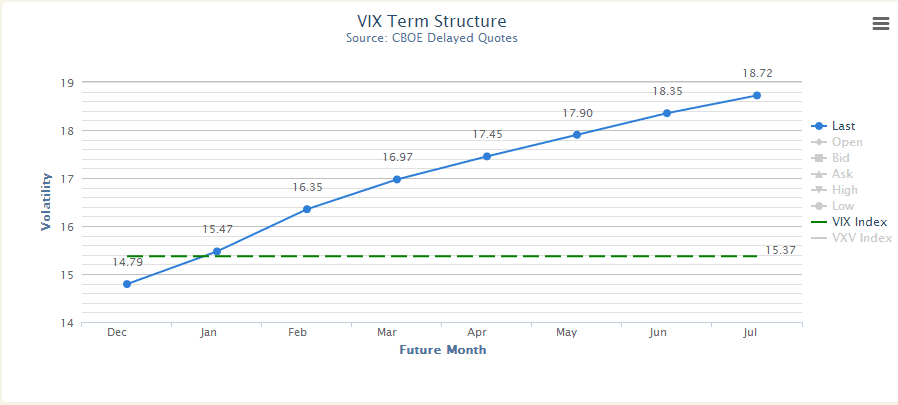

Yesterday, ?the big news in the option world will be that the VIX went backward cash-Dec future and is essentially flat against January. ?

Yet, ?if one takes a deeper look at how volatility behaved, ?one has to ask if this is a one off event. ?The SPX sold off over 1%, ?to 1782, ?a huge move relative to the VIX. ?The VIX was trading under 14 Tuesday, ?yet yesterday, as the market dropped we saw the VIX barely budge to 15.30. ?Still predicting a move of under 1% a day. ?Additionally, ?the dollar was weaker, ?gold didn’t sell off and most importantly, ?the bond market has actually moved higher since last Friday’s number.

Is yesterday’s budget deal important? – apparently not to anyone except to the equity market. ?I think that it’s is likely a one off event, ?we might have a touch of follow through, ?but I highly doubt this is the beginning of the end. ?There is almost no sign of a taper adjustment in December anywhere. ?If the Fed does anything, they might point toward tapering in March instead of April. ?This is an institution that is about as dynmaic as melba toast, ?so to expect the unexpected is fruitless (unless the unexpected is INACTION).

The Trade:

I would be using today as an opportunity to begin looking for ways to sell some tightly defined premium. ?I like butterflies, calendar spreads, ?I also like starting a short VIX or VXX position, the goal being to have a full trade on by next Tuesday.

Disclosure: ?Short SPX and VIX vol