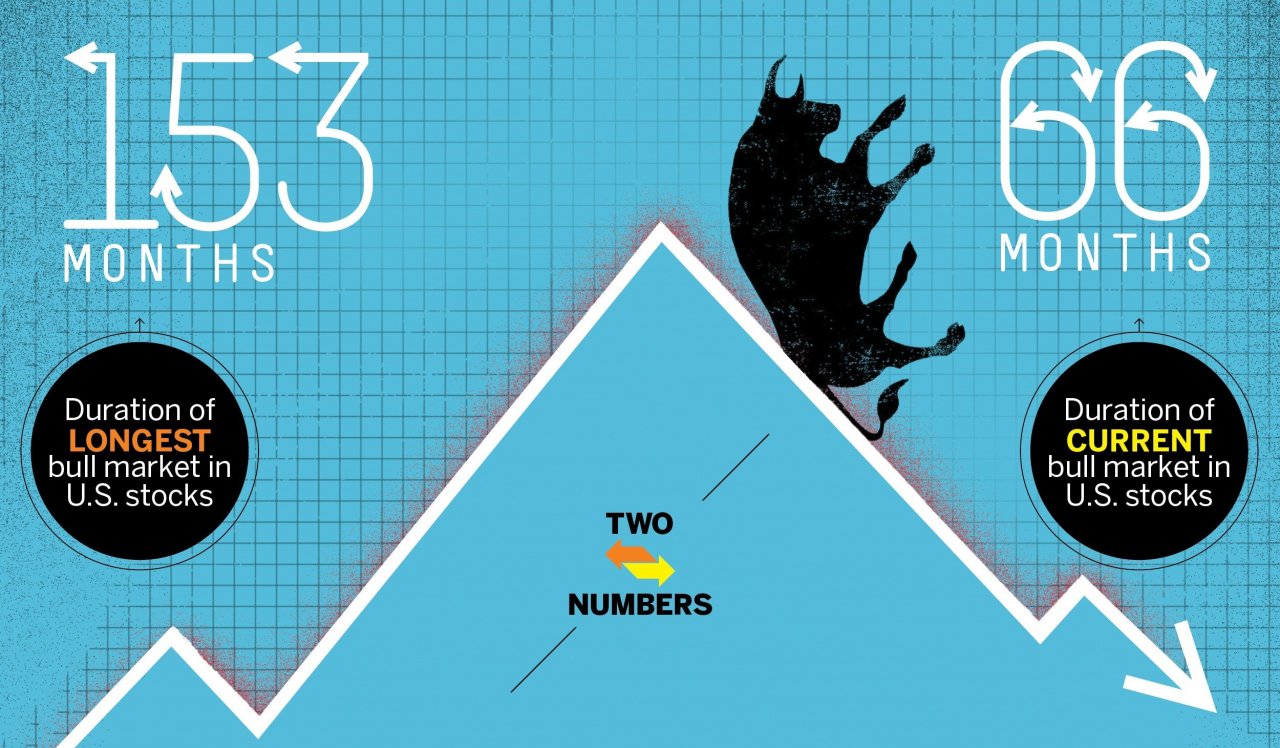

Reading his own obituary 13 years before his actual death, Mark Twain observed, "The report of my death was an exaggeration." Sixty-six months into the current bull market on Wall Street, a growing number of stock market analysts have trumpeted the end of its long run.

Fears that global economic growth is slowing and some parts of the world, like Europe, could be heading back into recession have fueled recent speculation about the death of the bull market. Yet so far, despite a sell-off in October, the bulls are holding on. If this keeps up, November would mark the 67th month of the current long run, which happens to be equal to the average duration of a bull market in U.S. stocks.

Recall that a bull market is a long-term climb in stock prices, typically defined as any period where the S&P 500 gains 20 percent or more without a decline of 20 percent in between. So far, the S&P 500 has gained around 130 percent since the market began its advance back in early 2009.

The current bull market still has a long way to go before it approaches the longest bull market in U.S. history, both in terms of duration and magnitude. After a big sell-off in 1987, beginning with a 22 percent drop on Black Monday, October 19, the market climbed more than 500 percent from the beginning of 1988 to the bursting of the tech bubble in 2000, a duration of 153 months.

The recent sell-off, which began after the S&P 500 closed at a record high of 2,011 points on September 18, was followed by the best week for stocks in nearly two years. Typically, a bear market is defined as a 20 percent or more drop in stock prices. By October 27, the S&P 500 was off about 2.5 percent from its high.

Just over half of Americans say they personally, or jointly with a spouse, own stock outright or as part of a mutual fund or self-directed retirement account, according to an annual survey by Gallup. Deciding what to do with those stocks during periods of intense market volatility can be unnerving. Just remember, like death and taxes, the end of this bull market is a certainty. Only the timing remains in doubt. On the bright side, it's better to buy low than to buy high.