Following the success of the SPIVA (S&P Indices versus Active) in the U.S., Australia, Canada, India, Japan, Europe and Latin America, we are now starting coverage on South Africa. Like the reports covering other regions, we aim to shed some light on the ongoing active vs. passive debate. SPIVA South Africa will be published twice a year, mid-year and at the end of the year.

Let’s take a look at the results of the past year.

Overall, 2014 was somewhat mixed for South Africa, owing to labor disputes, electricity shortages and weak domestic demand. However, the performance of ZAR-denominated domestic equities, as measured by the S&P South Africa Domestic Shareholder Weighted (DSW) Index, held up reasonably well and went up by 16% over the year. However, they still lagged global equities as a whole.

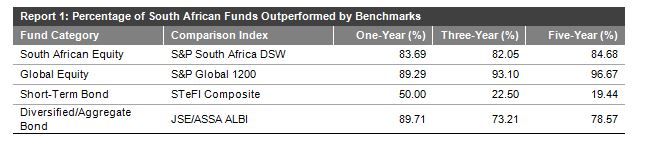

Given the volatility over the year, we would have expected active managers to outperform their benchmarks but this did not turn out to be the case. Indeed, South African active equity managers underperformed their benchmarks in all equity fund categories and over all time horizons. (see Report 1 below).

In regards to fixed income, the results were less consistent. While active managers beat their respective benchmark in the short-term bond category, this was not the case in the longer-term diversified/aggregate category.