English speakers have grown to love the German word schadenfreude. But what’s the single word for indifference to the suffering of others? We need to figure this out to describe what’s happening in the US options markets.

For the past decade, European and US options investors have been sympathetic to each other’s pains. When we chart the EURO STOXX 50 Volatility Index (VSTOXX) against the CBOE Volatility Index (VIX), we can see that the VSTOXX has typically been a little higher than VIX, but that these two indices have moved largely in sync.

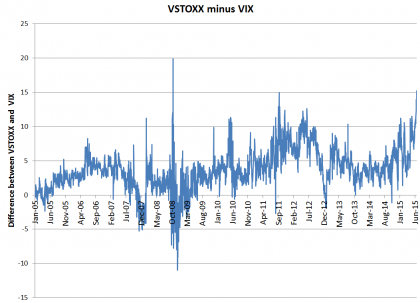

Something strange has happened, though, in the past year. VSTOXX and VIX have diverged. As VSTOXX has gone up, VIX has stayed near its floor in the low teens.

This is easier to see when we subtract the daily values of VIX from the daily values of VSTOXX and chart the difference. For only the third time in the past decade, the gap between these two measures has hit 15 volatility points.