Thank you to all those who attended our Bear Market Trading seminar. Look for the March Seminar topic coming soon!

The Fed is continuing the modest tapering of bond purchases and thankfully ignoring the machinations in Turkey and Argentina. A stronger statement of course would be that they taper 20 billion instead of 10 billion.? There were some hopes that maybe with stocks lower that they would ride to the rescue.? That did not happen.

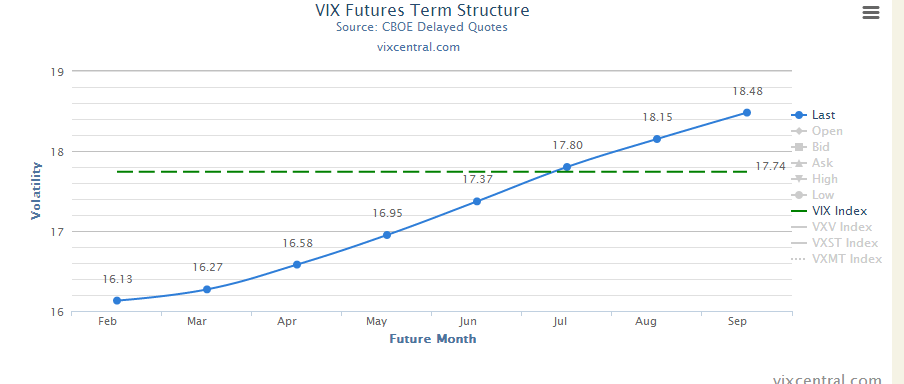

What we had was the first non-drop in IV after a FOMC meeting announcement in about 8 months.? The term structure is very underwater for the VIX as the underlying movement remains brisk but not enough to punch up the volatility futures.? For now, the current volatility forecast is lower than where we are now going out several months. ?That is usually not a recipe for disaster but at least some chop short term.

The turnaround overnight in sentiment and the jump in bond prices indicate the problem is still the perception of frailty in emerging markets.? The Fed?s move out of bond buying seems to be set at this point.? That means a quick snap back for US Equities is going to be tough to come by and a huge drop will be tough without a reason.

The Trade

If we get another small drop in IV tomorrow, the time is ripe for index Iron Condors.? The two way tug should keep our rallies muted for now as monetary nitro starts to dissipate. ?For now I would stay away from selling ATM options.