Asian billionaires create wealth fastest

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Wealth was created faster by Asia’s billionaires than by those in any other part of the globe in the past 12 months, with the region accounting for almost a third of a 12 per cent increase in global billionaire wealth of $7.3tn, according to an annual survey.

The combined wealth of the world’s billionaires is now higher than the combined market capitalisation of all the companies that make up the Dow Jones Industrial Average, according to the survey, conducted between June last year and July by Wealth-X, a research firm, and UBS, the Swiss-based bank.

Billionaires control nearly 4 per cent of the world’s wealth, the survey claims, with 155 new billionaires minted in the past year, pushing the global population to a record 2,325 – a 7 per cent rise from the last period surveyed.

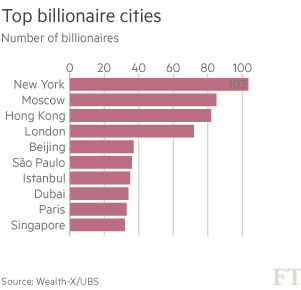

New York hosts the biggest number – 103 – with Moscow (85), Hong Kong (82), London (72) and Beijing (37) taking the next four spots.

On Tuesday, SoftBank founder Masayoshi Son overtook Tadashi Yanai, founder of Fast Retailing, to become Japan’s richest man, boosted by the forthcoming Alibaba initial public offering. Mr Son has a personal fortune of $16.6bn.

Europe, with 775 billionaires, was the region with the most billionaires and billionaire wealth ($2.37tn). Asia boasted the largest billionaire wealth increase, with fortunes growing by 18.7 per cent over the period surveyed, compared with a global average rate of 11.9 per cent.

Asia’s billionaire population grew 10 per cent in the 12 months to July, with 52 new entrants into the billionaire club – of whom 33 were from China.

North America – the region with the most billionaire wealth in 2013 – was overtaken by Europe in terms of wealth in this year’s census.

The US maintained its position as the world’s top billionaire country with a population of 571 billionaires, followed by China (190) and the UK (130), which took third spot from Germany (123).

Wealth-X and UBS said a “massive wave of intergenerational wealth transfer from baby boomers to their heirs” was under way, with the result that billionaires with partially inherited wealth were the fastest-growing segment of this population.

“Yet, one of the common characteristics of the world’s billionaires is their entrepreneurialism. In most instances, achieving billionaire status requires more than merely inheritance: 81 per cent of billionaires made the majority of their fortunes themselves,” the two said.

Billionaires increased their holdings of cash and cash equivalents such as shares or bonds in the period to an average of $600m each from $540m last time.

Both amounts were the equivalent of 19 per cent of average net worth, with the increase in value of cash holdings rising because total wealth increased in the period.

Wealth-X and UBS said the level of cash held signalled that many are “waiting for the optimal time to make further investments”.

Comments