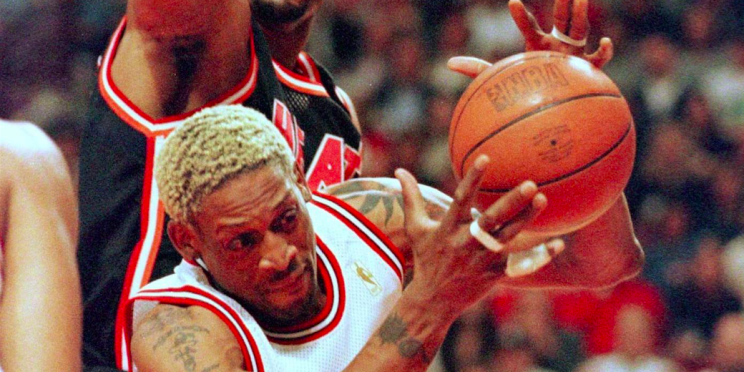

The unexpected lesson investors can learn from NBA great Dennis Rodman

Texas-based volatility hedge fund manager Christopher Cole of Artemis Capital Management made an astute basketball analogy for when it comes to investing.

“If you really want to understand portfolio optimization in a world of negative interest rates, forget [Harry] Markowitz… you need to study the mercurial Dennis Rodman, former professional basketball player,” Cole wrote in a note to clients this spring that’s being recirculated among Wall Street inboxes.

Rodman is the lowest scoring inductee of the Basketball Hall of Fame, never averaging more than 11 points per game. Even still, Rodman is “one of the greatest to ever play basketball” because of how he made his teammates better, according to Cole.

“Rodman dominated the game without scoring by dramatically improving the statistical efficiency of his teammates via rebounding a defense. His rebounding prowess on both ends of the floor resulted in countless second chance scoring opportunities and higher per possession utility. How many Michael Jordan jump shots, Isaiah Thomas layups, or David Robinson dunks began from a Rodman rebound? Rodman had a measurable impact on the per possession efficiency of his team when played. Counter intuitively, his team’s shooting percentages improved dramatically when Rodman was on the floor despite the fact he was a terrible shooter himself and rarely need to be guarded!,” he wrote.

This can also be applied to investing.

“Rodman’s Paradox describes hidden and non-linear benefits when adding a nonconformist but negative returning asset amplifies the output of a portfolio of positives. The sum is greater than the parts. The same way Dennis Rodman improves the efficiency of his teammates by rebounding their misses, the combination of active volatility exposure with traditional investments can generate impressive risk-adjusted returns by rebounding a portfolio from drawdowns,” Cole wrote.

Cole explained the “Dennis Rodman” asset in this case is the CBOE Long Volatility Hedge Fund Index, an equally weighted index that tracks hedge funds that seek exposure to volatility (^VIX). Cole’s Artemis Vega Fund, LP is part of that index.

One way to think about how volatility funds make money is to look at it as buying insurance. Volatility funds buy insurance — usually in the form or put options — while it’s cheap and no one’s anticipating a major market sell-off. And when markets fall and those premiums get more expensive, they then sell that “insurance” for a profit.

During bull markets, exposure to volatility can be a flat to negative yielding asset, which doesn’t seem that attractive to investors. The strategy had some challenging years when central bank monetary easing led to a surging stock market.

The way to view it is to think about rebounds and playing defense.

When you think about a standard portfolio it’s allocated 60% to stocks and 40% to bonds. This can be problematic though as bonds do not always move opposite of stocks.

“Not only are stock and bonds positively correlated most of the time but there is a precedent for multi-year periods whereby both have declined. In the event stocks and bonds simultaneously lose value, volatility will be the only asset class that is capable of protecting your portfolio,” Cole wrote.

Having exposure to volatility can give investors the chance to make money and buy more stocks cheaply during bear markets.

“Despite relatively low scoring averages during bull markets, can be just as valuable to your portfolio as Rodman was to his championship teams. The convex asset that expands non-linearly during major linear declines in equity markets allows investors to 1) Improve the risk-adjusted returns of a traditional basket of assets through portfolio optimization; 2) Maintain portfolio discipline and even profit from times of crisis; 3) Buy assets when they are below intrinsic value.”

Cole’s note was written back in the spring, but it’s currently being passed around Wall Street inboxes. Yahoo Finance obtained a copy. You can read a copy here (PDF).

—

Julia La Roche is a finance reporter at Yahoo Finance.

Read more:

Dan Loeb: Managing money the past year as been like ‘Game of Thrones’

Billionaire Rubenstein: These 6 traits will help you succeed on Wall Street

How a $650,100 lunch with Warren Buffett changed one hedge fund manager’s life

Yahoo Finance

Yahoo Finance