The VIX is supposed to be a forward-looking measure of volatility, but as it turns out, it may be a better indication of where things have been than where they're going.

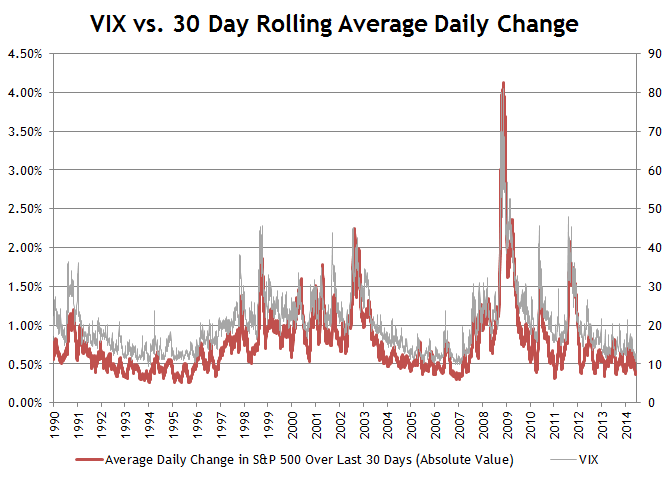

Below is a comparison of the VIX to the average daily change of the S&P 500 (absolute value) over the previous 30 days. The correlation is extremely tight, which implies, perhaps not too surprisingly, that the perception of future volatility ends up being a projection of what recent volatility has been.

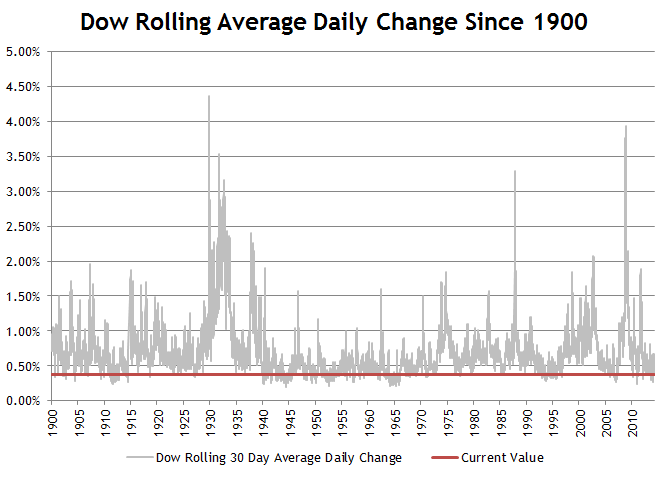

Knowing that the VIX can be approximated by rolling average daily changes, below is a chart showing the 30-day average daily change of the Dow 30 going back to 1900. Today’s environment may feel like low volatility, but for significant periods of the 40s, 50s and 60s the average daily change of the Dow was even lower than it is today.

In terms of volatility, the financial crisis period really only equates to the Great Depression. During the depression, volatility unwound over a five year period from 1929 through 1934 and then became more muted until 1937. In the present bull market you could argue that it took until 2012 for volatility to unwind, which means we’ve now had two years of quiet compared to the depression’s three.