When we trade stocks, or futures or Forex contracts, we always need a plan for each trade. It includes an entry price, as well as a plan for how we will exit the trade. The exits include one or more profit targets, as well as a stop loss. In our trading classes we use the acronym SET, which stands for Stop, Entry and Target.

Most option trades also require stops. There are a few exceptions ? for example, a Straddle trade, which includes both a long put and a long call, is helped by price movement in either direction, and the more movement the better. So it does not need stops. But straddles are one of a handful of exceptions. Most option trades do need them.

Stops on options are not quite as straightforward as on other instruments. Many, if not most times, we need to base our stop-loss order not on the price of what we are trading (the option), but on the price of something else (the underlying stock). Furthermore, our option position might include multiple components, or legs; if so, our emergency exit orders need to unwind the whole position, not just one part. If the stop conditions are met, we might need to close out two, three, four or more separate options, and maybe a position in the underlying stock as well. How do we do it?

The exact mechanics differ from one broker?s software to another, but the principals are the same. Two things are needed in the trading software.

The first is?Conditional order?capability. This is needed in order to?base our option exit orders on the underlying?s price rather than the option?s price. Some brokers call these?contingent orders, or something else. Tradestation, for example, calls them?activation rules. Think or Swim calls them?order conditions, within its?Order Rules?function.

Besides conditional or contingent orders, so that we can base option orders on the underlying in the first place, the second thing we need to be able to do is to?unwind multiple option and/or underlying positions automatically. That is, when our stop condition is met (stock price goes beyond our stop price), we need to do not just one thing (sell this option), but several (sell this option,?and?buy to cover that option,?and?sell this other one,?and?buy to cover that other one, etc.), in order to close out all legs of the option position.

Different trading software platforms approach this in a couple of different ways. In some packages, like TD Ameritrade?s Think or Swim, we can create a?spread order?(multi-legged order to close out all parts of the position), and the whole thing can be triggered by the stop condition (order rule). You tell the program, in effect, ?If Apple stock goes below $525, close out my bull put spread.?

In contrast to this approach, Tradestation uses the Order-Sends-Order functionality to do the same thing. We would tell Tradestation, in effect, ?If Apple goes below $525, buy to close my short put. When that is done, then sell to close my long put.? The effect is the same ? the whole position, incuding both the long and short options, are liquidated. The difference is that Tradestation can not combine the idea of an activation rule with the idea of a multi-legged order. It can do each of those things, but not together. We get around this by basing a?single order?on an activation rule; and then using OSO to make that order send another order for another option, and so on until all legs are done. That takes a few more clicks, but is not difficult.

Fortunately in both of these platforms, once you have queued up all the elements of the stop order, including the conditions based on the underlying, you can save and reuse the plan. Tradestation calls these saved templates ?staged orders.? Think or Swim calls them ?custom order templates.?

Now for a specific example. For the last couple of weeks, I?ve been writing about the Covered Call strategy (also known as a Buy-Write). This involves owning an underlying stock, and selling a call option on that stock. This is a positon that really needs a stop ? we own the stock, and if its price drops, we lose money. If it drops beyond a certain point, we need to sell the stock. And if we sell the stock, we also need to buy back the short call. Most trading platforms will not allow you to enter a stop order on a stock if you have sold calls against it. I received a question about that from a reader this week. He writes:

?I bought HYG long stock at 92.80 and want to get out if it goes below 92.50. I have sold covered calls against the stock. Tradestation will not allow me to enter a stop market order to sell the stock, since that would leave the short calls naked. How can I create a stop on this position??

Here is the answer to this question, for the Tradestation platform:

The trick is to use OSO to create an order to buy back the short call, and then have that order send a separate order to sell the stock. That second order will not fire until the call is bought back, so there is no problem with potentially naked short calls. Here are the steps:

1. Make sure your Order Bar is visible (the regular order bar, not the Matrix), and bring up an option chain (OptionStation Analysis window) for HYG.

2. On the option chain, click on the particular call option that you have sold, to load its symbol into your order bar. Highlight the symbol in the order bar, right-click and select Copy. This is just to avoid having to type a long option symbol later.

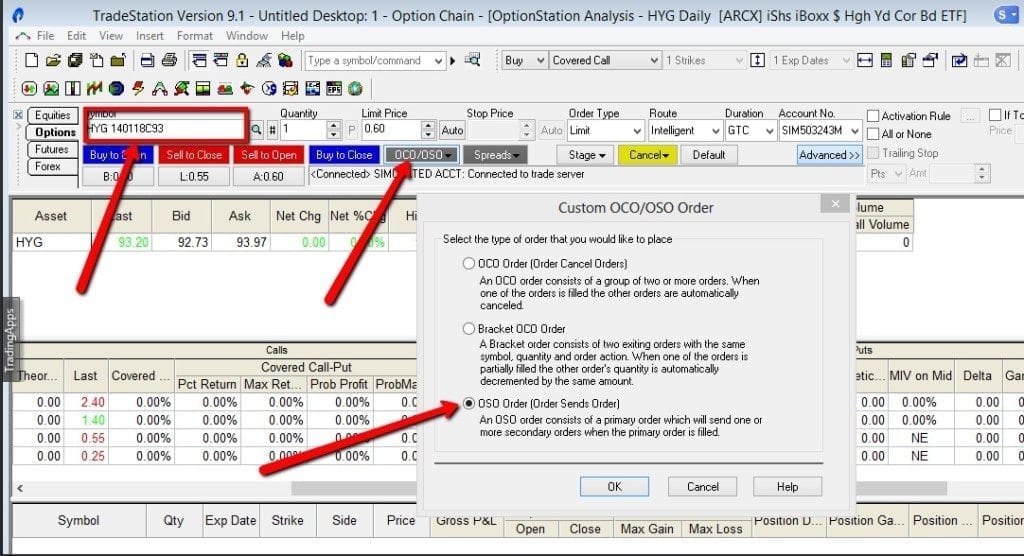

3. Click on the OCO/OSO button on the order bar, and select the next-to-last item ? Custom OCO/OSO Order. See below for what appears next:

4. On the above screen select the third button, labeled ?OSO (Order Sends Order)? and click OK. The ?Order Cancels Order & Order Sends Order? window will appear, as shown below.

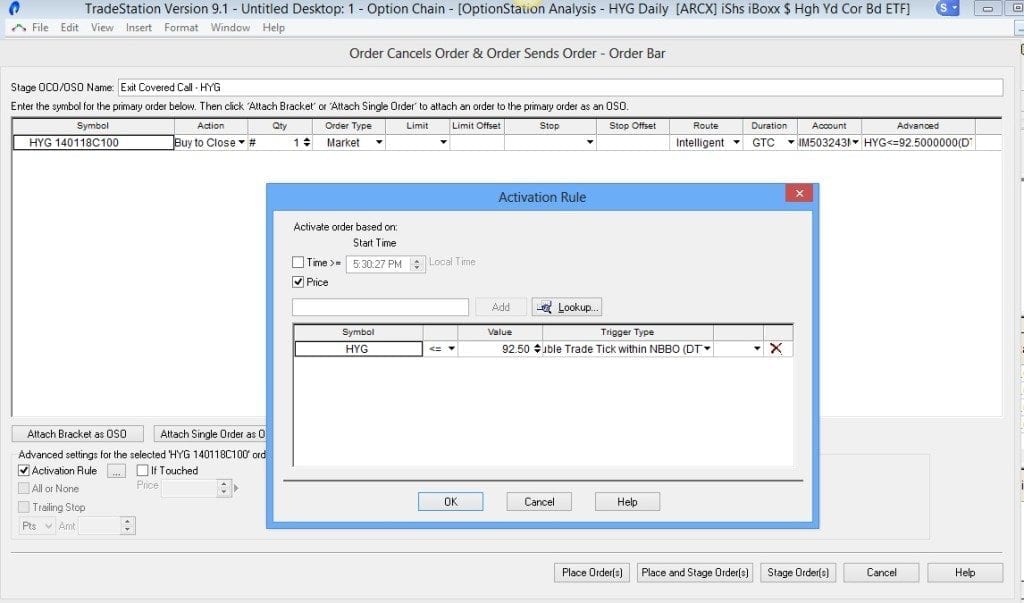

Note that changing the symbol on this screen is quirky. You have to click in the Symbol field, type a character, backspace that character out, and then right-click and select Paste.

Do that in the Symbol field, pasting in the symbol for the call option. Also enter Action = Buy to Close; Order Type = Market; and Duration = GTC. See next picture below.

5. Check the checkbox in the lower left for Activation Rule, and create a rule like the one shown below, which is Price of HYG <= $92.50 (your stop price). This should now look like the example below. Click OK in the Activation Rule window when done.

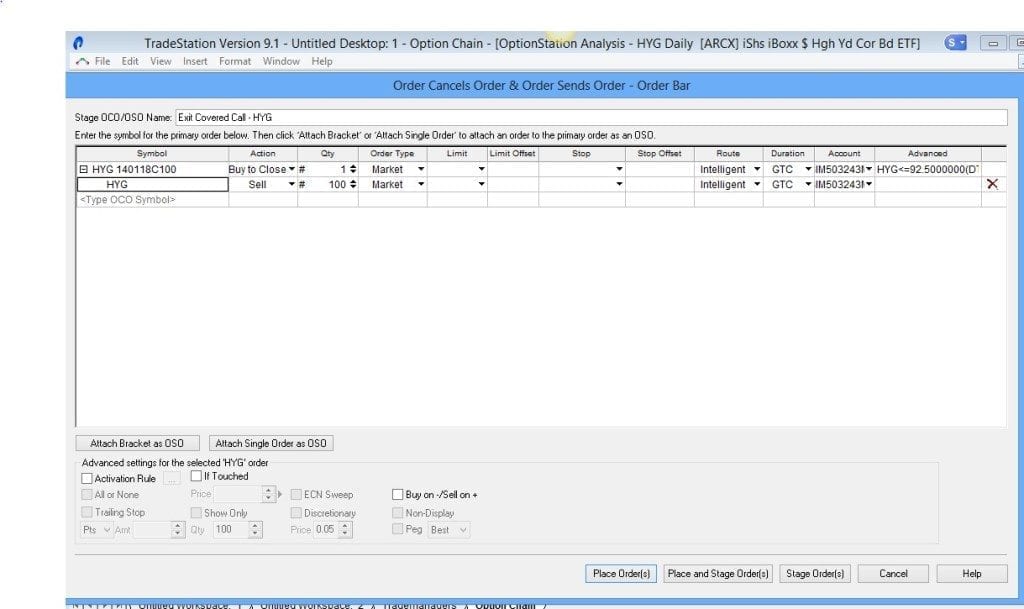

6. Now click the button at the lower left labeled ?Attach Single Order as OSO.? When the row for the new order appears, change the symbol to HYG; change the Action to Sell; enter the correct quantity (in shares); Order Type = Market.

7. The finished OCO/OSO window will look like this:

You can now click on Place Orders to send the order; or, as I prefer, click Place and Stage Order(s). If you do stage it, you can later retrieve it from the Staged Orders tab of the Trademanager window and edit it and re-send it, if you need to. If you just click Place Order(s) without staging it, the system will try to send the orders; but if there are any errors you lose everything and have to start over.

This is how the covered call stop is accomplished in the Tradestation platform, For other trading platforms, the steps may be slightly different. But it can be done in any platform, as long as there is the capability for conditional orders and also for Order-Sends-Order.

In future articles, we?ll demonstrate how the stop/unwind is accomplished on other types of positions.