On April 17, 2017 volatility expert Steven Sears wrote an article in Barron’s called “Profiting From the Stock Market’s Latest Fears.” In this piece, Sears recommends that long-term investors take advantage of rising market anxieties by selling put options. The most nervous investors can cope by:

“…stockpiling cash and buying some bullish call options to control equities they want to buy.”

Sears acknowledges that timing is everything with these trades: he particularly advises put sellers to act when they think “fear is peaking.”

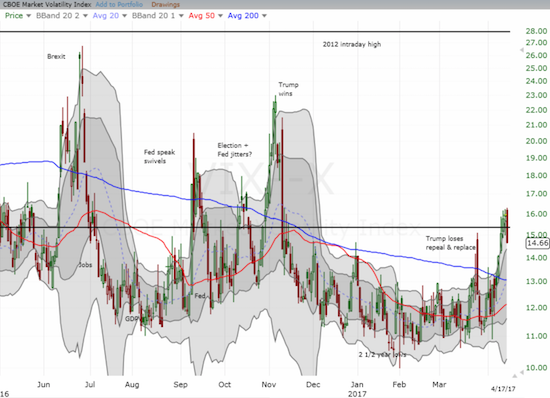

The period of extremely low volatility has indeed come to an end. When I wrote about the surprisingly benign implications of a period of extreme low volatility, I used twenty trading days as the duration over which the volatility index, the VIX, has to close above 11 to end a period of volatility extremes.

The VIX last closed below 11 on March 3rd. The 20th trading day with the VIX closing above 11 occurred on March 31st. At that time, the VIX was in the early stages of its current run-up. Yet fear, in the form of volatility, has not likely peaked. In the latest trading on April 17th, the VIX tumbled 8.2% to close below the all-important 15.35 pivot.

The volatility index, the VIX, may now establish a higher baseline pivoting its comfortzone around 15.35.

The ease by which the volatility index dropped below the 15.35 pivot suggests that the market is nowhere near a peak of fear. Yet Sears characterizes this market as one full of fear based on search interest: “More people are Googling World War III than at any time since 2004.”

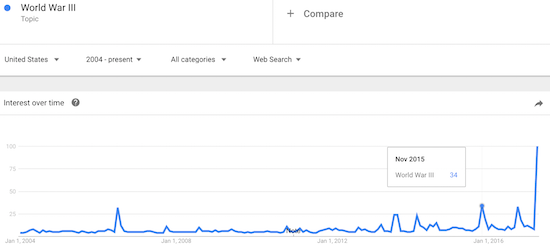

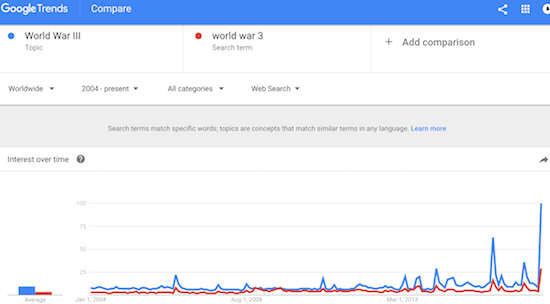

The recent surge in searches on World War III are indeed remarkable. The interest in “World War III” as a topic is way off the charts! I include a comparison to “World War 3” as a search term (the topic is not available presumably because Google (NASDAQ:GOOGL) aggregated such topical searches into World War III).

On a worldwide basis, the search on World War III as a topic has surged to its highest level since Google started measurements in 2004.

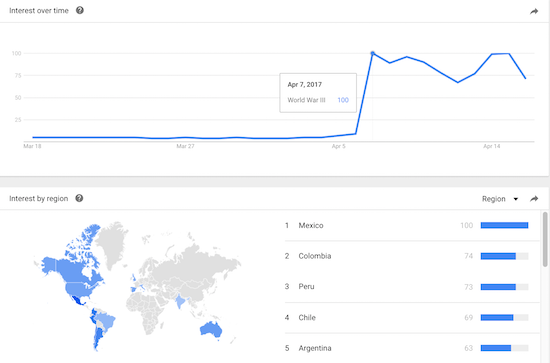

Strangely enough, the U.S. on a relative basis is NOT the main source of the angst over a worldwide calamity. South and Central America have a much higher concentration of concern.

On a country basis, Paraguay leads the pack of nervous nations followed by Egypt, Panama, Bolivia, and Guatemala. The U.S. does not even show up on the ranked list until #32. Russia is ranked at a very sleepy #53.

When I narrow the focus to the last 30 days, the ranking of countries changes dramatically but the main regions of nervousness do not: Mexico, Colombia, Peru, Chile, and Argentina. After these top 5, the list looks a lot less surprising: Australia, Canada, United States, Spain, and the United Kingdom. However, the list of countries bottoms out with Italy, Brazil, and India.

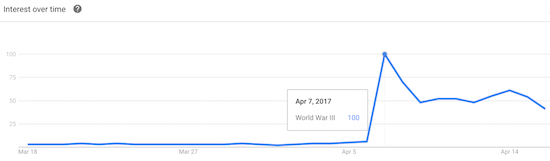

Russians currently cannot be bothered with fears of World War III. Moreover, the fear peaked on April 7th, the day after the U.S. bombed Syria. World War III topic searches surged again with the sabre-rattling around North Korea but are already on their way down again. (I post an explanation of ranking by regions at the end of this post).

World War III fears are flaming out quickly with Central and South America acting like “ground zero.”

So we can hardly say there is surging panic in the U.S. relative to the rest of the world. Besides, what is fear of a world war without Russians? Turning the microscope on the U.S. is even more revealing about the true nature of this World War III fear. The fear peaked on April 7th in the U.S. and has declined ever since. I include a monthly chart for the U.S. to confirm that this month has exhibited the largest interest since at least 2004.

A fear of World War III has gone parabolic in the U.S. as measured on a monthly basis.

Fears of World War III peaked on April 7th and declined right through the latest dust-up with North Korea.

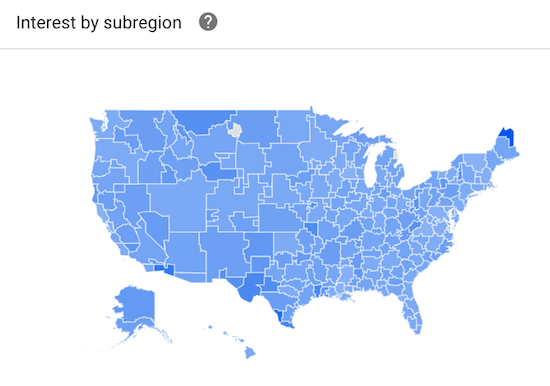

Over the past 30 days, on a state-by-state basis, New York, the center of finance, is way behind the curve of concern with a lowly rank of 45 (of 50 states!). The U.S.’s most populous state, California, is much more fearful at #17. Still, leading the pack are states with relatively small populations: Wyoming, Alaska, New Mexico, and North Dakota. Arizona pops up at #5. I wonder whether bomb shelters and survival bunkers are peppering the deserts and vast wildernesses in these states. A country map of metro-level search interest is quite telling: notice New York City is not even close to a hot spot.

U.S. metros on or near the borders with Mexico and Canada have generated the highest concentrations of search interest in World War III.

So, while the U.S. has a pattern similar to the rest of the world in a surging interest in the World War III topic, relative to other countries, the concentration of concern in the U.S. is small. Within the U.S., the fears of (the search interest in) World War III are far away from the population centers of the U.S. and definitely far away from the financial hubs. So, if fears of a major war are a reliable indicator or harbinger of volatility in financial markets, then there must still be a good ways to go to the upside for a slothful VIX.

Regardless, be careful out there!

For interest readers, here is an explanation of how Google ranks search trends by sub-region:

“See in which location your term was most popular during the specified time frame. Values are calculated on a scale from 0 to 100, where 100 is the location with the most popularity as a fraction of total searches in that location, a value of 50 indicates a location which is half as popular, and a value of 0 indicates a location where the term was less than 1% as popular as the peak.

Note: A higher value means a higher proportion of all queries, not a higher absolute query count. So a tiny country where 80% of the queries are for “bananas” will get twice the score of a giant country where only 40% of the queries are for “bananas”.”

Full disclosure: long UVXY call and put options