Being India’s first global stock exchange is an uphill task but it is grinding on.

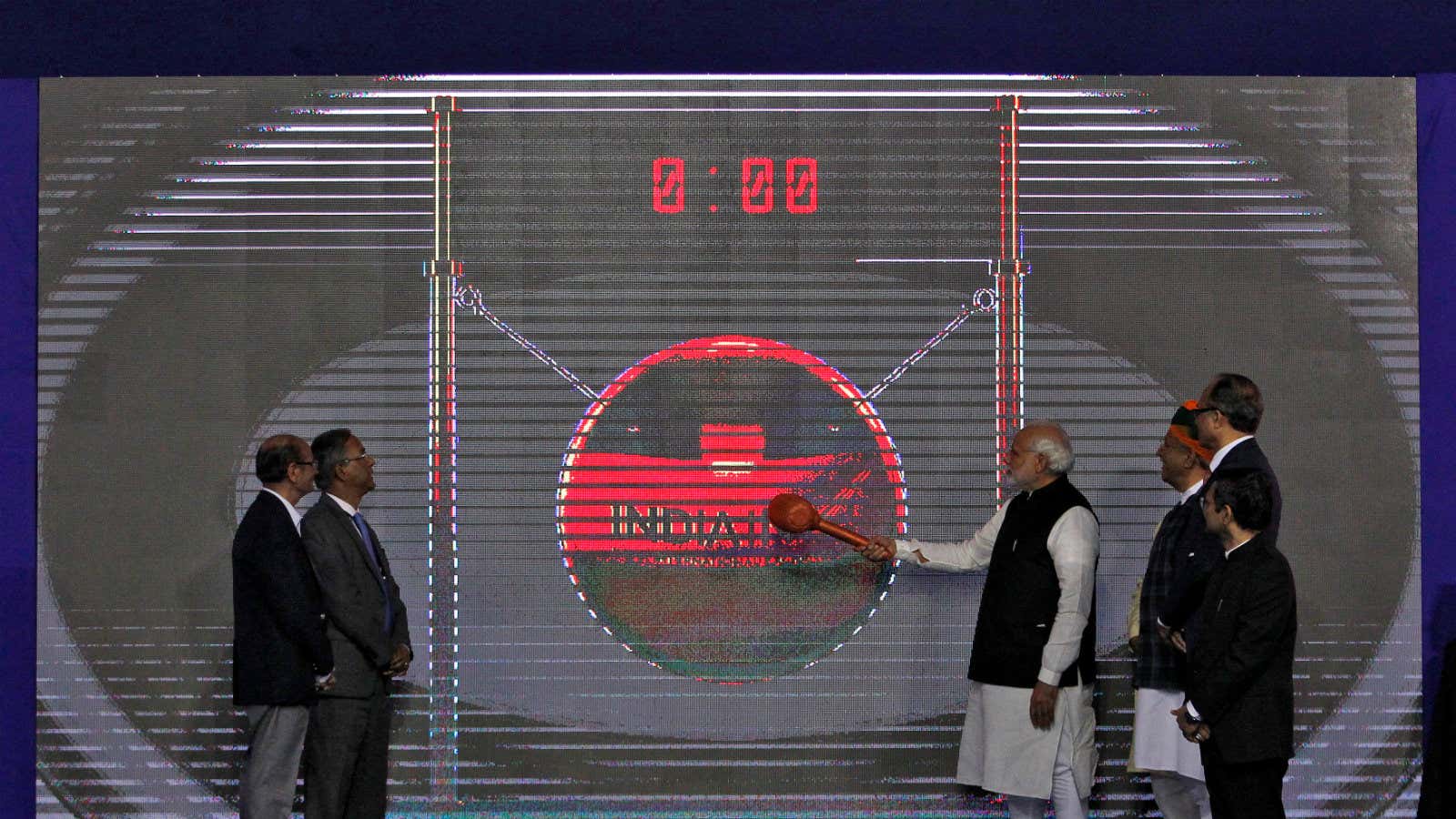

Barely months after its January 2017 launch, the Gandhinagar-based India International Exchange (India INX) is struggling with tepid turnover and poor broker registration.

However, with a trade speed of only four microseconds (the world’s fastest) and trading of up to 22 hours a day, it is confident of succeeding in the long run.

Slowly and steadily, things are changing, its managing director and CEO, V Balasubramaniam, confirmed. To begin with, it has expanded its suite of products since its launch. So, turnovers have improved. Looking to compete with international exchanges in Dubai, Singapore, Hong Kong, New York, and London, it’s trying to introduce game-changing products such as rupee-dollar contracts and masala bonds.

Quartz spoke to India INX about its plans. Edited excerpts:

The first few months were challenging in terms of low turnover. Have things improved now?

We started with only seven products…By August (2017), we have about 180. As a result we have been able to expand our markets to include equity derivatives, commodity derivatives, currency derivatives, and cross-currency products. As a result, the offerings are more sophisticated. Recently, the market regulator also approved around 85 single stocks from Indian futures and options, so now we have 108 such stocks. Therefore, it has become easier for foreign investors to access Indian markets as they can trade in dollars here. One of the features of India INX is that you can’t trade in rupees, only dollars. So, for any foreign investor, it has now become as simple as wiring money and taking it back, as they don’t have to worry about currency conversion.

Earlier brokers faced a lack of clarity on foreign investor participation and slow registrations. How’s that been dealt with?

There were some procedural concerns, but that has been taken care of. As regulations have cleared up and (the number of) products are increasing, more brokers are also registering. When we began, we were hardly clocking $1-2 million turnover. But after product approvals began coming in, daily volumes have shot up to over $100 million (on May 05). Today, on an average, we are clocking a turnover of about $65 million (daily). By the end of the year we should look at a further 20%-30% rise.

Are there any more specific products you may add?

We want to introduce the rupee-dollar contracts. If it happens, it will be a big move. Two other international centres, Dubai in the west and Singapore in the east, witness a lot of interest in this product. Whenever there are volatile periods, for instance US elections or Brexit, we see their volumes shoot up. In Dubai alone, they trade about $1 billion of rupee-dollar contracts everyday. Today, even for products like the masala bond, Indian companies are going to international markets, which we can win back if we can introduce it in India.

Why hasn’t the RBI allowed these yet?

We don’t know the reasons, but we want a level playing field vis a vis other international centres. If India has to find its place in the financial world, we can’t be followers; we have to be price setters. We’ve been far too dependent on the foreign world.

How confident are you of competing with other global financial centres?

We know it is going to take a long time but we believe we can. For us at Indian INX, it is clear that the competition is not the domestic markets; it is the world’s top international exchanges, and we can get there in the long run.