“Every month is a great month for an Iron Condor!” False. Options income traders frequently want to throw on the same trade every month. Sometimes they make slight adjustments for market conditions or volatility, but the reality is that it’s essential to understand the markets you are trading. And furthermore, the volatility characteristics of different markets can present additional complications that impact the performance of trades. And that’s why understanding options skew is so important.

Suppose an options income trader liked trading a Butterfly every month in the Russell 2000 ETF (IWM). However, what if the trader decided to step out and move into a new, uncorrelated market and try a similar trade strategy in Gold (GLD)? Let’s take a look at the two potential trades.

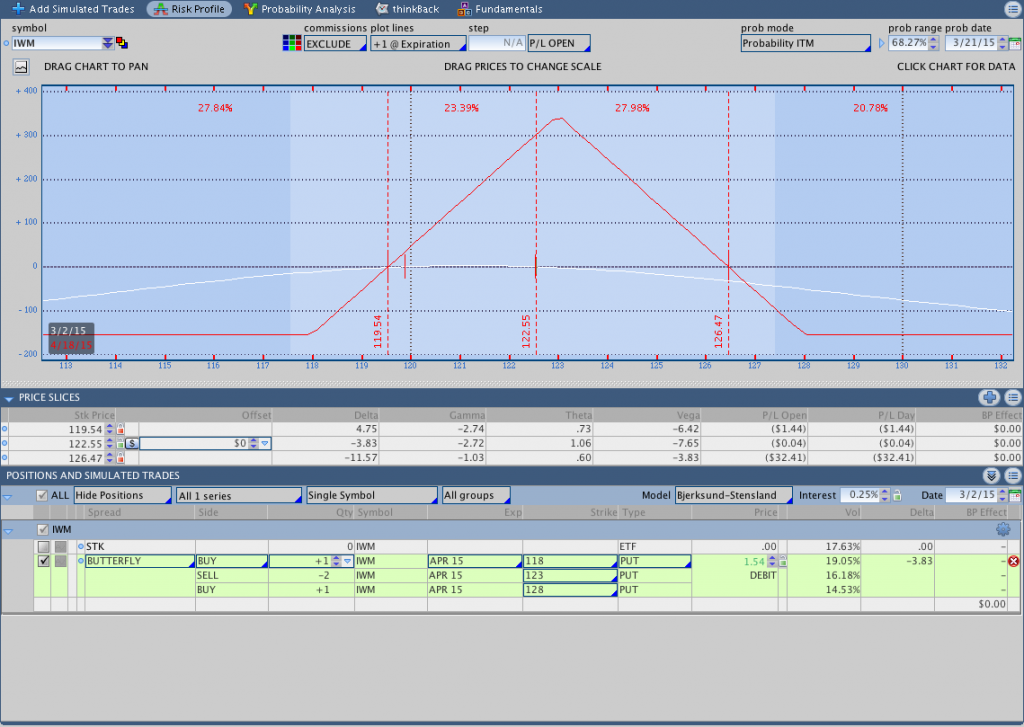

The trade below shows an At The Money Butterfly in the Russell 2000 ETF (IWM). The position is an April 2015 118/123/128 Put Butterfly.

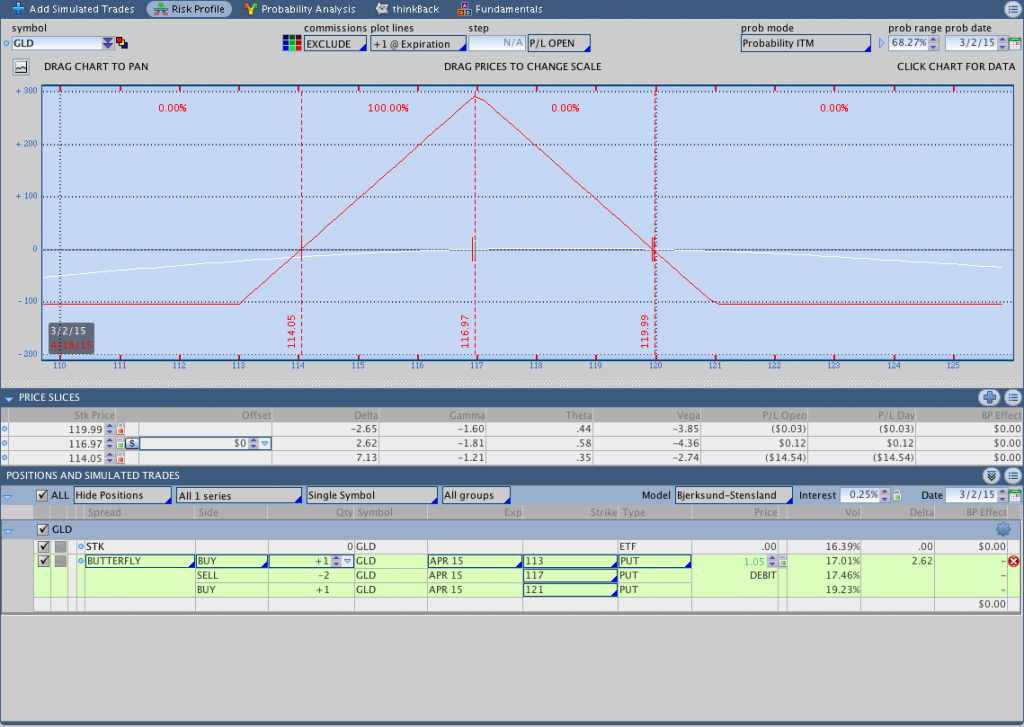

The next trade is an At The Money Butterfly in the Gold ETF (GLD). Specifically, the trade is an April 2015 113/117/121 Put Butterfly.

When we look at the two images, there’s a noticeable difference between the white T+Zero lines on the risk graphs. That difference is due to the options skew in the two markets.

Skew is used to describe the implied volatility of options at different strikes. In equity index markets, out of the money puts trade at higher implied volatilities than at the money puts. While options traders today expect that relationship, it didn’t always exist. The put skew in equity index markets is something that developed after the 1987 crash. The crash caused options traders to elevate the implied volatilities of out of the money put options in response to the downside risk. That structural change created the put skew we have today. However, not all markets have the same skew.

Understanding the skew is conceptually important for options traders and it will also have a significant impact on how the two trades perform. Equity index options traders are conditioned to expect put skew, however, sometimes that expectation is wrong. The T+Zero line for the Gold Butterfly shown above is much flatter than the Russell Butterfly. The flat skew will impact both the initial trade and any adjustments the trader makes. Additionally, changes in skew will impact the positions differently and having an expectation about both volatility and options skew is essential for successful trading.

Many options traders use the Greeks to manage their positions, but sometimes the Greeks can be misleading. In a recent post, we discussed how a short vega butterfly trade benefitted from an increase in implied volatility. Hint: it had everything to do with options skew.

Thanks for reading.

Follow Dan on Twitter: @ThetaTrend

Author holds positions in the Russell 2000 and IWM at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.