Much has been written about the severe underperformance of the Dow Jones Transports and select transportation stocks (vs the broader market). Is Dow Theory at play here? Will the Transports pull the market lower? Let’s scan the markets to get a better picture of what’s happening.

- Market bears are pointing to action in Transports

- Bulls cite how well financials are acting to prove why bears are wrong

- VIX remains pinned by 15, bullish (financials); VIX past 15, bearish (transports)

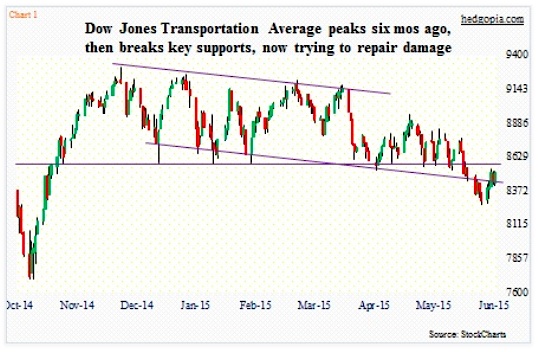

The Dow Jones Transportation Average peaked in late November of last year, then proceeded to trade within a declining channel (at one point briefly falling out of the channel toward the end of May). In the meantime, though, it lost crucial support around 8550-8600 (see chart below).

Dow Jones Transportation Average – Prior Support Now Resistance?

Nonetheless, for followers of the Dow Theory, which combines the Dow Transportation Average and the Dow Industrials, to look for signs of divergence between the two, there is no sell signal yet. The latter is yet to break support at 7600.

Off the lows six sessions ago, the Dow Transportation Average (8509.64) has rallied three percent, and currently sits right underneath horizontal resistance. With the recent rally, daily momentum indicators are approaching the median of the range. If this rally is just an oversold bounce, then this would be a perfect place for momentum to turn back down. It is a show-me time for market bulls. If they can reclaim that support-turned-into-resistance, the near-term picture would improve. Weekly momentum indicators are way oversold.

This is one side of the equities coin. And it does not portray a healthy picture.

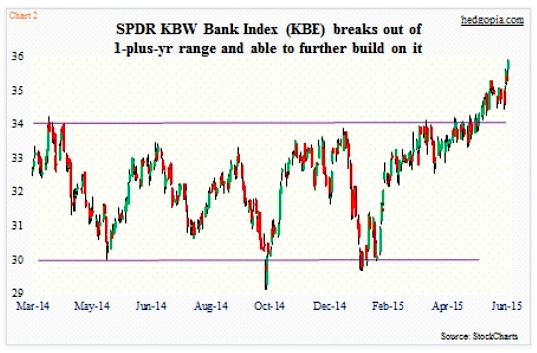

Enter the financials, and we see the other side of the coin – a healthy one.

Regional Bank Index Chart – Breaking Out!

Chart 2 shows the price action in KBE (35.99), the SPDR KBW Bank Index. It broke out of a one-plus-year range a month ago. Just looking at that breakout, a technican can come up with a measured-move target of 38. It is halfway there. On the coattails of a 31-basis-point surge in the 10-year Treasury yield last week, the ETF shot up three-plus percent. A steepening yield curve is good for banks and brokers. It has nearly 78 percent exposure to regional banks. This is also the reason why it closely mirrors KRE, the SPDR KBW Regional Banking Index.

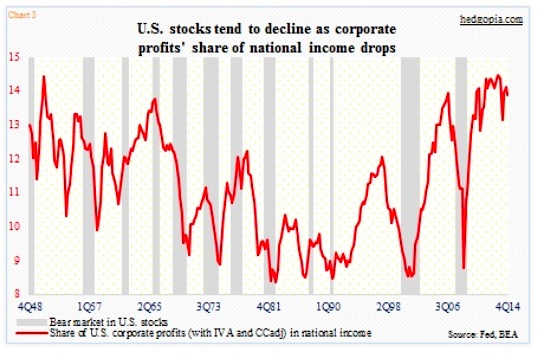

Corporate Profits As Percent Of National Income Chart

So which one of these two is signal and which one is noise? If transports are right, stocks in general are headed for trouble. Not so if financials are sending the right message. In the former in particular, several indicators, one of which is shown in the chart above, look overstretched. The red line represents the share of corporate profits in national income. In the past, stocks have not liked when the line begins its journey down from extended levels.

Financials Sector ETF (XLF) Chart – At Critical Juncture

One thing, though. The knock on financials’ rally is that they are not all rallying with the same intensity. XLF (24.79), the Financials SPDR ETF, is lagging KBE; the former assigns the most weight to the leading financials. The top three weights go to WFC (8.7 percent), BRK.B (8.5 percent) and JPM (8.1 percent). The ETF has been unable to break out of 25 and change, which stopped the advance twice – late December and mid-May. The good thing is, the October 2014 trendline is intact (see chart above).

So what will break the logjam between transports and financials, and their respective signals? VIX, anyone?

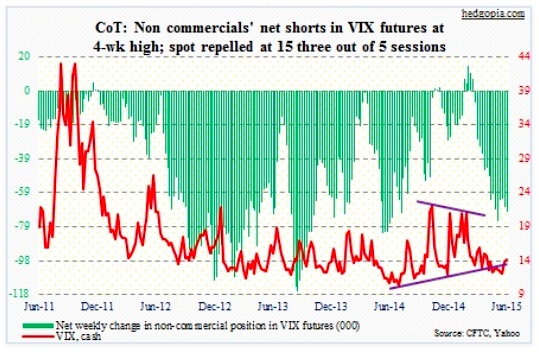

Volatility Index (VIX) Chart – The Importance of 15

The Volatility Index has attempted to rally past 15 for over two months now, and has been denied a close above that level 10 times, three of which were just last week (see above chart)). There is a real tug of war going on between volatility bears and bulls.

Based on VIX action last week, equity bulls have an opportunity to push volatility lower in the very near-term. Which, if this occurs, may just be enough to push the Transportation Average through resistance and the XLF through the 25 level. For this scenario to come to pass, the Volatility Index would need to continue to move lower to sideways (and the 15 resistance hold). This would be a cheerful scenario.

VIX COT Chart

But it does not take much to push Volatility Index past 15. It is right there for the taking. Should that occur, three different resistance levels would have been won over: 1) October 2014 declining trendline, 2) 200-day moving average, and 3) two-month-plus resistance at 15. In this scenario, non-commercials have a bunch of net shorts in VIX futures that will need unwinding (see chart above).

The longer this wait-and-see game continues, the subsequent move in VIX can be fast and furious.

Thanks for reading!

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.