If the Fed is spiking the punch, why can't we?

In my "Weighing the Week Ahead" series, I always include some suggestions for individual investors. I try to share with the do-it-yourself investor what I am doing for my clients. I have suggested that investors who have been out of the market can step in gradually by purchasing the stocks of strong companies with reasonable dividends and enhancing the yield by selling near-term calls. Some readers have asked me to be more specific. This post provides an example illustrating the process.

Background

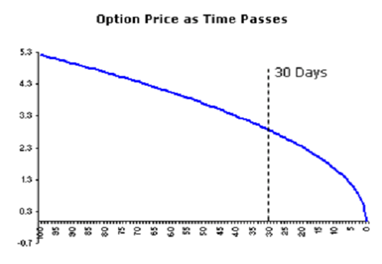

The Enhanced Yield system means choosing a suitable stock and also the right call to sell. We maintain a watch list of about 25 candidates, updated for changing prices and market conditions. I discuss the covered write in more detail in Part 4 of my "Quest for Yield" series. I focus on near-term calls since they have the greatest time decay. This chart from optionMONSTER illustrates the point:

Their message to buyers is as follows:

This time value will deteriorate as that expiration approaches; time decay increases exponentially in the last 30 to 45 days of an options life, so this is usually not the time to own options.

Since we are sellers of calls, we capture the exponential decay by selling near-term calls. This is much, much better, but it takes more work. You must frequently adjust your positions, finding new calls to sell. Some who do covered calls lazily sell options that have a long term. They are like that late night TV guy who says, "Set it and forget it!" Getting the best return requires more work.

A Current Example

I want to turn away from theory and illustrate with a specific recent trade. For clients in my program I bought Exxon Mobil Stock (XOM) and sold the FEB 100 call. I stick to the regular monthly options, not weeklies, so these calls (called the FEB "pars" by the pros) expire on 2/21/14.

Why XOM?

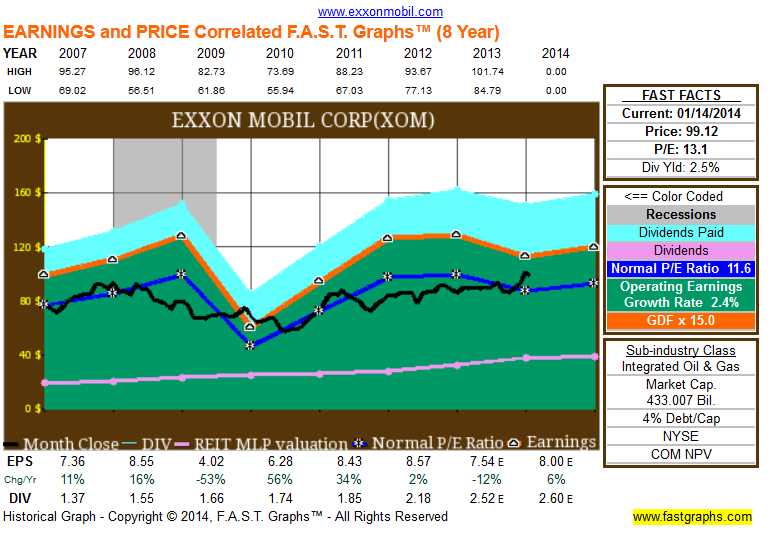

I like to have some sector diversification in this portfolio, but it is most important to have good value. Energy stocks are relatively cheap right now with a lot of pressure on oil prices. Exxon Mobil Corporation, (XOM) has a dividend yield of over 2.5% and almost no debt. The cash flow is lower with oil at a low point, but it is not dangerous. This is a safe stock that is cheap on an earnings basis. The Chuck Carnevale F.A.S.T graph site is a great tool for screening candidates. While there is plenty of detailed information, the valuation chart is a good starting point.

Which Call?

I try to sell calls that are 2-3% out of the money (the difference between the strike price and the current stock price). These have some real "meat" – enough premium to justify the trade. A good rule of thumb is that the call premium, if annualized, would provide about 10% return. The FEB 100 call was trading at a price exceeding a dollar, so it met this test.

What Price?

The best time to establish new positions is on scary looking down days in the market. You can buy the stock at a lower price. The call premium is a little "juiced" because the market volatility keeps the premium higher. You can calculate a net price for the buy/write (or covered write) and most brokers will let you enter the trade as a spread. I do this as a block trade for an entire group of clients. If you have a price in mind, you put a limit order in and wait for the market to come to you.

I picked a net price of $97.50 and we were filled with a stock price of about $98.60 and a call price of $1.10. To choose the price I look at the stock chart and also tweak if I see the market moving. We have already made a little on the trade, but it is still attractive and you might get a better price if the stock trades lower this week.

The Profit Potential

Let us first suppose that the stock is unchanged over the next month or so. We will collect the $1.10 premium and also a dividend of 63 cents. (The dividend has not yet been announced, but the dividend history suggests an ex-dividend date in early February. It will not be paid until March, but we will be the owners before the ex-date.). This is a pretty good return for a short time.

If the stock rallies to the strike price or higher, we will also make another $1.40 on stock appreciation. Our best case return is a total of $3.13 in five weeks. When this happens, I need to find a new position, but I am willing to be patient whenever I can ring the cash register.

The Risk

The risk in these trades is that the stock price moves a lot lower. The call premium and the dividend provide some protection for a limited move, but not for a bigger decline. That is why you must start with stocks that are fundamentally sound and you are happy to own anyway. I also employ the other regular risk analysis that I monitor every week in my series.

Risk control is a matter of market risk and stock risk. You need to monitor both. Because these are conservative stocks with middle-range dividends, it is a safer program than selling calls on Google Inc, (GOOG) or Apple Inc, (AAPL).

Size

I like to have nine or ten positions. Call contracts are in round lots – hundreds of shares. The minimum size for this trade requires an investment of about $10,000 in a portfolio of $100,000.

Conclusion

This method, which I call our "Enhanced Yield" program is very profitable and much safer than a straight purchase of stocks. It is also fun to trade, since you get to make frequent changes of stocks and calls. You need a broker that has low commissions and favorable treatment for option trades. You can shoot for a return of 8 – 9% even in a sideways market.

Go ahead and try it for yourself, but start small and get a feel for the technique.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

How To Boost Your Dividend Yield

Published 01/16/2014, 01:24 AM

Updated 07/09/2023, 06:31 AM

How To Boost Your Dividend Yield

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.