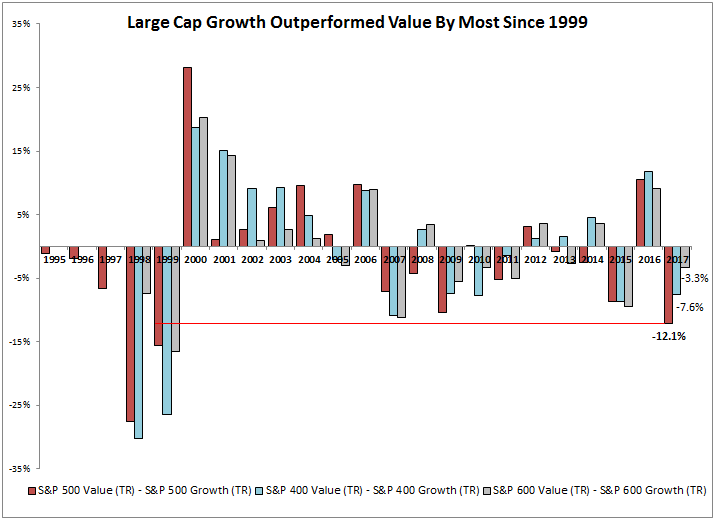

In the last year, plain old beta performed remarkably well in comparison to the so-called “smart” alternatives tracking large-cap U.S. equities. Of the 17 different strategies reported in our year-end factor dashboard, less than a third outperformed the S&P 500’s total return of 21.83% over the last 12 months.

When they are criticized as the basis of investment strategies (or at any rate when alternatives are promoted) cap-weighted equity benchmarks tend to be ascribed with certain “flaws” – in particular: an undue concentration in the largest stocks or sectors; a disregard for valuations; and a propensity to overweight recent outperformers. Ironically, it was the supposed flaws of capitalization-weighted benchmarks that drove their relatively strong performance last year.

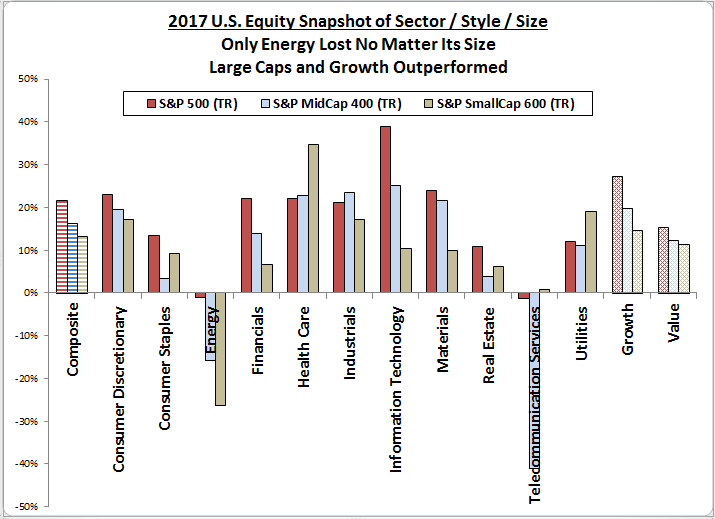

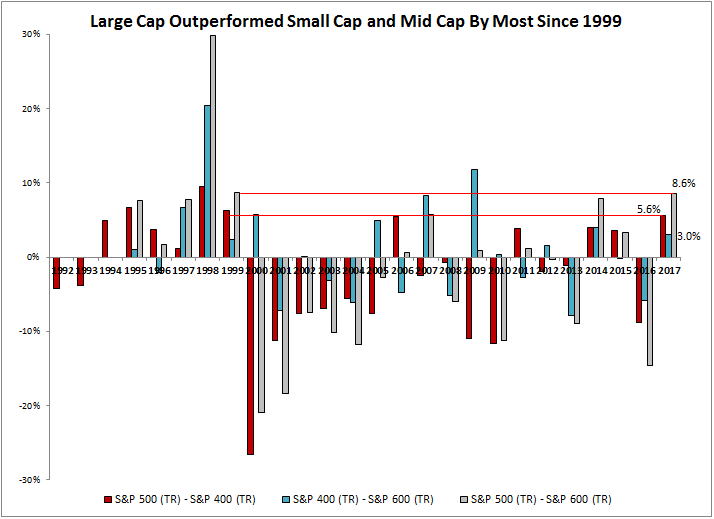

In 2017, size mattered. The smallest quintile of S&P 500 constituents (based on prior year-end market capitalizations) averaged a total return of only 8.4%, while the largest stocks gained 22.3%. In between, returns increased monotonically with size quintile.

Moreover, the U.S. market’s largest sector (Information Technology) had a banner year, soaring by 39% over the year and driving strong correlations between an index’s allocation to the sector, and its total return over the year.

These size and sector perspectives are useful because nearly all smart beta strategies will – unless explicitly controlled for – underweight the largest stocks or sectors. (Strategies based on momentum, growth or quality can provide occasional exceptions.)

As we’ve argued previously, the performance of an equal weight index is a useful tool to gauge whether capitalization weighting alone helped or hindered returns. Last year, the S&P 500 Equal Weight underperformed its parent by around 3% – a material hurdle for smart beta to overcome through stock selection and additional weighting tweaks. Those that did outperform largely did so through exposures to the factors said to weaken market benchmarks – owning larger stocks, or underweighting value, or simply following the trend.

The posts on this blog are opinions, not advice. Please read our Disclaimers.