By Marshall Auerback, a hedge fund manager and portfolio strategist. Cross posted from New Economic Perspectives

Nearly one Spaniard in four is unemployed, according to data released on Friday, as the country’s economic and financial predicament prompted a government minister to talk of a “crisis of enormous proportions”.The data from the National Statistics Institute showed 367,000 people lost their jobs in the first three months of the year. At this pace, Spanish job losses are equivalent to 1 million per month in the United States. That means more than 5.6m Spaniards or 24.4 per cent of the workforce are unemployed, close to a record high set in 1994.

Spain has become the new Greece. Actually, in many respects Spain is now worse than Greece. The Spanish unemployment rate is already so high and unlike Athens, Madrid has made no headway in reducing its public debt levels (whereas the Greeks are close to running a primary fiscal surplus at which point they could leave and turn the problem back on to Brussels). Moreover, Spain has a huge private debt burden that is twice that of Greece.

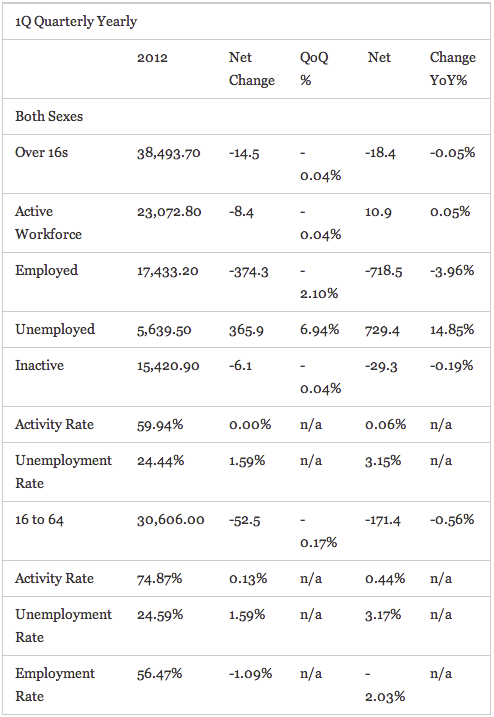

Although I have warned on these pages before that Spain’s austerity program was leading the country to disaster, my reaction to this economic catastrophe has been one of amazement. Just take a look at this employment data

Spain First Quarter Unemployment: Summary (Table)

2012-04-27 07:00:00.13 GMT

Yet, until now Rajoy Administration has been saying that the marginal decline in GDP estimated by the Bank of Spain for the first quarter was exaggerating economic weakness. Now we have the spectacle of the Spanish government suggesting that the Bank of Spain estimate of a .4% decline in Q1 Spanish GDP is too pessimistic. But in light of these numbers, what kind of GDP decline should one realistically expect when employment falls two percent non annualized in a quarter? At least a four percent annualized decline. more likely much higher. Yet who is talking discussing that as a real possibility in Brussels? Nobody. Everybody remains asleep at the wheel.

For years, the Spanish GDP figures have been hard to square with the underlying collapse in industrial production and rise in unemployment, both of which were more realistically reflecting the scale of the country’s collapse into depression.

When I said a few months ago that the Spanish government was lying about their numbers, I was attacked by a few Spanish readers of this blog, who claimed I was a nefarious hedge fund manager, likely loaded up to the gills with CDSs on Spanish debt who was trying to foment panic. For the record, I have never bought a credit default swap in my life. If anything, I was trying to foment panic because I was horrified by the new ultra austerity stance adopted by the recently elected Rajoy Administration.

Now consider the reality: the economy is crashing, hence the unemployment rate rise. Yet German Chancellor Angela Merkel and the ECB President, Mario Draghi, continue to insist that one can have both fiscal restriction and a lower domestic price level despite the fact that Spain has a non financial private debt to GDP ratio of 230%.

Interestingly enough, Dutch levels of private debt to GDP are even higher, at 249%, the highest in Europe. By contrast, the Italians still have net household savings. So who are the real “profligates” in Europe?.

Those who embrace these ruinous austerity policies will soon be seeing the experiencing much the same kinds of conditions as the Spanish (albeit from less depressed levels) including the moralistic Dutch, whose finance minister has been a crusader in favour of even harsher fiscal rules than those embodied in the Stability and Growth Pact.We have also recently witnessed a big surprise decline in the German consumer confidence index last week as well as a collapse in an Italian retailing sentiment index. The austerity disease is intensifying the crisis, even in the core.

It is inconceivable to me that Super Mario Draghi won’t be changing his tune soon, in spite of what he and the Merkel government are now saying for public consumption. To continue with this present course will not only precipitate a collapse of the euro, but a political collapse across Europe.

There is no question that larger deficits are needed to support aggregate demand at desired levels. However, as all of us who have contributed to this blog have long noted, the problem is the national governments are currently like US states and as such are revenue constrained because they are USERS, rather than ISSUERS of the currency (as opposed to, say, Canada or the US, both of which are sovereign issuers of their own currency).

So relaxing the deficit limits without some kind of ECB funding guarantees can cause markets to abstain from funding the national governments, which creates a solvency crisis of the kind we are experiencing today. Said another way, without the ECB the euro members are currently deep into ‘Ponzi’, as my friend, Warren Mosler has described it. In reality, they have all been in ‘Ponzi” since day one. But it took a crisis of the magnitude of 2008 to make this manifest for the markets.

At some level, the ECB understands that, as it always”writes the cheque” when a systemic crisis pushes the system to the brink. It can be no other way, as it is the sole issuer of the euro. But for the most part, Europe’s policy making elites remain in denial, as they continue to turn away from the one entity that could address the insolvency issue.

And let’s be clear once and for all. The US government does not face the same kind of crisis as the Spanish, the Greeks, the Dutch or even the Germans. The US government has expanded its public debt ratio considerably in recent years but yields remain low and when the ratings agencies downgraded their assessment of the US sovereign debt the demand for it rose. Whither the so-called “bond market vigilantes”?

The Euro governments are in a different camp altogether. All those who actually understand that the member governments are using a foreign currency and thus are not at all like Japan, the US or the UK governments, appreciate that their is default risk attached to the paper issued from the EMU governments.

They also appreciate that with the non-elected eurocrats of Brussels insisting on a decade or more of austerity and implementing fiscal rules that these would ensure a crisis every time there has been a serious downturn in aggregate demand. And with that, the risk of default with government debt has risen. That is what we are seeing today across the euro zone. And in Spain it is writ large.

The mainstream austerity line is trapping Spain (as well, as Greece, Portugal, Italy, Ireland and soon the core of the euro zone) in a dangerous downward spiral of lost income and increased unemployment. I still think Francois Hollande’s likely election could well change the political dynamics in the euro zone, even though he generally buys into the mainstream neo-liberal euro line. Hollande is an “austerity lite” character, as opposed to being a genuine reflationist. But even he cannot be oblivious to the looming political and social dangers which await France, if he continues to pursue the policies embraced by the current President, Nicolas Sarkozy.

So far, Brussels has not let facts get in the way of a good neo-liberal theory, but it’s getting increasingly hard to ignore this emerging horror show.

The other interesting part of the private debt figure is that amount of that debt that is owed outside Spain. Government debt only accounts for about 300 billion of the external debt, with the remaining 1.5 trillion euros owed by private entities (about half of that by banks).

The big question now is who is going to backstop this private debt, since it is obviously not going to get repaid, and making even more Spanish people unemployed isn’t going to help them pay their mortgages on time.

Then there’s the question of whether the central government in Spain really even has the power to make the cuts that they have been proposing, since most of the cuts involve money to pay for powers (health, education) that has been devolved to the regions. The government of Catalonia (the region around Barcelona) recently walked out of negotiations with the central government and some officials have starting to threaten to hold a (probably illegal) referendum on independence.

Fun stuff.

“probably illegal”

The American Revolution was definitely illegal.

Visca el Barça i Visca Catalunya!

And the tea party participants would be rendered to Gitmo under the Patriot Act.

I question the ability (legally and politically) of any Spanish government to enforce a prolonged period of austerity in any event.

The slowly boiling pot in Spain could potentially turn very volatile later this year. If you’ve been been immersed in Spanish culture and politics you’ll know that we’re in for a rough ride, far rougher than Greece.

When people get upset in Spain they let you know. This is goign to be a hot summer.

Can we please stop using the word austerity and call it what it is “government shrinkage”. It is being fought because there are many who know nothing else and many who can not imagine a life or a society without a government backstop. I believe that what is now unfolding is awful but necessary I simply tire of folks who seem unwilling or unable to grasp the idea that socialism doesn’t work-never has never will.

Can we please stop using the word austerity and call it what it is “bank bailout”. It is being fought because there are many who know nothing else other then to work for big Defense Contractors like Lockheed, or Booze or Big Banks and they rely completely on government welfare extracted from citizens for their survival. I believe that what is now unfolding is an attack by American Banks on Europeans. I simply grow weary of folks who seem unwilling or unable to grasp the idea that fascism doesn’t work-never has unt never will.

It is being fought because there are many who know nothing else and many who can not imagine a life or a society without a government backstop. Mike

Especially bankers whose “craft” could not even exist without government backstop?

But their victims are to be denied?

Isn’t that just a wee bit unjust?

Austerity is the euphemism that has been chosen by your fellow corporatists. If you are not happy about your faction’s linguistic decisions, please take it up with them, not us.

As the readers of this blog clearly see through that euphemism and have already labeled it as the wealth transfer that it is, what makes you think that we will be influenced by your even more transparent euphemism of “government shrinkage”?

If you are “simply tire[d] of folks who seem unwilling” to genuflect at your passing carriage and the misguided dogma you transport with you everywhere, might I recommend staying off the public highways.

From an MMT perspective, a monetarily sovereign government does not need the money that is in the hands of its citizens nor it’s corporations. Conversely, the ECB could print as much money as it wants to bailoit all debtor if it choose to. However, the ECB will not do so. At present the aim of the elites is to transfer the real wealth of the economy over to its overlords… Not the paper money, the control of land , infrastructure and other real productive assets of an economy. To do this you must control the Proportion of fianacial Income and fianacial Wealth controlled by the cronies, and this is achieved through the talk of ‘unsustainable government debt and future pension obligations, imposed austerity on its citizens, so that they believe in the lie of ‘scarce money and enforcement of debt’, which causes desperation among its citizens, until they accept to privaisation of real assets, and the enforcement of government mandated licenses and monopolies, in exchange for a writedown of unpayable debts and a temporary rescinding of austerity ia a resumption of bond market sponsored government spending backed by more debt.

…when the ratings agencies downgraded their assessment of the US sovereign debt the demand for it rose.

“Free markets” are a wonder to behold, no?

Good point!

The demand rose on the expectation that there would be less US Government debt issued so get it while one can?

Demand rose on the assumption that downgrading US debt signalled bad times ahead for world economy growth prospects in general (because the nominal reason for the downgrade was the LACK of austerity in US fiscal policy). Calls for austerity are correctly interpreted by the bond market as signals of low growth prospects, resulting in an increase in demand for safe assets. US debt is the safest in the world, regardless of the opinions of the ratings agencies.

I am curious about the huge private debt in Spain. Who is it owed to anyway? Would like to see an analytic chart showing who is this money owed to: German vs. Spanish vs French vs. U.S. banks in percentages and what was it spent on, e.g. construction or other private expenditure, eg, autos, education, appliances, health, etc.

Any takers.

http://www.spiegel.de/international/business/bild-828996-342720.html

Banksters. ‘Take me out to the ballgame, la di da di da doo’

Why do so many of you assume that the collapse of the Euro would be so tragic. Was it tragic of Argentina when it stopped using the dollar? No, despite the calls of permanent depression sold by many, including Domingo Cavallo.

The ECB is doing what the ECB can do. The ECB promised the German voter that it would never resort to monetization of debt.

For those of you who insist on a more prooactive ECB and a United States of Europe, what are you ready to concede to the German voter?

— Perhaps have German taught in all schools for 1.5 hours daily?

— German command of military/police in every state?

But it doesn’t have to come to that.

The other option is for Spain to simply leave the Eurozone. No one will invade it if it does so.

And I guarantee the following. 18 months after it’s left the EZ, Spain will be growing at a 5% annualized clip.

Prove me wrong.

A universal bailout of the entire Eurozone would go to German savers too.

Because it’s not just a monetary union, the political union is strong (the Spanish in particular welcomed EU membership after the return to democracy post-Franco’s death in 1975), and breaking the political union with the EU would have major international consequences on top of the insane national austerity now being attempted.

EU membership has led to huge integration in law that has grown up over decades, and isn’t going to be easily unpicked, and unpicking would add to the chaos. The autonomous regions such as Galicia, Andalusia and others, which benefit from regional development funding, would also suffer even more than they are now.