Taking a look at the S&P over-extension chart shown above, we see that the S&P has been going sideways at its upper red trend line for the past several trading days. Friday morning's opening showed the S&P at 214 points above its 324 day EMA line, the midterm neutrality line for stocks and indexes. Looking back over the past two years I have marked in the peak over-extensions and how many points each was over-extended from its 324 EMA line. The average over-extension peak is +219 points. Technically we stopped five S&P points below the average over-extension peak, but the fact that the S&P has not been able to break through the resistance of the upper red trend line shown above lends to the argument that the peak might be here.

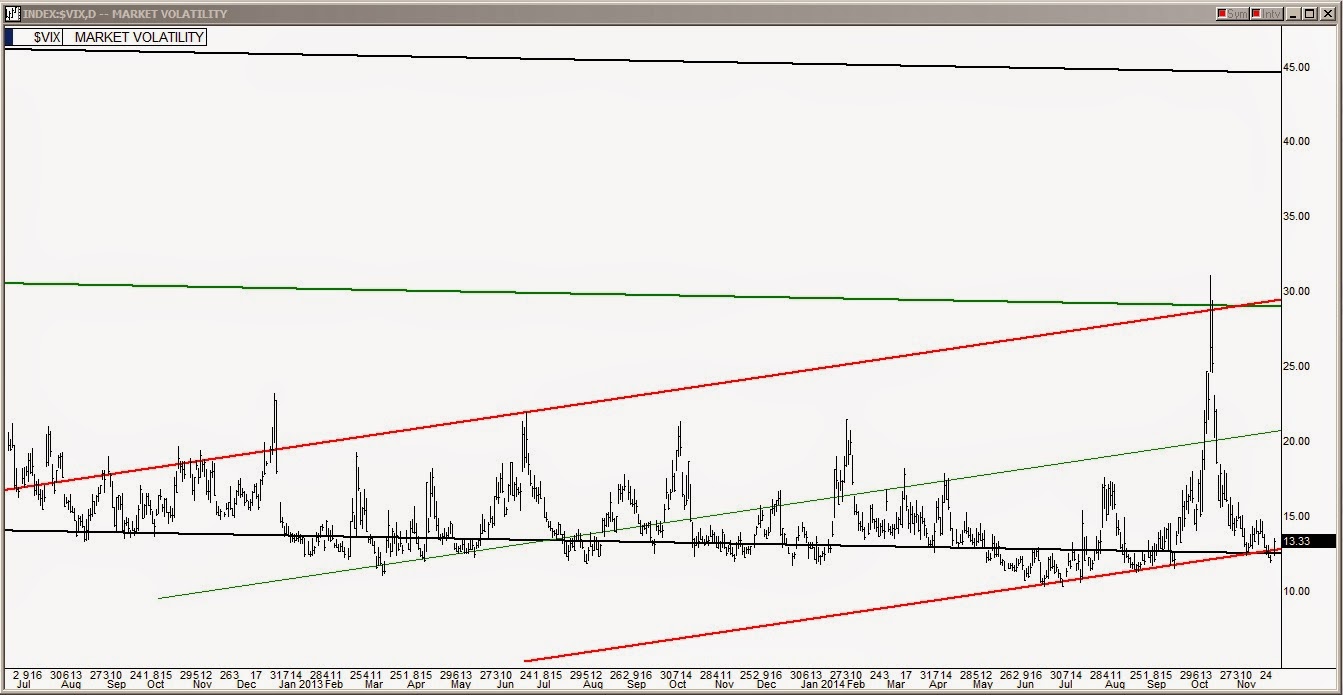

Everyone knows that the trading action over the past week has been nothing more than keeping the S&P as high as possible to entice consumers to be a little looser with their purse strings during black Friday shopping. However, there has been considerable conversation on the internet the past 24 hours as to what happened shortly after lunch on black Friday when the indexes and key stocks took a sharp dive. This sudden drop was triggered by the up crossing of a channel line in the VIX chart below.

Taking a look at the VIX chart above, focusing on the last trading bar, we see that the VIX opened still below the lower lines of both the black line long term channel and the red line midterm channel. By late morning Friday, the VIX crossed up back into the black line channel and and then at midday it crossed back up into the red line channel which caused the sudden drop in just about everything.

The Fed's task of getting the market as high as possible for the black Friday shopping weekend was obviously a success. Now that the job is done and the bulk of the consumer's retail spending has been done (consumer spending is 70% of the economy), everyone will be watching to see if the VIX's return back into its uphill red channel is an indicator that we just saw the traditional Santa rally and that December trading will be nothing more than chart noise or a decline.