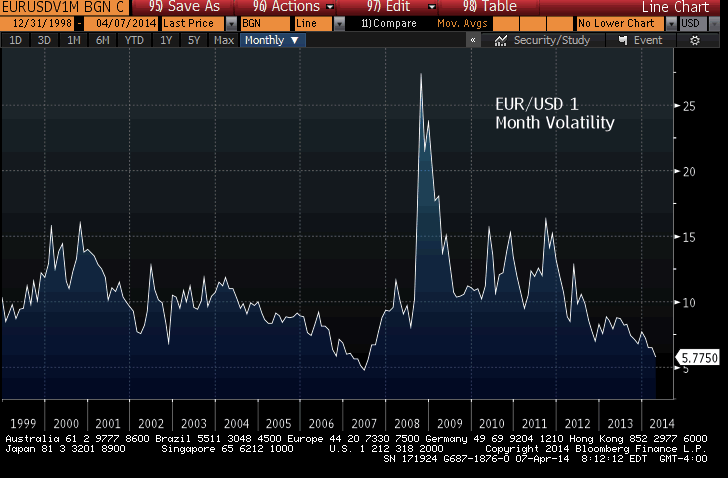

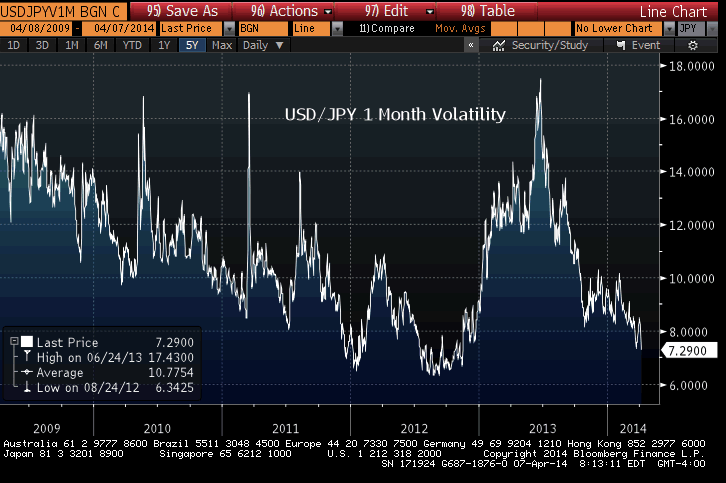

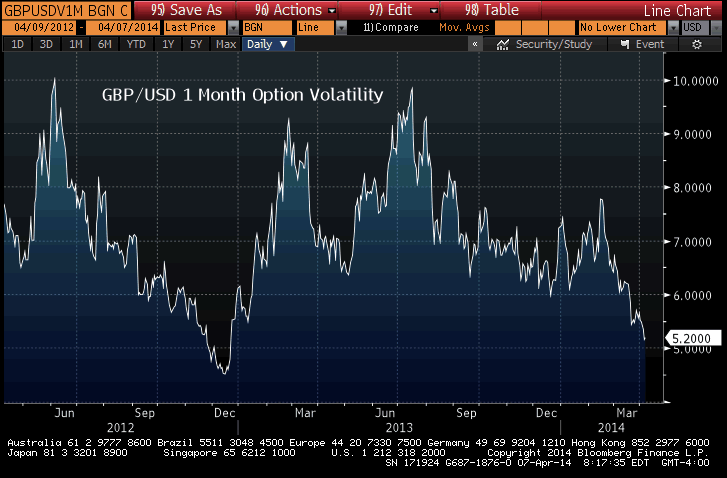

At the start of trading this week, option volatilities in the foreign exchange market have dropped to fresh multi-year lows. As shown in the charts below, the volatility of EUR/USD 1-month options has fallen to its lowest level since 2007 and for USD/JPY and GBP/USD, volatilities are at their lowest level since 2012.

The low volatility environment has a few important implications for currency traders. First, low volatility points to range trading and with no major U.S. or European reports, there's a very good chance that currencies will consolidate this week. This makes the chance of the EUR/USD breaking 1.36 and USD/JPY rising above 104.50 slim.

Secondly, low option volatility can also mean additional profit taking on long USD/JPY positions. We know that many investors were positioned for a solid non-farm payrolls report and when the data failed to impress on Friday, the currency pair was hit by liquidation. Hawkish FOMC minutes on Wednesday could lend support to the greenback but we don't expect much upside momentum. Instead, currency trades will most likely take their cue from equities as the earnings season kicks off this week.

Kathy Lien, Managing Director of FX Strategy for BK Asset Management.