Rallying stocks from India to Brazil are driving down options prices as investors unload contracts to protect against future declines in equities.

The Chicago Board Options Exchange Emerging Markets ETF Volatility Index, a gauge of options prices, is down 32% since February 3. Last week, it capped a record streak of decreases. Contracts on the exchange-traded fund tracking countries such as China, Russia and India are the cheapest in almost six months versus US stocks, data compiled by Bloomberg show.

Money is flooding back to emerging-market ETFs at the fastest rate in seven months as rising share prices lure investors who until the last few days were being battered by a selloff in the US China’s government last week outlined a package of measures including railway spending and tax relief to boost growth, tensions have eased between Russia and Ukraine, and Brazil’s Ibovespa Index is approaching a bull market.

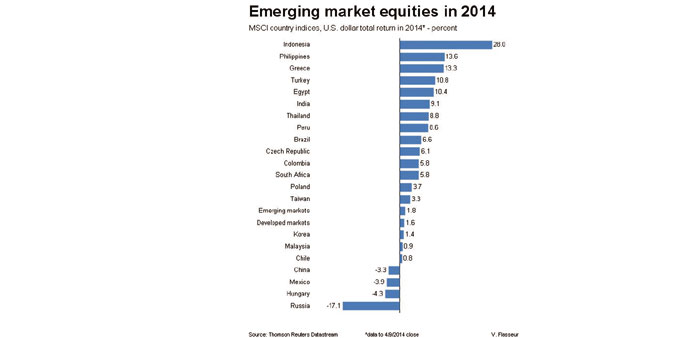

“Some of the more significant worries that were driving a panic about the emerging markets have subsided,” Bruce McCain, who helps oversee more than $20bn as chief investment strategist at the private-banking unit of KeyCorp in Cleveland, said in a telephone interview April 4. “Those markets sold off heavily and you’re getting some recovery.” The MSCI Emerging Markets Index has climbed 11% from a five-month low in early February.

The gauge of stocks in 21 countries tumbled 6.6% in January, the worst start to a year since 2009, after Argentina devalued its currency and China’s economy weakened.

Turkey’s Borsa Istanbul 100 Index of stocks has rallied 15% over the past month. Brazil’s Ibovespa has gained 14% since March, when it reached the lowest level since 2009.

Investors seeing those gains have plowed cash into ETFs. US-based funds focused on equities and bonds in developing markets attracted $3.3bn this month, poised for the biggest increase since September, according to data compiled by Bloomberg.

“Flows are showing that there is some value here,” Matt Lloyd, the chief investment strategist at Advisors Asset Management Inc in Monument, Colorado, said in an April 2 telephone interview. His firm oversees $14.2bn. “Emerging markets is one of those areas where you still have vibrancy.”

Optimism that the shares will increase has made options cheaper. The emerging markets VIX slid 2.9% to 21.31 yesterday and last week touched the lowest level since October.

The gauge is down 1.9% in 2014. The CBOE Volatility Index advanced 0.4% to 13.87 at 9:50am. in New York. Europe’s VStoxx Index fell 1.8% to 16.62.

Implied volatility, the key gauge of options prices, is 19.52 for the iShares MSCI Emerging Markets ETF, according to data compiled by Bloomberg on contracts expiring in three months. The measure for the SPDR S&P 500 ETF Trust is 12.79.

It’s too early to get excited about China, according to Robbert Van Batenburg, a director of market strategy at Newedge Group SA in New York.

The world’s second-largest economy probably grew 7.4% last quarter from a year earlier, according to analysts surveyed by Bloomberg News in March, down from a previous median estimate of 7.6%.

“China is still a big risk and some emerging markets are still teetering,” Van Batenburg wrote in an e-mail April 4. “Lots of market participants believe China will embark on more fiscal and monetary stimulus. I think these hopes are illusive.”