Pulling the world back from the brink of catastrophic climate change cannot be done for free. Changing the way the world is powered means big spending -- and huge investment opportunities -- as new clean energy infrastructure is built across the world.

And that’s catching the attention of the global financial community.

This week, from New York to California to Abu Dhabi, business and political leaders have been talking about the costs and opportunities inherent in the historic pledge that the nations of the world made in Paris last month to limit global warming to 2 degrees Celsius. They are also considering whether the financial world is up to the challenge.

Bloomberg New Energy Finance teamed up with Ceres and Ken Locklin of Impax Asset Management to measure the difference between the substantial level of funding already flowing annually into clean energy, and the level of investment needed to meet commitments made in Paris. The resulting report, Mapping the Gap: The Road From Paris, finds there is enough money at play in the world’s financial markets to finance the transition. But policymakers in every country will need to “mind the gap” of over $200 billion annually for the electric power sector that needs to be mobilized to help assure it happens in time.

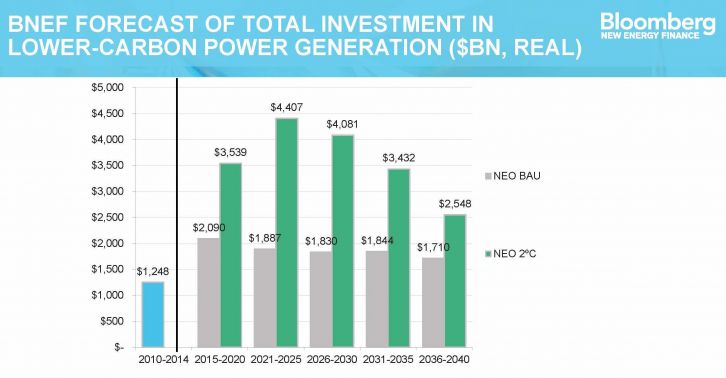

First, consider a “business-as-usual” scenario. Bloomberg New Energy Finance (BNEF) shows that we are already on track to spend $6.9 trillion over the next 25 years on new renewable electric power generation. The deployment in the sector has been growing rapidly as technology costs come down, government policies encourage a cleaner energy future, and the markets see renewable energy as an increasingly attractive investment.

The problem is that this considerable momentum will not clean up our energy supply quickly enough to limit warming to the 2 degrees Celsius level cited in the Paris accord. To accomplish that goal with existing technologies, like wind and solar, BNEF’s modeling suggests power sector investment will need to rise by an additional 75 percent, to $12.1 trillion, over the next quarter-century.

That’s no trivial amount of money, but it’s a goal that is eminently achievable. To put it in perspective, the average amount the entire world needs to invest in clean electric power annually to hit the 2-degree target is only 7 percent more than American citizens invest in car loans each year. Just as there was plenty of capital available to build the infrastructure to power the world with fossil fuels, there is more than enough capital available to build the infrastructure to power the world with clean renewable energy.

But policymakers need to support this transition. Part of the reason oil, coal and gas have been so successful is that governments supported their build-out and expansion with incentives including direct investment, favorable tax treatment, and subsidies. G20 countries still subsidize fossil fuels far more than they support clean energy -- to the tune of $450 billion annually. These subsidies are perverse; they are using public funds to create a problem the world has agreed to fix in Paris. And they leave us all to pay the societal costs that fossil-fuel pollution causes.

The opportunity is enormous. According to a report released last week by IRENA in Abu Dhabi, merely doubling the amount of clean energy by 2030 from 2010 levels -- an increase well short of the increase modeled by BNEF for 2040 -- lifts global GDP by $1.3 trillion. And improvements in human welfare would go well beyond gains in GDP, thanks to the range of social and health benefits of clean energy. That includes millions of additional jobs compared to the business-as-usual case.

We must recognize that greatly expanding the scale of investment in clean energy probably won’t happen by accident. There are vested interests and elements of friction which can slow this transition. But under United Nations auspices in Paris, the world declared it will rein in climate change. Now, we need to match our actions to our promises -- and create the conditions needed to put our money where our Paris climate agreement commitments are.

***

Danny Kennedy is managing director of the California Clean Energy Fund (CalCEF), a pioneer in clean energy investment. Ken Locklin, co-author of Mapping the Gap: The Road From Paris, is a director of Impax Asset Management, leading the firm’s North American activities on issues related to climate change and sustainable investment.