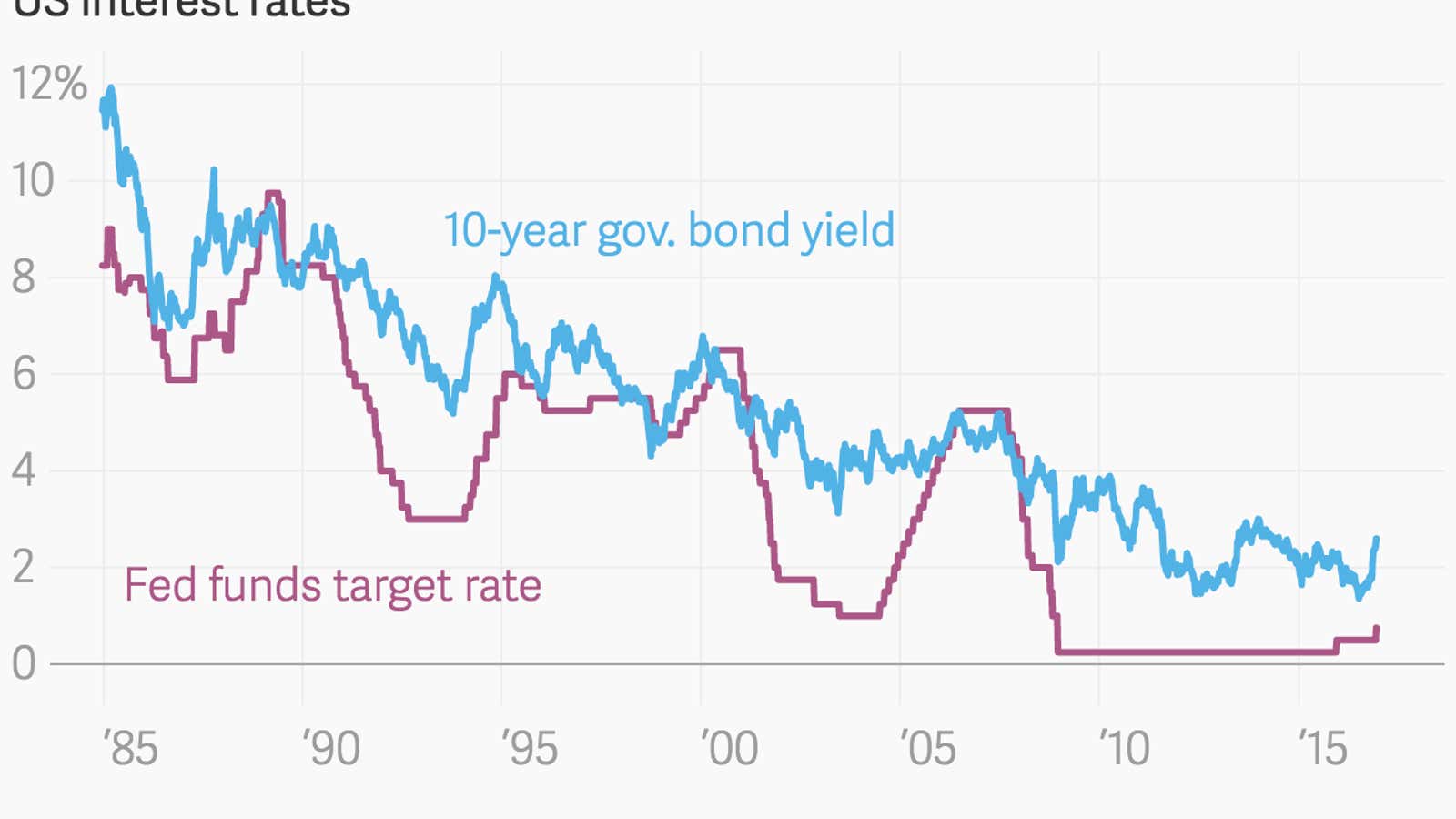

After seven years on hold, the US Federal Reserve has raised interest rates twice in the past year. This will have cascading effects on the rates of everything from credit cards to mortgages and many other financial products.

It may not sound like much—a 0.25% increase in the Fed’s benchmark rate yesterday, following an identical hike in December last year—but there is a growing sense that a profound shift in financial markets is underway. Namely, an end to the 30-year bull market for US government bonds.

In context, the recent jump in bond yields (which move inversely to prices) doesn’t look very significant. But a long-delayed “normalization” of monetary policy—that is, a Fed benchmark rate that is meaningfully above zero—is coming into view.

At their meeting this week, Fed policymakers said they now expect to hike rates three times next year, up from a forecast of two hikes when they met in September. In response, in early trading today the two-year US government bond yield jumped to a six-year high, and the 10-year bond rose to a two-year high.

Inflation is the enemy of bond investors, since rising prices depress the value of fixed interest payments. The Fed’s more hawkish stance is in response to higher inflation forecasts, which stem from an improving economy, Donald Trump’s pledge to spend billions on infrastructure when he becomes president, and other factors.

The next thing investors will be watching for is a steeper yield curve, in which the spread between short-term and long-term rates grows wider. That is generally a signal that the economic outlook is improving, with faster growth generating higher inflation (and prompting higher interest rates) in the future. You can see how the steepness of the yield curve has varied since 2000 in the interactive below:

The spread between two-year and 10-year treasury yields is currently around 130 basis points (or 1.3 percentage points), down from 400 basis points in early 2011.

The people most eagerly anticipating a return to a steeper yield curve are bankers, because this boosts the margin between what they pay to borrow money via deposits and what they can charge on longer-term loans. Banks are already among the biggest winners following Trump’s victory, given his promises for lighter regulation. A steeper yield curve would be the icing on the cake.