The ubiquity of Bloomberg terminals at Wall Street trading houses may be facing its biggest threat yet.

Reports emerged last week that Goldman Sachs is weighing a ban (paywall) on “person-to-person” communication by its employees using third-party services including Bloomberg, Yahoo and AOL messenger. A Goldman spokeswoman told Quartz that the bank has made no decision about its internal chat policy.

But if Goldman took such a decision, it would be the latest, biggest move to weaken Bloomberg’s dominance in the terminal business. Bankers are some of the biggest subscribers to Bloomberg terminals, and Goldman is one of the biggest among bankers. Talk of banks looking for other, cheaper data service providers has been in the air for a while, since accusations that Bloomberg was spying on its clients. Some banks, including Deutsche Bank and Royal Bank of Scotland, have begun to ban chat with external traders and market dealers, after regulatory probes unearthed evidence of traders colluding over chat to allegedly manipulate currency prices and key lending rates.

Banks are leery about chat because they believe that its immediacy means employees may be more likely to make comments they’ll later regret than over email. That’s one reason why JP Morgan Chase opted to ban multi-party exchanges over chat and told its staff to use email or phones.

Of course, Bloomberg terminal services, which cost nearly $50,000 for a two-year contract (the minimum), offer much more than simply chat. But the chat function is such a widely used feature that one banker described Bloomberg terminals as a “a very expensive messenger service.”

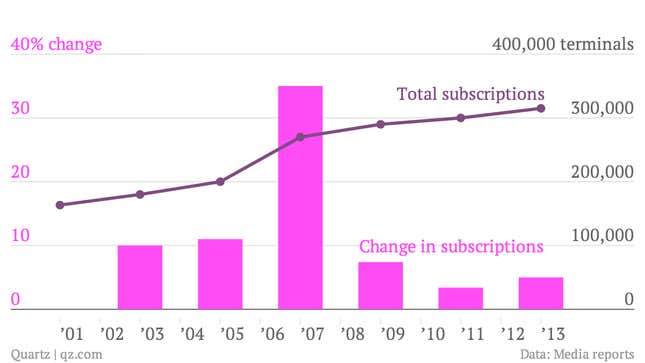

It’s impossible for now to say whether the past few months’ events have hurt Bloomberg terminal sales, since data are available only every two years. But the troubles for Bloomberg come after several years of comparatively sluggish sales growth. After growing at double-digit percentage rates in the early and mid-2000s, peaking at 35% from 2005 to 2007, sales have grown in the mid-to low-single digits since then.