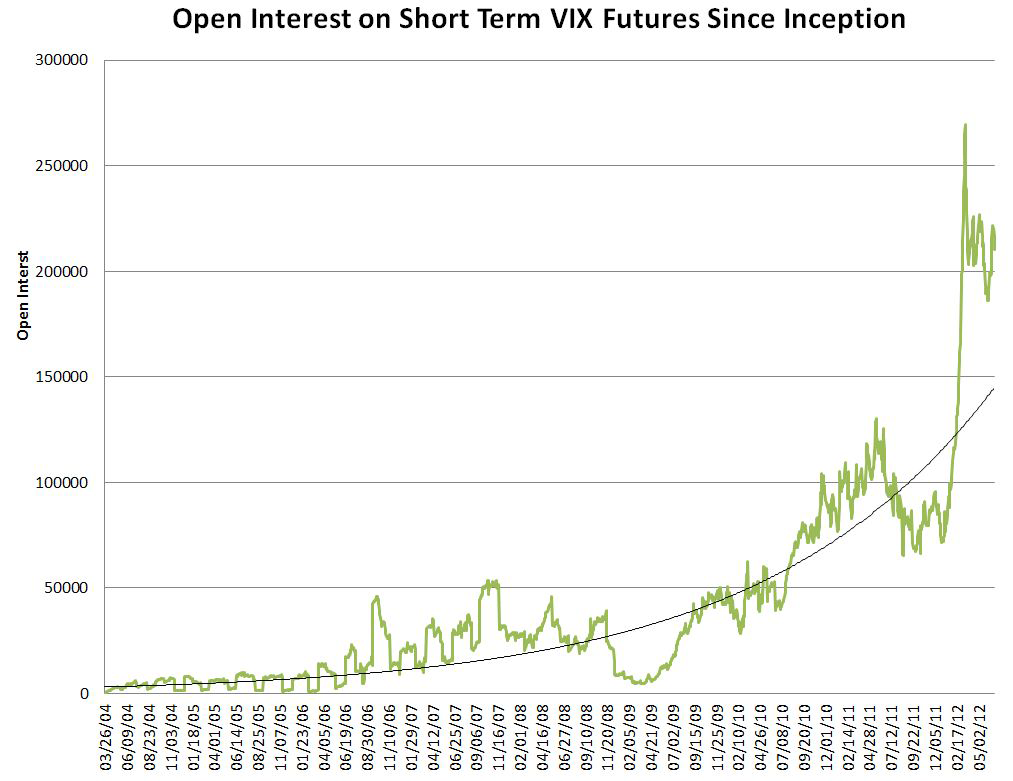

What stands out to me, looking at the chart below, is the ongoing exponential growth that the short term VIX futures have demonstrated over the last 8 years. If anything their growth is accelerating above their historic 43% annual growth rate.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Short Term VIX Futures Growing St 43% Per Year—At Least

Published 06/29/2012, 03:28 AM

Updated 07/09/2023, 06:31 AM

Short Term VIX Futures Growing St 43% Per Year—At Least

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.