Are ETF Launches Sputtering?

As you’d expect, we closely monitor new fund launches here at IndexUniverse. In the last few weeks and months, we noticed that the spigot of new funds has been tightened.

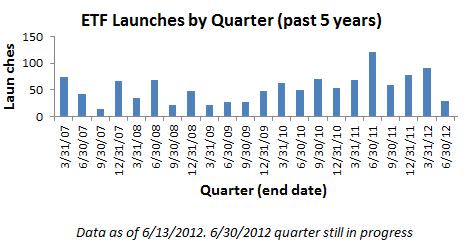

To put this in context, I looked at the number of ETF launches in each quarter over the past five years. The resulting chart has funds that launched but haven’t closed, so readers can rightly call me out on survivorship bias.

Still, it’s clear that, while this second quarter of 2012 isn’t entirely in the books yet, we’re on pace for one of the thinnest quarters in years with respect to new launches.

Low numbers from one incomplete quarter are hardly a reason to push the panic button. Indeed, who’s to say that unchecked growth in the number of funds helps investors?

After all, the existing fund base does a decent job covering an incredibly diverse market.

Want a U.S. equity size and style fund? You have over 200 to choose from, not counting levered or inverse products. Emerging market debt? Corn futures? Double short euro? VIX futures term-structure plays? There are ETFs and ETNs for that.

(In fact, our analysis of the ETF market currently shows no fewer than 588 unique market segments populated by 1,469 funds, and it’s all spelled out in our free ETF finder .)

I don’t mean to say that there isn’t room for more and better products. Personally I’d like to see more bullet maturity fixed-income products and a broader choice of asset-allocation funds.

But over the last five years, an average of 55 new funds have launched in each quarter. That’s roughly one per trading day—in other words, a rate that’s probably unsustainable in the long run.

No Free Launch

We’ve seen issuers launch expansive sets of niche funds, with mixed results.

PowerShares and Russell each launched a group of factor-based equity funds that focus on beta, volatility, momentum and more.

While most of these funds haven’t gathered much attention, the PowerShares S'P 500 Low Volatility (SPLV - News) took off like a rocket. It launched just over a year ago, and has gathered $1.84 billion.

To me this highlights half of the key dynamic:the part that says the market will decide which funds it wants, and will reward the issuers who bring them to market.

The other half of the dynamic is that funds that don’t work need to go away in an orderly fashion. The fund closure mechanism seems to work, though it’s a tad sluggish.

In 2011, we saw only about 27 closures, while 2010 had 49. But 2011 had almost 100 more launches than 2010, so I’d expect—and maybe even hope—that closure will tick upward for 2012.

Why hope for more fund closures? Simply so that unwary investors don’t latch on to illiquid or poorly supported products that bump along the bottom of the ETF pool.

In the end, I’m less concerned with the flow of new funds at the top so long as the drain at the bottom is fully functional.

In other words, those ETFs that the market has ignored should be closed, redeemed or de-listed in an orderly fashion, without loss to investors beyond the change in investment value and taxes associated with the distributions.

As to the top line, I’m confident that issuers will keep offering new products in hopes of landing the next SPLV, and that investors will direct their assets to the products they like.

Permalink | ' Copyright 2012 IndexUniverse LLC. All rights reserved

More From IndexUniverse.com