Oil prices continue to swing wildly, but they are subject to a hard fact—the incessant flow of US shale oil, which, according to a leading energy research firm, is likely to dip only slightly this year before rising again by next summer.

When you add in the breakneck production of OPEC crude, which will probably only increase over the next year as Iran returns to the market, you get very little chance that income pressure will ease on struggling oil companies and petro-states.

Oil prices have gyrated wildly over the last week, punctuating a 14-month plunge. They have swung by 8% and even 10% on some days. But while almost no one expects the volatility to stop, the supply fundamentals suggest that today’s relatively low prices will persist through much of next year and possibly into 2017.

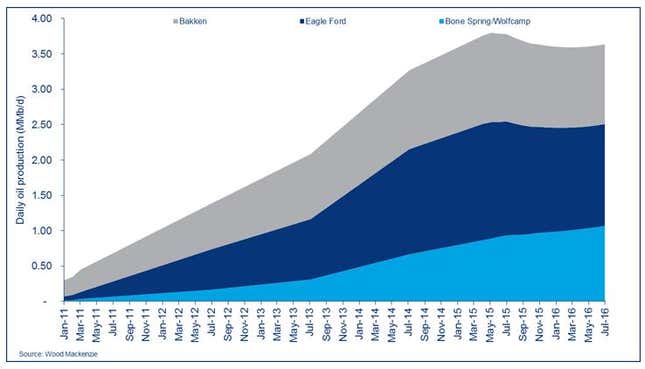

Analysts from Wood Mackenzie, an Aberdeen, Scotland-based energy consultancy, tell Quartz that production from the three main US shale plays will largely hold up through 2015 despite the plunge in oil prices and rigs working the fields.

Their chart above shows that in the coming months, we will see a flattening of the drop in production in recent months from the Bakken shale, in North Dakota. And by next summer, Bakken production will rise again, according to Woodmac’s Linda Clarke. Jeremy Sherby, another Woodmac analyst, said much the same will happen with the Eagle Ford shale in Texas.

Meanwhile, a consistent rise in shale production from Texas’s Permian Basin—the Bone Spring and Wolfcamp plays pictured in the chart—is bolstering the overall shale oil flow.

A caveat: The forecast is based on a $55-a-barrel average price in 2015 for West Texas Intermediate (WTI), the US crude oil benchmark. When you dip too far below that price, drilling becomes unprofitable, and producers may shut off some of their rigs.

As of now, WTI is averaging $51.25 a barrel for the year, and does not seem likely to hit the marker set by Woodmac. In order to get to $55, WTI will have to average about $63 a barrel for the rest of the year, which seems improbable if recent prices of $44 to $47 a barrel are an indication.

Woodmac will reassess its price assumptions next month, but Sherby said any changes are unlikely to affect the production forecast for 2015.