The markets story of 2017 — fake news, real returns

2017 will go down as one of the strongest years for global stocks in the last decade.

And while these returns can be attributed to the synchronized upswing in global economic growth and strong corporate profitability, hanging in the background of markets all year were a series of risks.

President Donald Trump’s chaotic administration, stop-and-start Brexit negotiations, and saber-rattling from North Korea were just some of the obstacles that seemed to stand between investors and a strong year for markets in 2017.

Seemingly endless fretting in the U.S. over whether tax reform was being priced into markets, and whether a failure to pass tax reform would send markets lower, ended up being for nought. The deal got done and stocks are at a record high.

And yet with these risks dominating news headlines seemingly every day, volatility in markets was muted virtually all year and the VIX is sitting just off its all-time low hit in November as we end the year. So in the end, the markets story of 2017 was the lack of volatility amid a chaotic news cycle.

This year in markets, the news was fake but the returns were real.

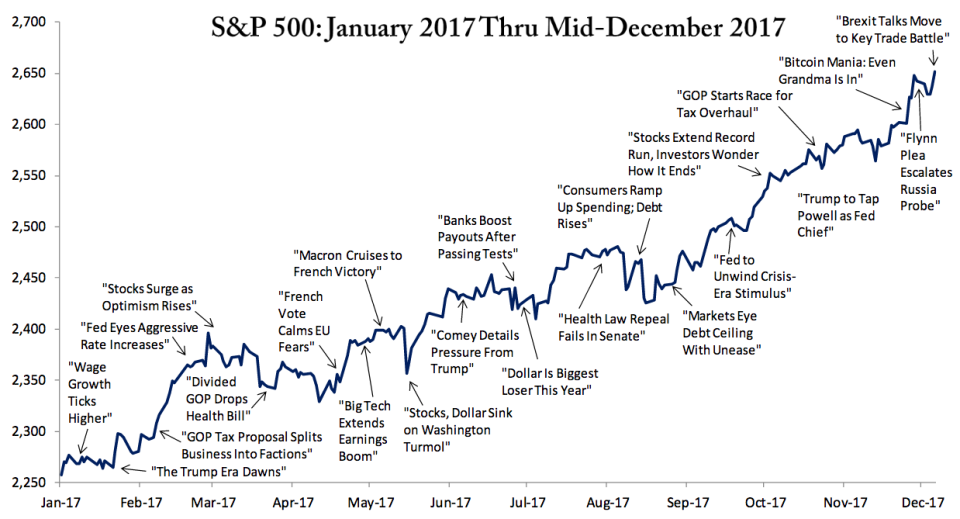

As this chart from Bespoke Investment Group shows, each seeming challenge from the news cycle — the Mueller probe, the debt ceiling, the Fed tightening — was deflected by markets that were determined to push higher.

In the U.S., the Dow has gained over 25% the S&P 500 rose has added just about 20%, while the tech-heavy Nasdaq is up nearly 30% this year. The small-cap Russell 2000 index is up about 13% in 2017.

Around the world, stocks were also higher. Stocks in Europe (IEV) are up 20% this year and emerging markets (EEM) have gained almost 30% this year. In India (INDA), stocks have gained 35%.

Richard Turnill, BlackRock’s global chief investment strategist, writes that two major lessons were learned by investors in 2017.

“First, low volatility can be sustained for longer than many expect,” Turnill writes. “Our research shows that equity market volatility tends to stay low in steady economic expansions, provided systemic financial vulnerabilities remain in check.

“Second, geopolitical risks are not all created equal.”

And it is this second point that seemed particularly difficult to digest in 2017. In 2016, investors began the year with two dreadful months in markets, all while two major political risks loomed — June’s Brexit vote and the November presidential elections in the U.S. Both events produced surprise results and chaos in markets.

Yet markets quickly bounced back after both votes, eventually pushing to new record highs, a harbinger of the resilience to come in 2017. Because while political risks may have increased starting in the second half of 2016, so too did the global economic cycle begin to turn higher. And though the stock market may not be the economy, the fortunes of both are closely intertwined.

Looking to 2018, Wall Street believes we’ll see more of the same — strong stock returns and solid economic growth. At least two firms have also increased their year-end price targets following the passage of tax cuts by Congress.

It is almost assured that the news cycle will not slow down next year. Donald Trump is still the president, mid-term elections in the U.S. are coming in November, the U.K. has still not settled on the terms of its exit from the EU, and North Korea is unlikely to be a more stable international player.

But as investors look to 2018 trying to discern a potential direction for markets, don’t forget that markets and politics might appear to be relatives, yet only sometimes do these worlds collide.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: