In my 2017 Market Wrap-Up post, I referenced major support (200) and resistance (280) as levels worth monitoring on the SPX:VIX ratio, on a monthly timeframe.

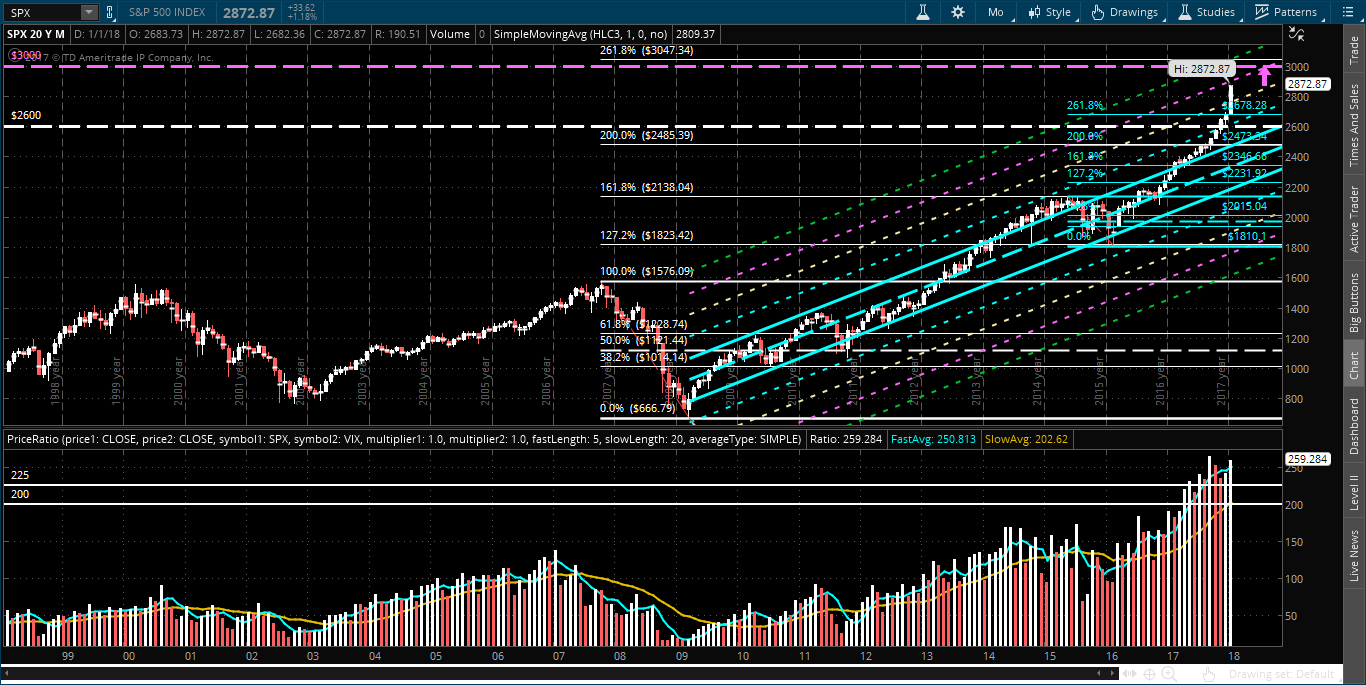

The following updated monthly chart of the SPX:VIX ratio reveals a few interesting things:

- All of the monthly closes since July 2017 have been above 225.

- December '17 and January '18 have spiked above the 280 resistance level, but not yet held above.

- A long-term uptrend line (heavy blue arrow) indicates near-term support around 225, at the moment.

- 225 is confluent with a major external Fibonacci retracement level at 228, as well as the bottom of the original long-term uptrending (green) channel.

- In my post of February 24, 2017, I identified 200 as a new level to be held above, in order to support a new bull market in equities.

- In April, 2017 we started to see closes above 200 (the next monthly chart shows the SPX in the upper half and the monthly closes (in histogram format) of the SPX:VIX ratio in the lower half, for a different perspective).

- Monthly momentum on the SPX:VIX ratio began to weaken last November, which hasn't supported the price breakout on the SPX above 2600.

From these observations, I'd make the following statements (based on a longer-term monthly timeframe and outlook):

- Watch 225 closely on the SPX:VIX ratio to see if price can continue to close above that level.

- If so, I'd need to see the momentum on this ratio strengthen, again, to support higher SPX prices.

- If we don't see a reversal in momentum, it's doubtful that the SPX will reach a target price of 3000 anytime soon, as I had described in my post of January 23.

- If price on this ratio falls and holds below major support at 200, volatility will rise dramatically and we'll likely see some major profit-taking occur in the SPX.

- In the shorter term, you can also monitor activity in iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG) and SPDR S&P Homebuilders (NYSE:XHB), as I recently described here and here, respectively, in connection with the SPX.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.