Almost half the world’s top pension funds are taking an ill-advised gamble on climate change, according to a financial thinktank.

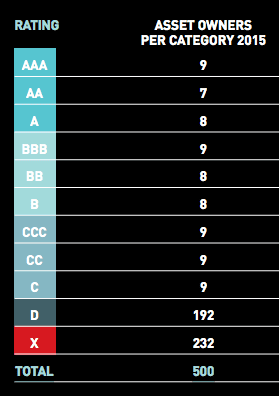

The Asset Owners Disclosure Project’s (AODP) annual index of 500 of the largest global asset owners found that 232 of them had done little or nothing to protect their investments from the financial upheavals predicted due to climate change.

Financial experts, including the president of the World Bank and the governor of the Bank of England, have warned that fossil fuel assets are risky investments because their reserves of coal, oil and gas cannot be burned if the world is to avoid the most extreme impacts of climate change.

A landmark report in 2013 showed that if these assets became “stranded” – suffering large-scale loss of value – it could destabilise global financial markets.

Julian Poulter, the CEO of AODP, said around 50% of assets held by the funds were exposed to some kind of climate risk, but many pension funds and other foundations are ignoring that risk and “betting on business as usual”.

He said these asset owners were gambling that nothing would be done to curtail the burning of fossil fuels.

“They’re betting around 20-1 that either the fossil fuel company influence will last forever or that their fund managers will bail them out of a crisis – but that didn’t work too well during the last systemic crisis did it?” he said.

Funds the AODP termed as “laggards” were those that received a D or X rating. These included the Wellcome Trust and the Bill and Melinda Gates Foundations, both of which are the subject of a Guardian campaign requesting that they divest from fossil fuel companies. It also included some of the world’s biggest pension and sovereign wealth funds.

The index found only 1.4% of asset owners had reduced their carbon intensity from the previous year and just 2% have a target for reducing the carbon risk for next year.

UN climate chief Christiana Figueres said the index was an invaluable tool for encouraging pension fund to finance the shift toward a low carbon economy.

“Pensions funds and the multi-trillion dollar assets they manage have a pivotal role to play in this transformation. [The AODP index] spotlights those funds embracing transparency and disclosure as a first critical step, alongside those pension funds who are going even further and shifting the mix of their portfolios to ever green, cleaner ones,” she said.

Nine asset owners were given a AAA rating, indicating that they had a strategy to protect themselves from climate change and had engaged with companies they own shares in, divested from carbon-heavy assets or hedged against the risk. These included pension funds from the Netherlands, UK, US, Australia, Norway and Sweden.

AODP and other experts believe that funds that do nothing to assess their climate risk may be breaching their responsibilities to their members. AODP and environmental law campaigners Client Earth launched a project last week that will assess whether UK pension funds are breaking the law.

Ben Caldecott, the director of the stranded assets programme at Oxford University’s Smith School said recent reviews of the law, by economist John Kay and the Law Commission, clearly showed asset owners must account for fossil fuel risk.

“In my view that settled it. Clearly fiduciaries can take account of these issues and actually if they don’t take account of material environment-related risks, whether it’s climate change or other factors, then they could be in breach of their fiduciary duties. So ignoring it is not an option,” he said.

Kay told the Guardian that remaining invested in fossil fuels and climate-exposed companies was legal, but not assessing the risk may expose pension funds to legal challenges.

“The courts will be very reluctant to challenge an honestly made business decision,” he said. “So to say ‘I know there is a very big risk to my beneficiaries and have decided to ignore it’ is problematic. But to say ‘having considered all factors I believe ‘Noxious Emissions PLC’ is an excellent investment’ is not, whether right or wrong.”

A representative of Dutch pension fund PFZW, which received a AAA rating, told the Guardian that 7.5% of its assets remained high-carbon and that it maintained fossil fuel investments because they judged it was best for their customers’ portfolios.